Got questions about building your business credit with EIN?

Unlike personal or consumer credit, you want to build business credit with EIN or Employer Identification Number that’s generated from the IRS (for FREE).

True or False…

Having an EIN (Employee Identification Number) means you have an established credit profile for your company.

If you said ‘False’ – you’re right.

As a business owner, you know your EIN (or Employer Identification Number) is important.

The EIN is the unique nine-digit number issued by the IRS.

It’s basically the social security number of your business. This number is what gives your business an identity in the system.

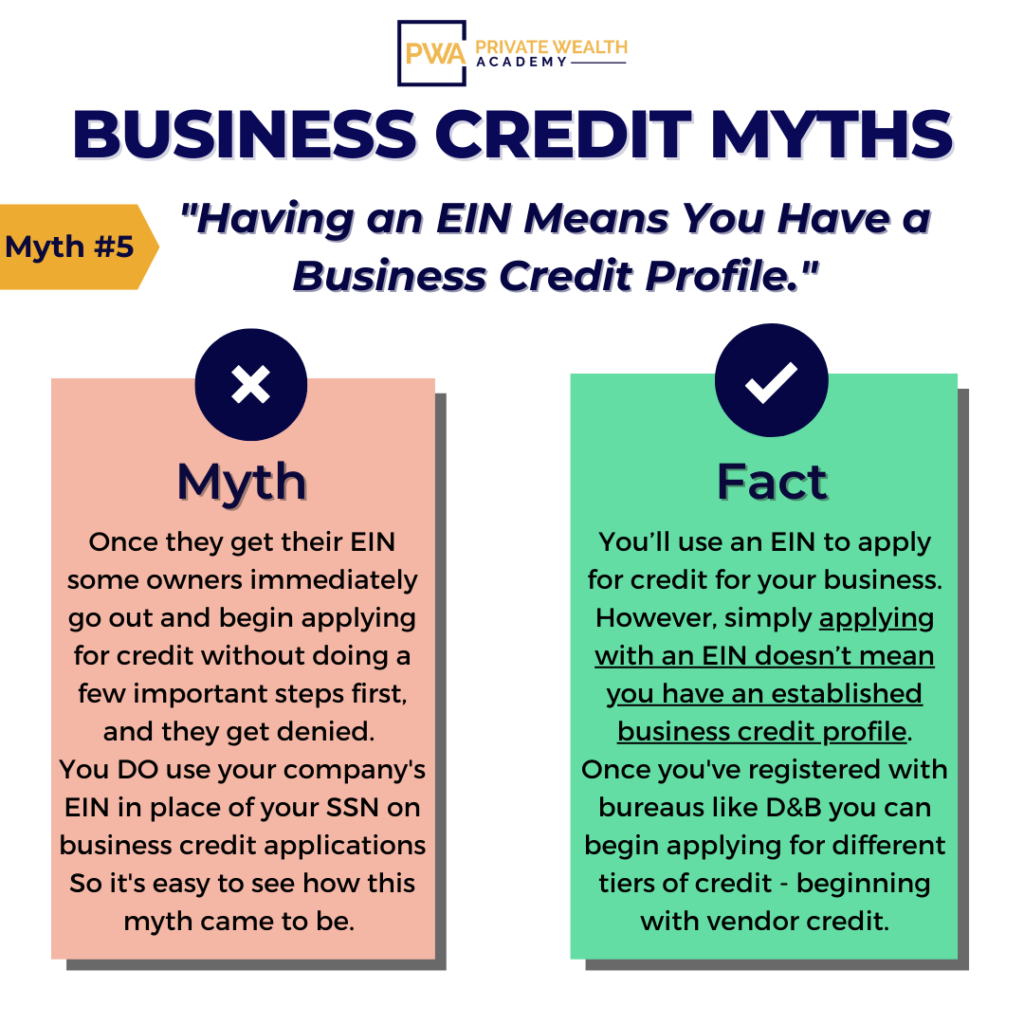

While the EIN is what you’ll use to apply for credit for your business – simply having an EIN alone doesn’t mean you have an established credit profile for your business…

If you go to a bank and try to get a bank credit card or financing with just an EIN and no established credit or financial history, generally the result will typically be the same every time – you will get denied.

Now, if you have good personal credit and don’t mind supplying a personal guarantee, you can use that to help you get approved…

But, as we’ve touched on in our other posts, you want to build business credit with EIN only whenever possible so that you build up your corporate credit history.

You still need to apply for credit under your EIN, but you will also need to build your company’s credit profile in the right order BEFORE you do.

Without a company credit profile, your EIN is basically useless for credit building purposes.

The trick is to start with specific lenders and vendors who approve companies without previous credit history or financial documentation.

After that, you can move on to accounts that require your business to have a more established credit profile.

By doing this, you’re maximizing your fundability and increasing your approval rates. That’s EXACTLY how we’ve designed the Corporate Credit Secrets program. We’ll show you how to quickly build your business credit with EIN and show you how to improve your personal credit as well to give you the highest chances of approval.

If you want to learn how to become highly fundable and get access to $50,000-100,000 in credit for your company in 6 months or less…

Join The Corporate Credit Secrets Program

Curious what the credit ceiling is for corporate credit? The answer’s probably not what you’d expect… Keep an eye out for tomorrow’s post where we’ll shed the light on this common question.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.