So you’ve been looking into HELOC line of credit and loans…

Curious if HELOCs are the same in every state?

Great question!

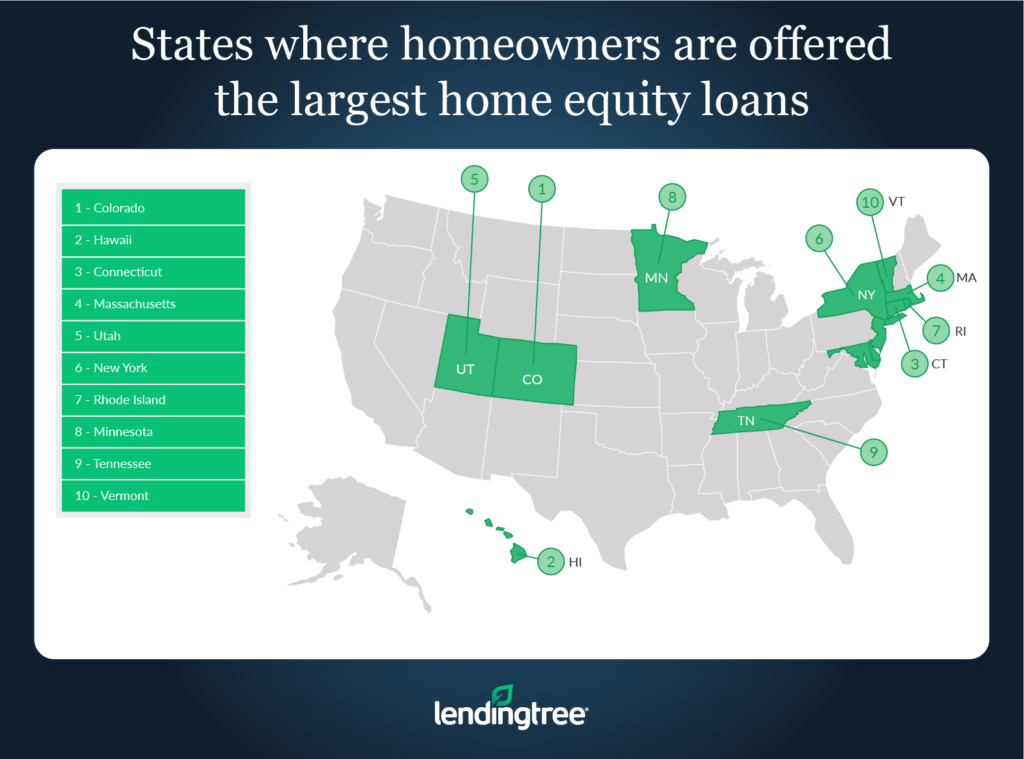

The HELOC is an excellent financial tool and beloved by many as an efficient leverage point for so many different purposes. When it comes to purchasing real estate or investing, you may decide to look beyond your current state.

HELOCs are NOT the same in every state…

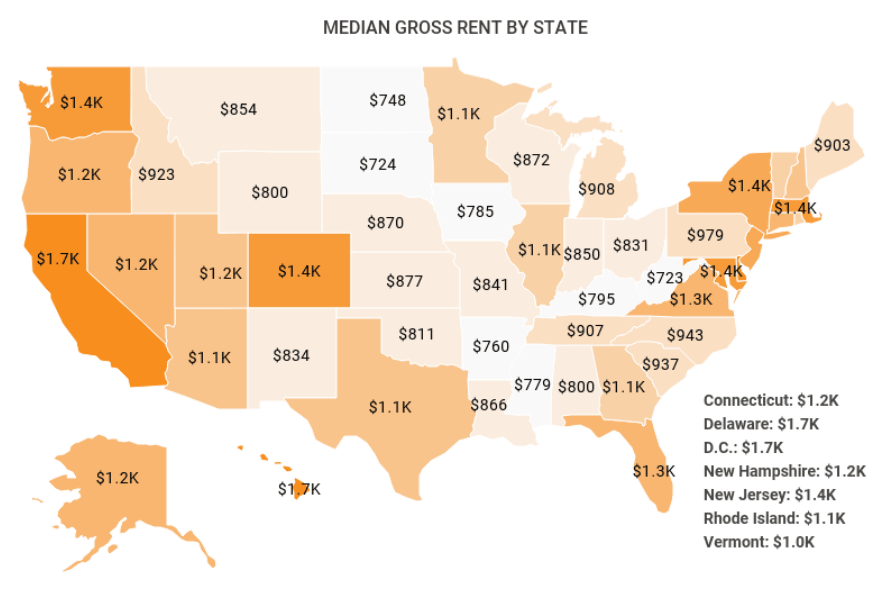

The availability and terms vary by state, and some states have specific regulations or restrictions. And, not all lenders operate nationally or offer HELOCs for properties in every state.

It’s common for regional banks and credit unions to only provide HELOCs in their state or neighboring states. Some lenders may not service specific states like Texas, Hawaii, or Alaska.

The state with the most HELOC restrictions (by far) is Texas.

Texas has regulations around home equity loans and HELOCs that don’t apply to other states. In fact, Texas didn’t allow home equity loans until 1997, weird right?

Texas law requires that all HELOCs have a maximum loan-to-value (LTV) ratio of 80%. And also requires a minimum draw of $4,000.

Here’s the summary:

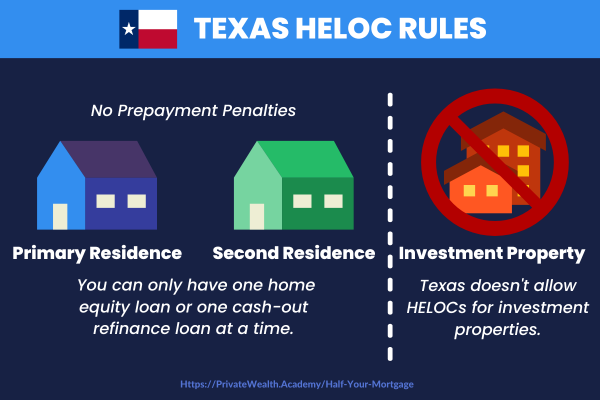

- Texas law permits that you can only have one home equity loan or one cash-out refinance loan at a time.

- Because of requirements surrounding fact-checking, loans cannot legally close any sooner than 12 days after the borrower applies & receives official notice of borrowers’ rights. Since it typically takes 30 days on average to close, this doesn’t change much.

- The Texas laws cap lender fees to 2% of a loan’s principal. Survey, appraisal, and title fees are not included.

- Home equity loans in Texas cannot be converted to other types of loans.

- Home equity loans can be paid off before they’re due without penalty or extra charge.

- Lenders can’t require a loan to be paid earlier than agreed upon based on the home value decreasing or the borrower defaulting on another loan.

Thinking of taking out a HELOC (or home equity loan) on an investment property in Texas? Think again. In Texas, you can only borrow against the property in which you live, not your second home or rental property.

You’ll learn more about any specific state restrictions when shopping around for lenders.

Tips To Get The Best HELOC Rates No Matter What State You’re In:

Boost Your Credit Score – If you have a high credit score, you’ll increase your odds of approval and get better rates and terms. Reducing your credit utilization and creating positive payment experiences are both effective strategies for raising your score. Use High Credit Secrets (FREE w/ HYM) to boost it to 720+ in under 90 days!

Shop Around – Rates vary drastically between lenders, so we highly recommend you put the time in needed to research to find the best available terms for HELOCs today. Don’t have much time to spare? No problem!

Compare Interest Rates – Typically variable rates will be lower but a fixed-rate HELOC can bring you the comfort of knowing how much your monthly payment will be and allow you to better plan your monthly finances.

Worried about carrying more debt?

Remember you choose how much to withdraw from your HELOC, and you are only charged interest on the amount you actually spend from your line.

Regardless what you choose to use the funds for – the Half Your Mortgage program will show you the absolute fastest way to pay off the loan (most students pay it off in 5-7 years on average.) And we’ll show you techniques you can use to pay it off in as little as 3 years.

No matter what state you live in, the Half Your Mortgage program will show you how to secure the best HELOC for you.

You’ll also get your very own list of lenders that offer first lien HELOCs in your state so you don’t have to spend hours of time researching.

Click the link below to get access today so you can find the best HELOC in your state and start tapping into your home equity like cash.

Learn More About the Half Your Mortgage Program

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.