What’s holding you back from getting a HELOC?

Are you wondering if a HELOC is actually right for YOU?

A home equity line of credit (HELOC) is one of the most powerful types of financing. It also allows you to borrow only what you need, when you need it.

Which is perfect during tight financial situations or uncertain economic times much like we’re experiencing today.

However, unlike a mortgage or home equity loan, you don’t have to know how much you’ll withdraw. And you’re also not locked into paying compounded interest on the full loan amount.

Unlike a Second Lien HELOC strategy to pay off mortgage…

A first lien HELOC RELACES YOUR MORTGAGE! Allowing you save TENS OF THOUSANDS in interest.

With a HELOC, you are only charged interest on what you spend which keeps costs low and also allows you to save a tremendous amount in interest freeing up cash for other goals.

Who Will This Work For?

As long as you have 10-20% equity, are cash-positive, and are able to make the monthly payments – a first lien HELOC is a fantastic tool to help you leverage your spending.

Worried about your less-than-stellar credit?

By joining the Half Your Mortgage program you’ll also get access to High Credit Secrets so even a low credit score doesn’t have to be a deterrent since we can help boost your score to 720+ within 90 days.

Are you interested in…

- Paying off your home faster?

- Paying less in interest?

- Making home renovations or remodeling?

- Wise investments (real estate, metal markets, etc.)?

- A more affordable alternative to credit cards or loans?

- A more affordable way to pay for business expenses or other large expenses?

- Having a large open line of credit you can use for whatever you need?

If you replied ‘Yes’ to any of these questions – a HELOC may be right for you.

We know you’re probably itching to start applying but there are a couple more things you should know before submitting a HELOC application. We’ll go into that in tomorrow’s email.

Just remember, every success starts with a goal…

Our goal is to help 1,000 homeowners cut their mortgages in HALF this year!

What goal are you hoping to accomplish with your HELOC?

Or yet, more importantly… What challenges are you running into?

Over the last 35 days we’ve shared the biggest benefits of a first lien HELOC, broken down the most costly mortgage “scams” to avoid and have shown you some incredible success stories of homeowners saving THOUSANDS of dollars and YEARS of payments.

But there’s obviously still something holding you back…

What is it that’s holding you back?

This is the most important question we could ask. Because if we can help you eliminate that, then we’ve helped you get one step closer to your goal.

And more importantly, help you finally be able to pay off your home FAST, improve your cash flow and take your investment game to a whole new level.

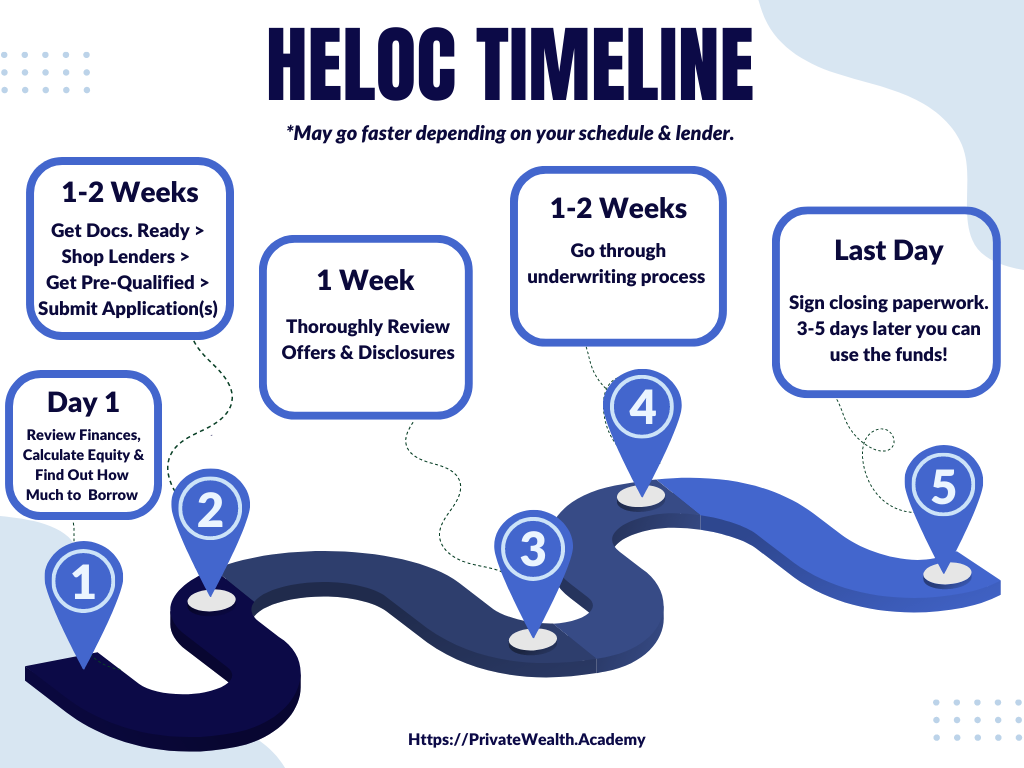

It might surprise you to know that if you would’ve taken action on Day 1 – you could have opened your HELOC account by now…

We don’t say that to rush you but to encourage you to seriously consider this opportunity.

This is your chance to reduce your mortgage by 50% – guaranteed!

Half Your Mortgage shows the mathematically proven method of paying off your HELOC in 5-7 years using only your current income!

We’ll show you how to find the right first lien HELOC, teach you the exact criteria to look for, how to prepare your finances, how to calculate the interest (so you know how much you’ll be able to save), how to find the best HELOC lenders, how to lock-in the best rates and so MUCH MORE!

Whether you’re looking for the fastest way to pay off a home or you just want a more affordable source of credit the Half Your Mortgage program will show you how to save tens of thousand of dollars (or more) in interest.

Ready to get started?

Learn More About the Half Your Mortgage Program

We’re here to answer your questions and help you get started…

Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE! Schedule a call with us TODAY!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.