Have you ever been scammed by someone claiming to be the IRS?

If so, you’re not alone. In fact, whenever tax season rolls around – it seems like the IRS scams come out in full force!

As the deadline for filing approaches, so do tax-time swindles ranging from high-tech identity theft to tried-and-true con jobs.

Here are six of the most common IRS scams to watch out for this year, according to the Internal Revenue Service:

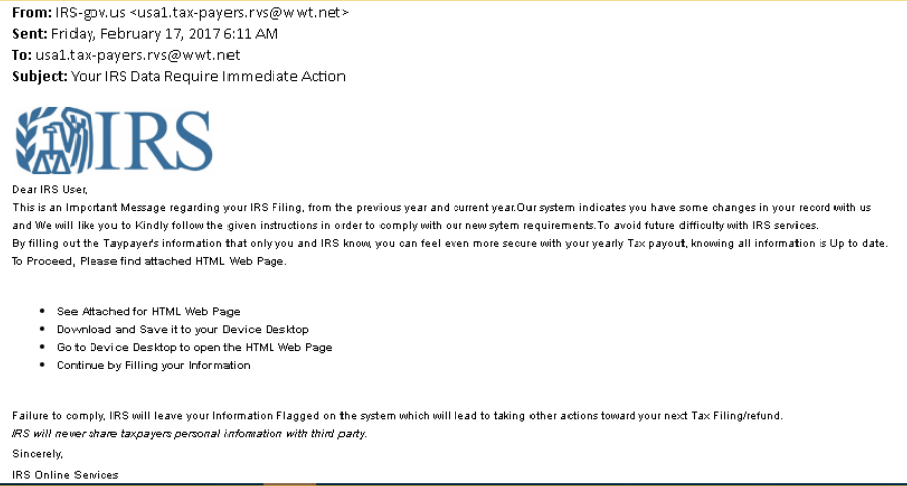

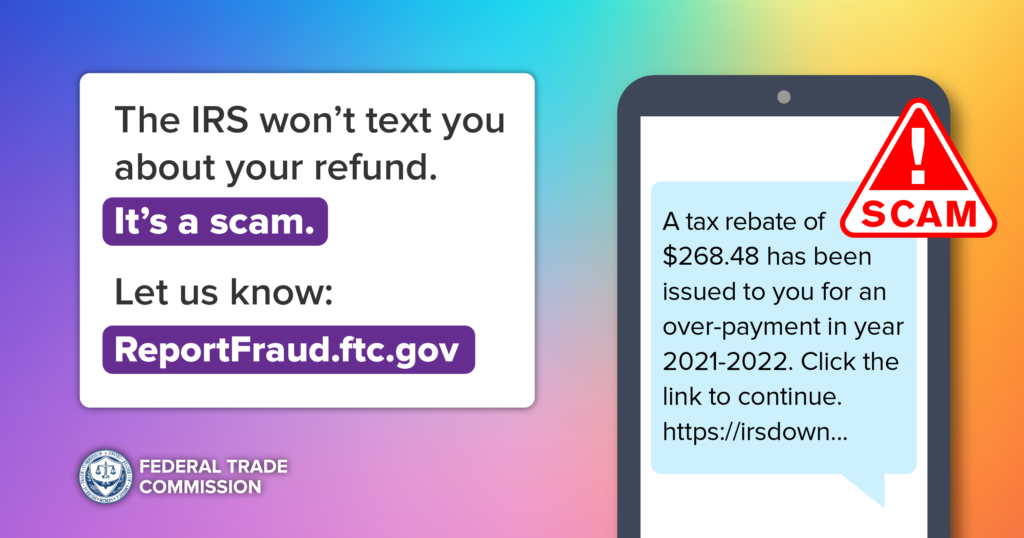

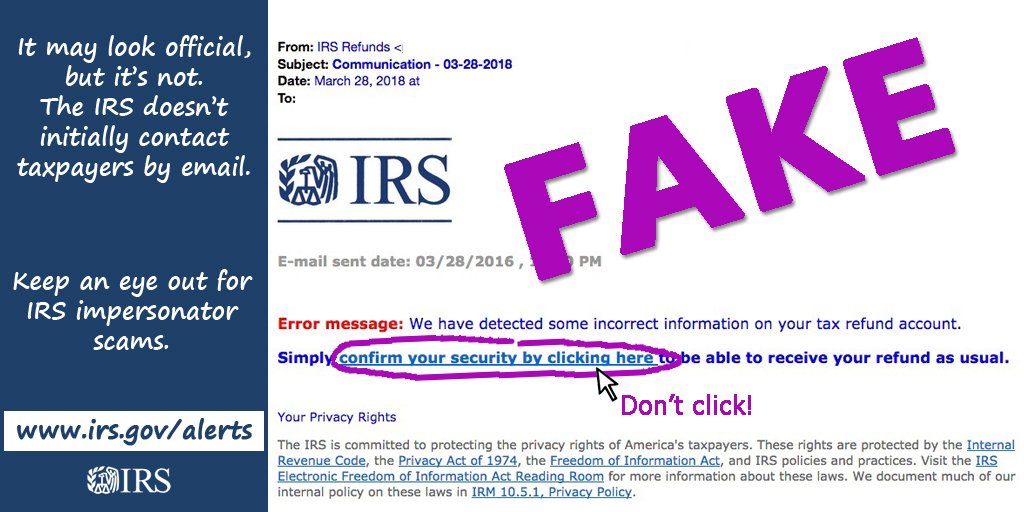

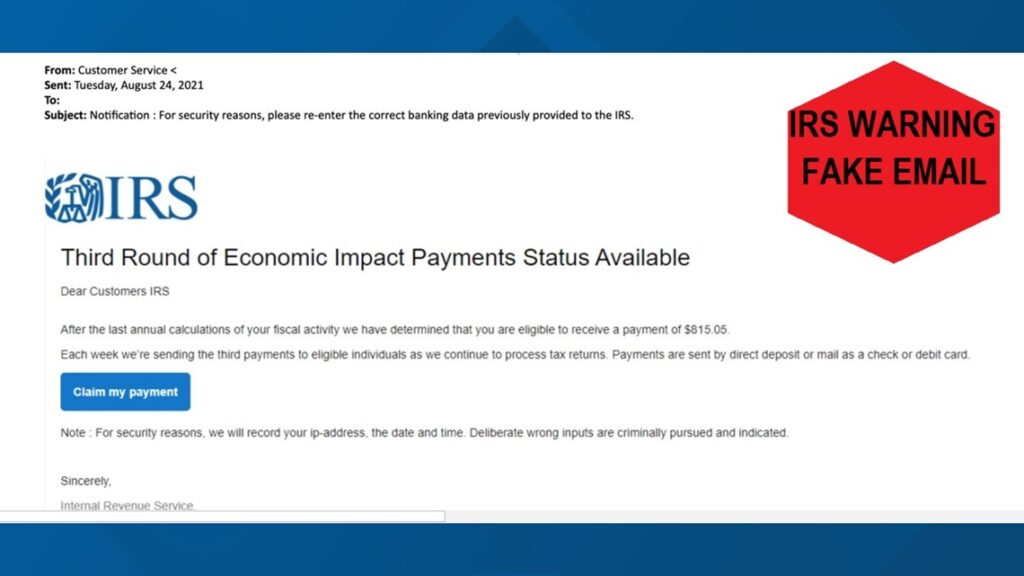

1. Phishing

Con artists use unsolicited email and fake websites to lure potential victims into divulging personal information that will then be used to commit identity theft and fraud. Be leery of unexpected emails from the IRS promising refunds or threatening to collect, IRS officials say. But, they’re fake — the IRS doesn’t initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information. You can also report any such suspicious emails to [email protected].

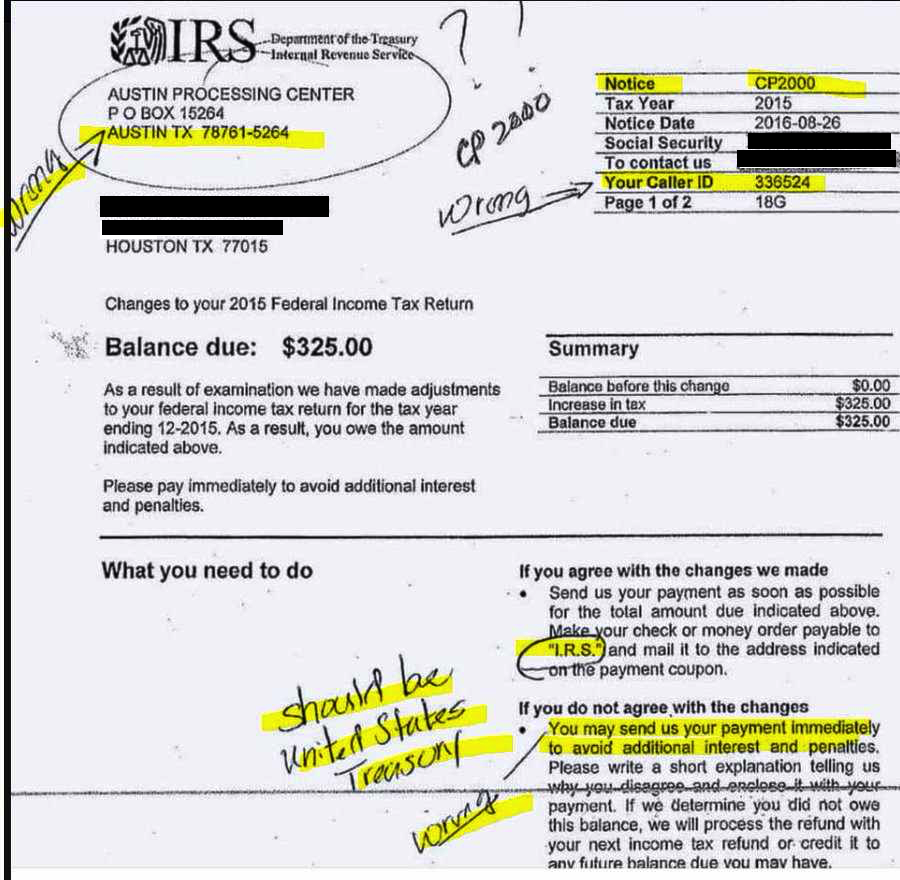

2. Verification requests

Don’t be fooled by scammers asking you to “verify” your W-2 or personal information. Some may also ask you to upload a picture of your forms. The only time that the IRS would request ID verification would be if they were concerned about a suspicious tax return with a real taxpayer’s name or also Social Security number. But, if that’s the case, they would generally send a Letter 507IC (check the upper corner for the number) in the mail and ask you to verify your identity using the Identity Verification Service

3. Phone Scams

Scammers impersonating IRS agents may make aggressive or also threatening calls demanding money or offering a refund. Sometimes they even alter their caller ID information to appear as if they’re calling from an IRS office. But that’s not how the IRS does business, according to officials. The first IRS contact with taxpayers is typically via mail.

The IRS will only call or visit to a home or business, in the event that:

- A taxpayer has an overdue tax bill,

- To secure a delinquent tax return or a delinquent employment tax payment, or

- To tour a business as part of an audit or during criminal investigations.

Even then, taxpayers will first receive a letter, sometimes more than one notice from the IRS in the mail.

4. Inflated Refund Claims

Beware of tax preparers who ask you to sign a blank check, promise big refunds before looking at your records or charge fees based on a percentage of your refund. They use fliers, phony storefronts and sometimes infiltrate community groups and churches. These scammers may file a false return in your name and take your refund. The IRS offers tips for choosing a preparer.

5. Fake Charities

After disasters, it’s also common for scammers to impersonate charities; some even contact victims, claiming to be with the IRS. These groups often have names similar to legitimate organizations. Don’t give out personal financial information or Social Security numbers. And don’t give or send cash.

6. Identity Theft

One of the most common identity theft scams involves filing tax returns using stolen Social Security numbers. Protect your personal data, and also check your credit report annually and review your Social Security Administration earnings statement each year to make sure you haven’t been targeted.

For more information, check out the IRS’ longer list of tax-time scams.

However, Just keep in mind that the IRS will never…

- Ask for payment using a pre-paid debit card, money order, or wire transfer.

- Request credit card information over the phone.

- Accept payment by gift card.

If you’re sick and tired of paying taxes like a “commoner”…

Click to Learn More About Elite Tax Secrets

Inside Elite Tax Secrets we’ll teach you numerous financial practices used by the elite to eliminate taxes by avoiding income taxable events altogether.

You’ll also learn how you can legally eliminate your taxation of income and better support your family by increasing your wealth, keeping every hard-earned cent.

These methods will work personally, for your business, for your trust, or your faith-based organization and it’s a lot simpler than you would think! Join the hundreds of students to free yourself of the voluntary tax system FOR GOOD.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.