Want to learn how to reduce tax liability quickly and easily?

First – POP QUIZ…

Are income taxes based on income? Or are they based on a taxable event?

If you said, taxable event – you’re right!

In case you still don’t quite understand what that means, let’s dive deeper…

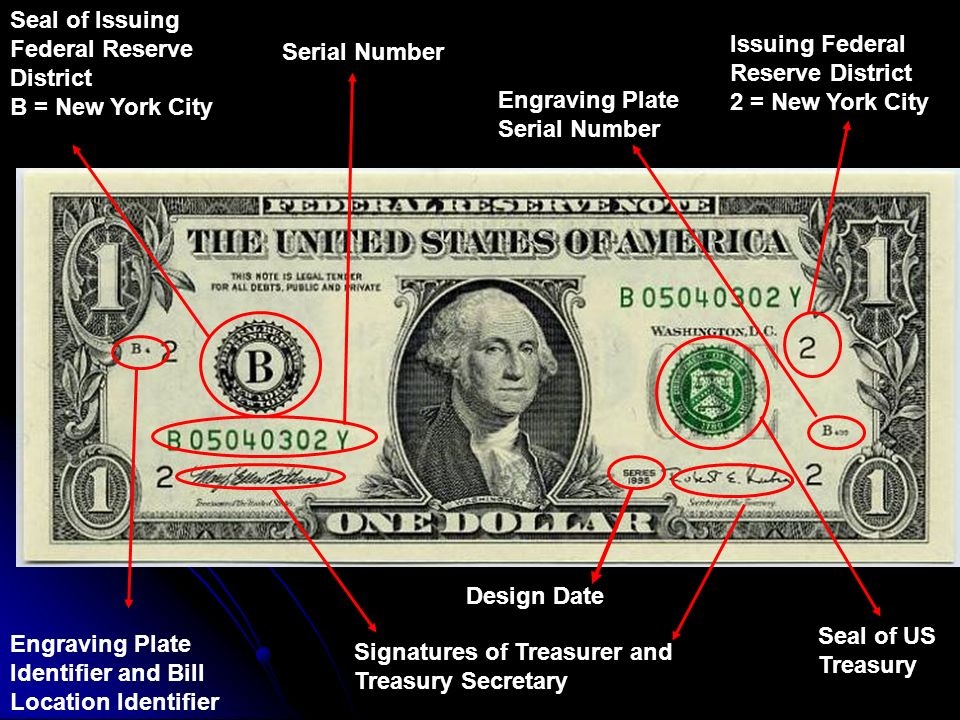

The dollar bills that we all use are Federal Reserve Notes (the Federal Reserve is a PRIVATE organization)

Federal Reserve Notes are a form of private credit which incurs an indirect tax.

The Supreme Court affirmed that the federal income tax is in the class of indirect taxes, which include duties and excises.

A charge is a duty or obligation, binding upon one who enters into it, which may be removed or taken away by a discharge (performance).

Income tax can be removed through a special type of tax redemption…

This redemption removes the taxable event and thus the tax liability.

We break it down in detail inside the Elite Tax Secrets program.

To be clear, we’re NOT talking about Withholding taxes, Social Security taxes or Medicare taxes…

Or evading or protesting taxes – NO!…

We’re talking about removing your income tax liability – LEGALLY!

If you’ve already filed your tax returns for this year – that’s okay. It’s the perfect time to learn this special method of redemption so you can literally SAVE THOUSANDS in taxes this coming year!

The best part is…

- The process is FREE & legal to do

- It’s easy to learn

- It’s FAST to do!

- It can remove up to 100% of your income tax liability

- Even the law protects you from being prosecuted for attempting to put this remedy in place.

So what are you waiting for?

NOW is the absolute best time to get Elite Tax Secrets and learn how to reduce your income tax liability FOREVER!

Learn More About Elite Tax Secrets

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.