Have you already opened a business bank account for your company?

Even if you have, listen up because there’re a few key things you may not have thought about when you chose your bank.

Opening a business bank account may seem like an overrated task but it’s a foundational step in starting a business plus it will help set the pace for how quickly you can build and secure credit.

Don’t rush through the step of choosing your business bank account – it’s important to choose a bank that meets your needs.

Here’s the process of opening a business bank account…

Step 1) Research Banks

First make a few notes on what you need in your bank account. You can start your search with the big national banks, but if your ultimate goal is to secure high amounts of financing, don’t overlook your local banks & credit unions.

Step 2) Choose Your Business Bank Account Type

Make sure you have all of the personal and business details that we list in this article before you start your application. Be ready to submit them, either via online upload or with physical copies.

Step 3) Gather the Information & Documents

You can either visit the physical bank or online, depending on which institution you choose. You’ll likely need to make a deposit into your new account, which you can do with a digital transfer online, or cash or check in person.

What Documents Do You Need to Open a Business Bank Account?

A bank might request copies of any of the following, based on your type of business structure.

- Partnership Agreement — If your business is legally set up as a partnership, you will need to provide a copy of your partnership agreement when you apply to open a business bank account.

- Articles of Organization — For LLCs, you should be prepared to provide your Articles of Organization.

- Articles of Incorporation — If your business is set up as a corporation, the paperwork you’ll need to provide the bank when you apply to open a new account is known as your Articles of Incorporation.

- Business License — Depending upon the industry in which your business operates, a bank might request a copy of your business license(s) as well.

Step 4) Open the Business Bank Account

Depending on the bank, you may have the option to open your account online or in-person. Some banks do require business accounts to be opened in person. Make sure to bring all documentation and proofs of ID with you.

Step 5) Put Your Business Bank Account to Use Right Away

Once you’ve finished applying, your bank will provide you with a debit card, either in-person or by mail, as well as business checks. You can start depositing money you’ve made from your business transactions, set up direct deposit and direct debit or ACH, and link your bookkeeping accounts.

When Choosing a Business Bank Account Consider the Following…

- Monthly Fees

- Min. Deposit Amount

- Transaction Limits

- APY

- Bonus Offer

- Other fees like…

- Transaction fees

- Address Verification (AVS) fees

- ACH daily batch fees

You should also check to make sure you meet the bank’s requirements.

Now on to the stuff you probably haven’t thought of…

► Who Does the Banks Underwriting?

A credit underwriter reviews credit applications and helps decide whether you should get a loan. A credit underwriter’s job is to review loan applications and check a loan applicant’s credit history. They may also verify income and debt information.

Finding the bank’s underwriter will tell you a lot about the lending patterns of the lender and give insight as to how much funding you might receive.

If the bank does their OWN underwriting – that’s great!

It means they ‘lend’ their own money. (Be sure to add that one to your list!)

It also means you’re more likely to get much more funding from them. Many local banks & credit unions do their own underwriting but always ask the bank’s loan officer to be sure.

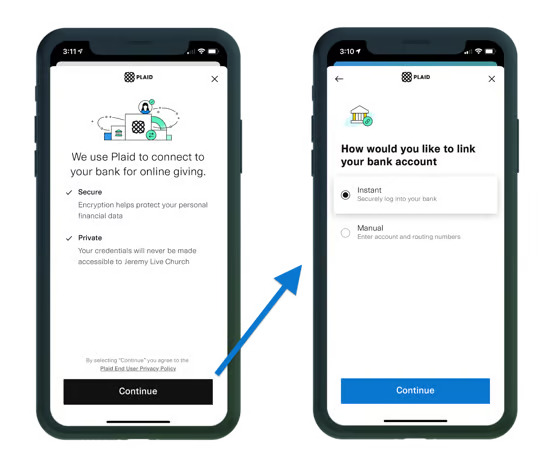

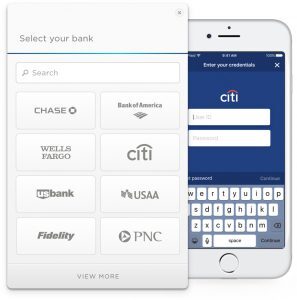

► Is the bank able to be easily verified using Instant Bank Verification (IBV) tools like Plaid?

What we’re talking about here Instant Bank Verification (or Instant Account Verification) it’s the step you have to take when you apply for a credit card, credit line, certain rental properties or are otherwise trying to verify your banking account details to another party.

Instant bank verification works for a variety of financial institution types, from banks to FinTechs and more. Banks and investment firms typically use IBV as part of their onboarding process when bringing on new customers or when qualifying someone for credit.

The problem is, this DOES NOT WORK WITH CERTAIN BANKS.

Since IBV is relatively new, there’s not a clear cut database of institutions this does and does not work for. Typically the big national banks work fine.

And there’s another problem…

It’s not just a matter of the lending institution not being supported or found in the third-party verifiers system. Sometimes it seems like there’s a login issue…

BUT even if you have the correct login credentials, certain banks (especially online-only banks like Lending Club), just won’t allow connect with instant verification no matter how you go about it.

Lending Club has super low costs and some good financing options but it’s definitely NOT the best option as a primary business bank account.

This may not be a big deal to you, but when you’re ready to start applying for company credit cards and lines of credit…

at best – this problem could slow you down and

at worst – momentarily stop you in your tracks.

Not being able to instantly verify your business bank account (when you have the funds to show) can dramatically slow down the funding process from what could have been an instant approval to 14-30 days.

Keep this in mind if you’re going to be applying for several credit cards or lines of credit or you want to make sure you can get approvals as fast as possible…

*It may take a little bit of digging, but you can try & search to find out if your potential bank will work with major IBV verifiers (like Plaid, MX, Yodlee, etc.)

The best way is to start with Google, Quora, Reddit, YouTube, forums – searching things like “BANK + Instant Bank Verification” or

“BANK + Instant Bank Verification not working” and see what results come up.

Which Credit Reporting Agencies Does the Bank Report To?

Believe it or not, each bank is slightly different with regards to which credit reporting agencies they report credit to and pull credit information from (like when applying for new credit). Knowing this can allow you to understand where the information is coming from so you can better position yourself for an approval.

You can call and ask directly but banks sometimes don’t like disclosing this information publicly. Instead, you can search “what credit reporting agency does BANK pull from” and the results should give you a good starting point.

*Also just because a creditor or bank reports information to the business credit bureaus, doesn’t mean they don’t report negative information to the consumer credit bureaus. So be sure to ask.

OR better yet you can skip all that and join Corporate Credit Secrets

Get Access to Corporate Credit Secrets

Inside the program we’ll show you how you can build a strong business credit profile & be a highly fundable company (that lenders will throw money at)!

We’ll also give you our list of the credit reporting agencies the Nation’s largest banks report to (and pull from) to save you time.

Tomorrow we’ll talk about how banks share databases and how that can affect your funding approvals. Keep an eye out for that.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.