So you’re wondering how to pay off your home in 10 years or less…

Which will save you more money: a mortgage OR a HELOC?

The answer is a HELOC!

A HELOC allows you to avoid the commitment of a 15 or 30 year mortgage and can save you hundreds of thousands of dollars in interest.

What sets the HELOC apart is that you’re only charged interest on the amount you spend. Interest is not compounded like with a mortgage.

If you’re wondering which offers the lowest monthly payments – the answer isn’t so cut & dry…

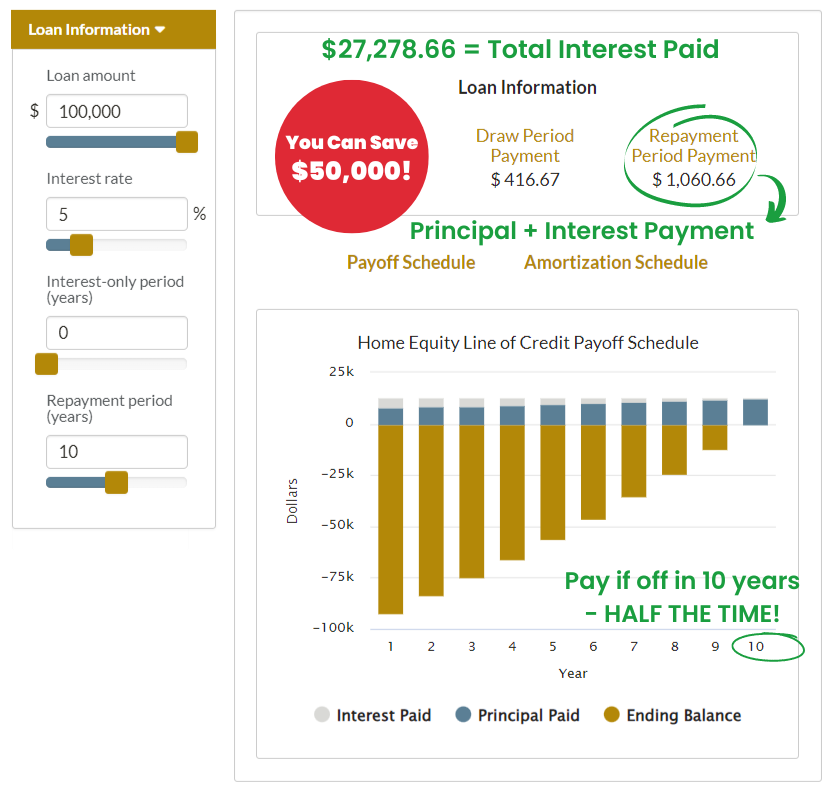

By making principal + interest payments (during the draw period) you’ll be able to pay off your home MUCH FASTER.

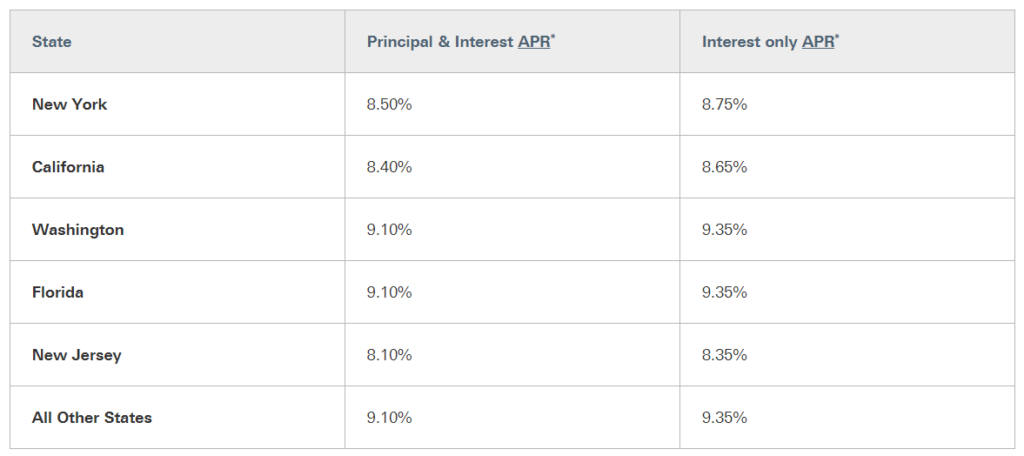

You’ll also tend to pay slightly lower interest rates…

How to Pay Off Your Home in 10 Years or Less…

What surprises most people though is just how much MORE they end up paying in interest when they choose the interest-only route…

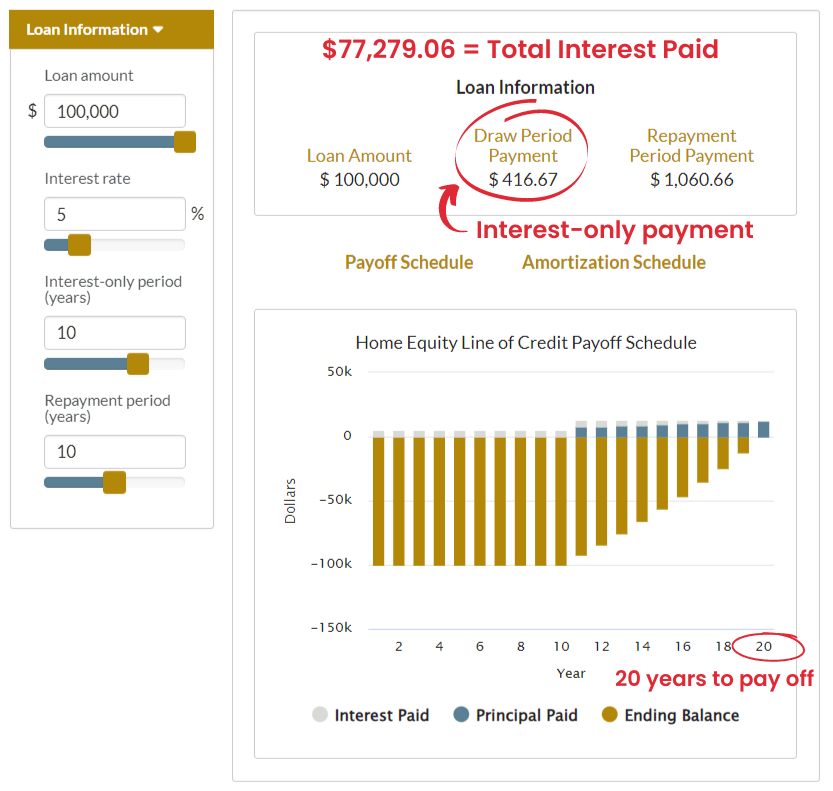

Say you have a $100k HELOC (at 5% interest) and you decide to make interest-only payments for the entire 10-year (120 mo.) draw period.

It would actually take a full 20 years to pay off the loan and you’d be paying a $77,279.06 in total interest.

While that’s great…

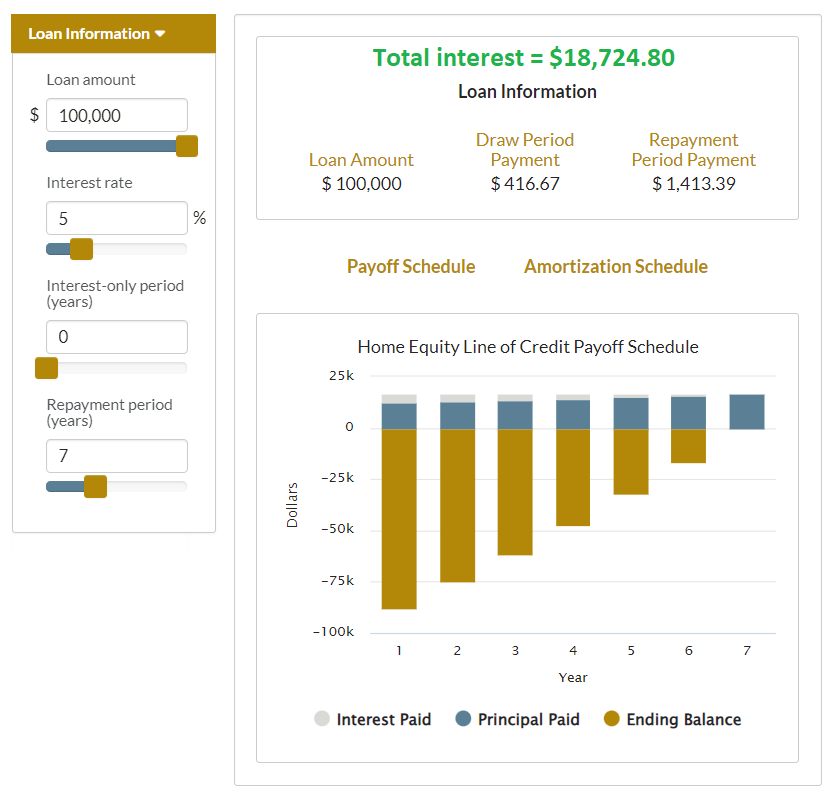

The truth is, you could pay this down even faster – like 7 years and only pay $18,724.80 in interest. Or better yet…

How to Pay Off Your Home in 5 Years or Less

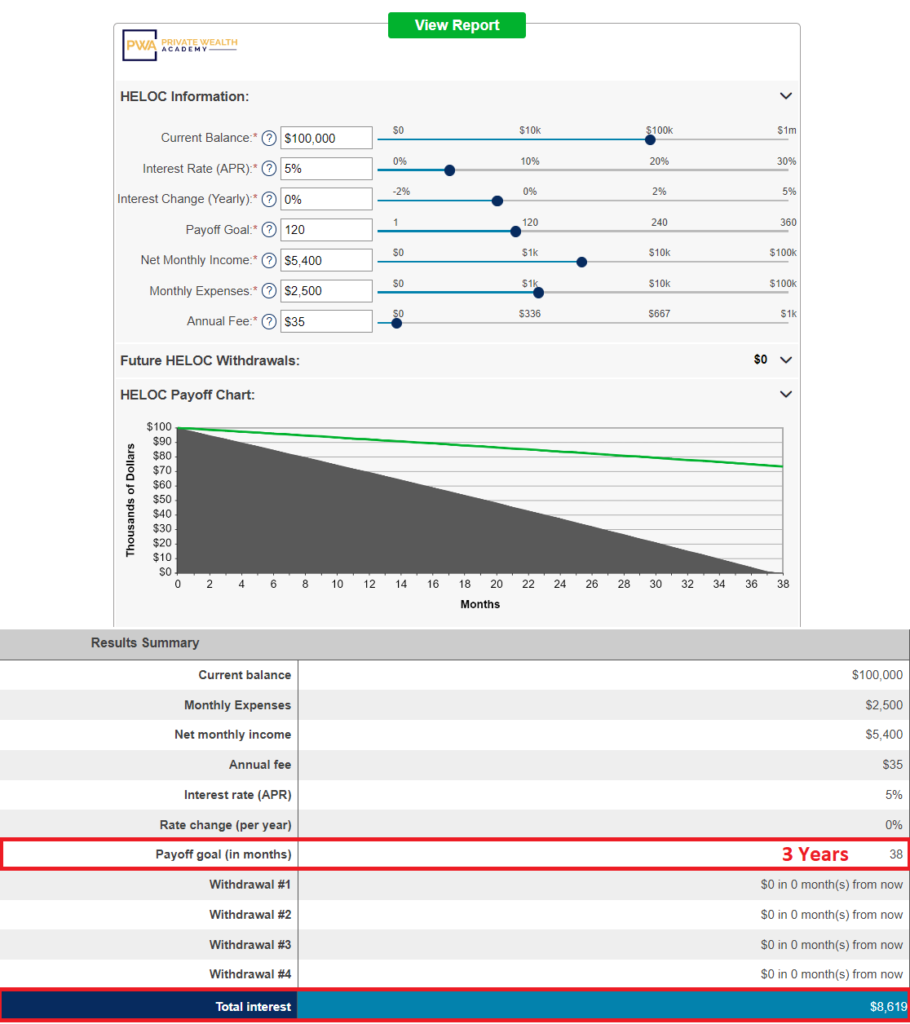

Using the HELOC Hyperdrive Strategy – you could pay it off in 3 years & only pay $8,619 in interest on a $100K loan!

That means you could save $68,660.06 and 17 YEARS of payments!

See how much MORE you can save by making additional principal payments? It’s pretty incredible, isn’t it?

The best part with a HELOC is, even if you choose interest-only payments to start – you can make additional payments toward principal at any time without penalty (unlike a mortgage).

Learn More About the Half Your Mortgage Program

By following the HELOC Hyperdrive strategy we teach in the Half Your Mortgage program, you can reduce your mortgage by 50% and pay off your loan in 5-7 years without changing your income or job.

Many students are able to pay off their home(s) sooner!

Helping you save a MASSIVE amounts of money and giving you a realistic strategy to meet future goals that may otherwise have been unobtainable.

Just listen to Jordan explain the extra interest costs…

You can also Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) we’ll run through the numbers with you using our proprietary software, see how much you’ll be saving in interest & determine YOUR EXACT PAYOFF DATE!

Wondering how much you’ll pay in HELOC closing costs? We’ll dive into that tomorrow… you’ll be pleasantly surprised.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.