Save on Taxes with a Gift Exclusion

The US Internal Revenue Service has announced that the annual gift tax exclusion is increasing next year due to inflation. The new gift exclusion will be $17,000 per recipient for 2023—the highest exclusion amount ever!

The general rule is that any gift is a taxable gift. However, there are many exceptions to this rule. Generally, the following gifts are not taxable…

- Gifts that are not more than the annual exclusion for the calendar year.

- Tuition or medical expenses you pay for someone (meaning you pay the education and medical bills directly).

- Gifts to your spouse.

- Gifts to a political organization for its use.

In addition to this, gifts to qualifying charities are deductible from the value of the gift(s) made. *The annual exclusion applies to gifts to each done. So each spouse could gift $17,000 to their child for a total of $34,000 per year.

ANNUAL GIFT TAX EXCLUSION

Each year, the IRS sets the annual gift tax exclusion, which allows a taxpayer to give a certain amount (in 2023, $17,000) per recipient tax-free without using up any of the taxpayer’s lifetime gift and estate tax exemption (in 2023, $12.92 million).

For married couples, this means that they can also give $34,000/year per recipient beginning in 2023.

GIFTS TO NON-US CITIZEN SPOUSE

Generally, spouses who are both US citizens may transfer unlimited amounts to each other without incurring any gift tax.

Gifts to a non-US citizen spouse, however, are limited. Since a non-US citizen spouse may not be subject to the US estate tax, one cannot transfer unlimited assets to a non-US citizen spouse since that transferred wealth could potentially avoid US estate taxation upon the non-US citizen spouse’s death.

For calendar year 2023, the first $175,000 of gifts to a spouse who is a non-US citizen are not included in the total amount of taxable gifts.

LIFETIME ESTATE AND GIFT TAX EXEMPTION

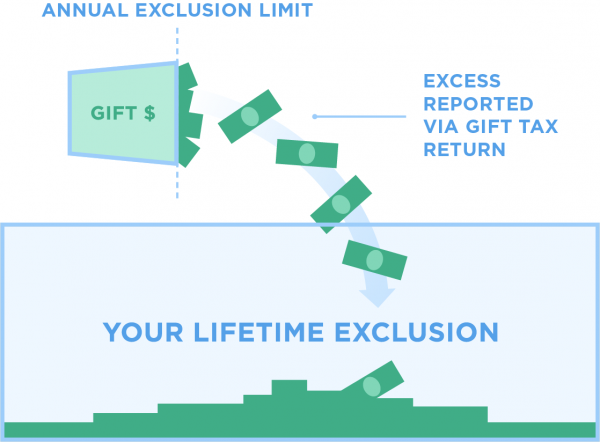

If one gifts an amount that is above the annual gift tax exclusion, that individual will use a portion of his or her lifetime gift tax exemption ($12.92 million in 2023).

If one makes gifts in excess of the annual gift tax exclusion, one must file a gift tax return, due April 15 in the following year, to report the gift and track the amount of the lifetime exemption that has been used.

Keep In Mind That Gifts to Individuals Are Not Deductible

Making a gift and also leaving your estate to your heirs does not ordinarily affect your federal income tax. You cannot deduct the value of gifts you make to individuals (only contributions to qualified charities are deductible). If you are not sure whether the gift tax or also the estate tax applies to your situation, refer to Publication 559, Survivors, Executors, and Administrators.

Ready to learn how to legally avoid income taxes like the elite?

Get Instant Access to Elite Tax Secrets

Inside Elite Tax Secrets we’ll teach you numerous financial practices used by the elite to eliminate taxes by avoiding income taxable events altogether.

Don’t worry though – you don’t need expensive assets, millions of dollars or complex tax shelters for this to work. The main tax method we teach is the simplest, easiest & FASTEST method to legally reduce your income tax liability. In fact, it’s as easy as writing a check!

You’ll learn how you can legally eliminate your taxation of income and better support your family by increasing your wealth, keeping every hard-earned cent. These methods will work personally, for your business, for your trust, or your faith-based organization. Why wait? Get started today!

Learn More About Elite Tax Secrets

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.