Have you ever heard financial gurus like Dave Ramsey or Suzie Orman warn against using HELOCs?

They’re not entirely wrong…

A HELOC comes with flexibility that it can be tempting to use it as a piggy-bank.

But we want to help you get the most benefit from your home equity line of credit and avoid it from becoming just another form of bad debt.

5 Things to Avoid to Reduce Risk When Using the HELOC Strategy:

1. Don’t Use a HELOC to Pay for a Vacation

HELOCs are a cheaper way to pay for expenses than using credit cards. They tend to offer interest rates below 8%. Credit card rates are stubbornly high, ranging from 14% to 25%. Using a home equity line to pay for a vacation and entertainment activities is not a wise way to spend. It’s cheaper than paying with a credit card, but it’s bad debt that doesn’t earn you any equity.

If you can pay off the entire amount within a month then it might be ok. But be careful because using debt to fund your lifestyle, especially while borrowing from home equity can exacerbate the problem. At least with credit cards, you are only risking your credit—overspending with a HELOC could put your home at risk.

2. Buy a Car

While HELOCs can offer much lower rates than auto loans, making it tempting to use the cheaper money to buy a car – it’s not usually a wise investment. *The one exception is if you’re in an emergency situation, only own one vehicle and NEED to replace your car. Otherwise, you probably don’t want to tap into your home equity to buy your next vehicle.

Buying a car with a HELOC is a bad idea for several reasons…

1) A vehicle is a depreciating asset meaning it’s constantly losing value. 2) An auto loan is secured by your car. If your financial situation worsens, only the car is at risk of getting repossessed.

3. Weddings, Parties, Celebrations

HELOCs are more affordable than personal loans or credit cards but your precious home equity shouldn’t be squandered on a one-time celebration (even a wedding.) Using a HELOC for this purpose will only tempt you to spend more than you would have if you saved up cash for it.

4. Investing Yourself Too Thin

This can happen with any type of investing but it’s an all too common occurrence with real estate investors… They begin using HELOCs to make down payments on investment properties and when the market makes a correction or their financial situation changes, they are left with nothing or worse – owing more than the properties are worth.

This is what happened during the ‘08 collapse and many REIs got completely wiped out! It’s a recipe for disaster that you want to avoid at all costs! Investing in real estate is still risky. Many unforeseen problems can arise, such as unexpected expenses or a sudden downturn in the market. The risks are even greater for inexperienced investors. Be sure to do your research & have a solid game plan in place.

5. Pay for College

Since HELOCs often offer lower interest rates, you may rationalize tapping your home equity to pay for a child’s college education. However, 4 to 8 years can be a long time and doing this may put your house at risk should your financial situation change for the worse. If the balance is large and you’re unable to pay down the principal before the repayment period, then you could face significantly higher monthly payments.

*With that being said – if you follow our proven HELOC Hyperdrive Strategy inside the Half Your Mortgage program you should be able to pay off the entire loan amount in 10 years or less (i.e. before the draw period ends.)

Run the numbers, sometimes student loan interest rates are lower than HELOCs – sometimes they aren’t. If you believe that you might not be able to repay a HELOC within 8-10 years, then a student loan may be a better option.

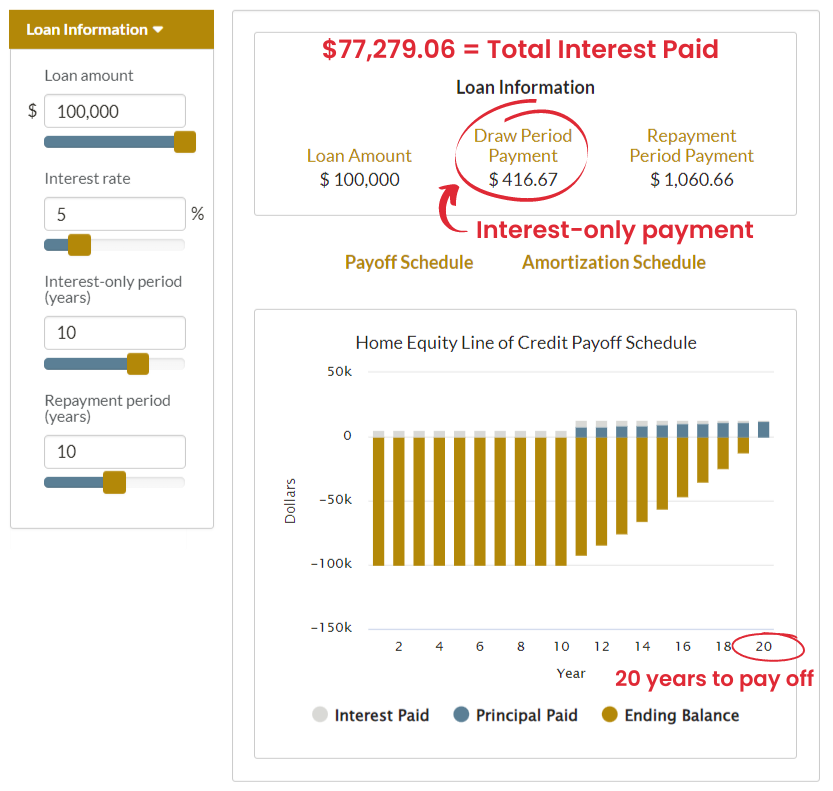

6. Making Interest-Only Payments During the Draw Period

This is the BIGGEST HELOC TRAP people fall into. They think that interest-only payments are the better way to go since monthly payments will be low. But you’re actually costing yourself MORE MONEY in the long run… Because the longer you drag on the principal – the more money you pay in interest. And that INTEREST ADDS UP FAST!

By putting off principal payments during the draw period – you’re setting yourself up for failure. You’re lulling yourself into a false sense of security for 10-15 years then…

BOOM! Monthly payments are double, triple or quadruple what you were previously paying.

***NOTE: It’s the comfortability of super-low, interest-only payments over many years that can cause people to make poor financial decisions. When it comes time to make payments on the principal they’re in a worse situation.

We want to help you avoid that stress! Our goal is to help you INCREASE YOUR WEALTH – not dig yourself deeper in debt. Besides, who knows what your financial situation will look like 10+ years from now, right?

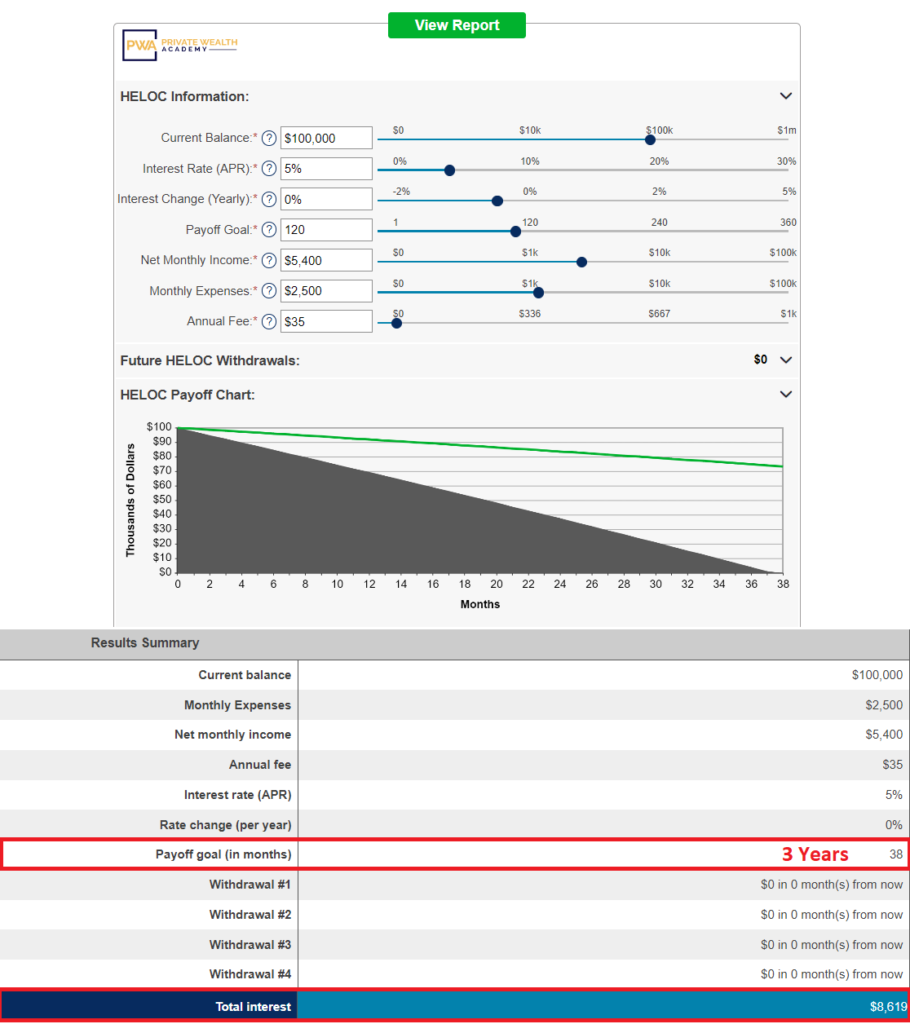

The HELOC Hyperdrive Strategy may have you putting more money towards payments than you’ve currently been making but not to worry because this will save you SO MUCH IN INTEREST and dramatically decrease your payments over time.

Plus, the fact is…

Until you own your home free & clear – you’re just “renting”.

By following the HELOC Hyperdrive Strategy and putting as much towards the loan principal as possible you’ll be able to…

- Own your home free & clear faster than ever – in as little as 3 years!

- Maximize your borrowing power and ability to redraw your HELOC funds (borrowing & repaying throughout the entire 10-15 year draw period) instead of withdrawing over years, racking up high amounts of interest and then suddenly having to make much larger payments the day the repayment period starts.

- Manage all your paychecks and bills easily from one account.

- Form good financial habits by paying off the most important things first – making you more mindful of where else your money is going.

We have so much to show you! And we think you’ll be pleasantly surprised how much money (and how fast) you’ll be able to save using this method.

Inside the Half Your Mortgage program we’ll show you the FASTEST way to pay off your HELOC loan. We’ll teach you the exact criteria to look for, how to prepare your finances, how to calculate the interest (so you know how much you’ll be able to save), give you access to our proprietary HELOC calculators, how to find the best lenders, how to lock-in the best rates and SO MUCH MORE!

Getting excited? You should be!

We’ll even teach you a few of our favorite real estate investment tips and a sweet banking secret that will allow you toearn a 12% ROI every year. Click the link below to learn how to use HELOCs for real estate investments.

Learn More About the Half Your Mortgage Program

You can Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE! Book a call TODAY!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.