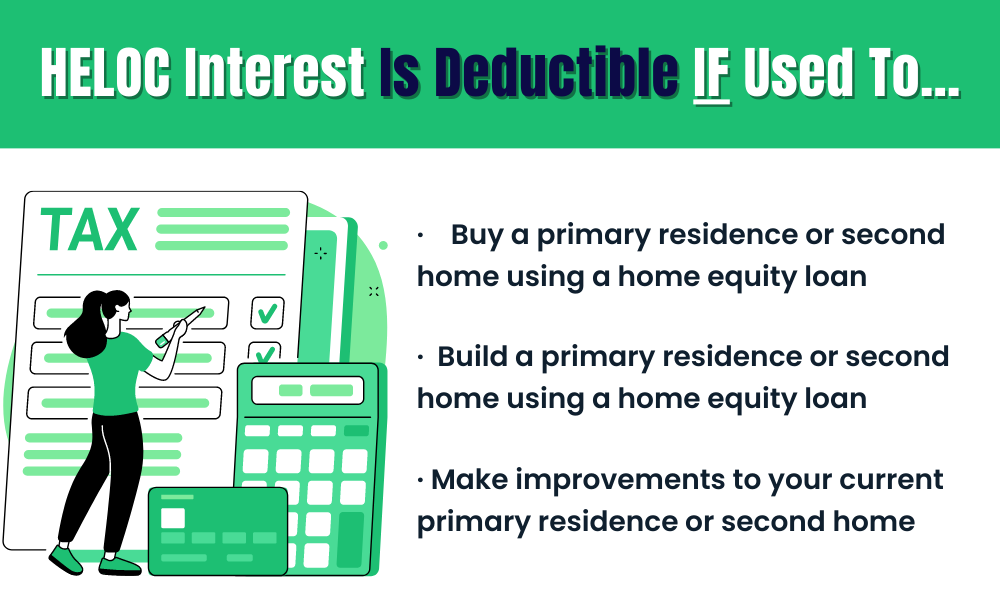

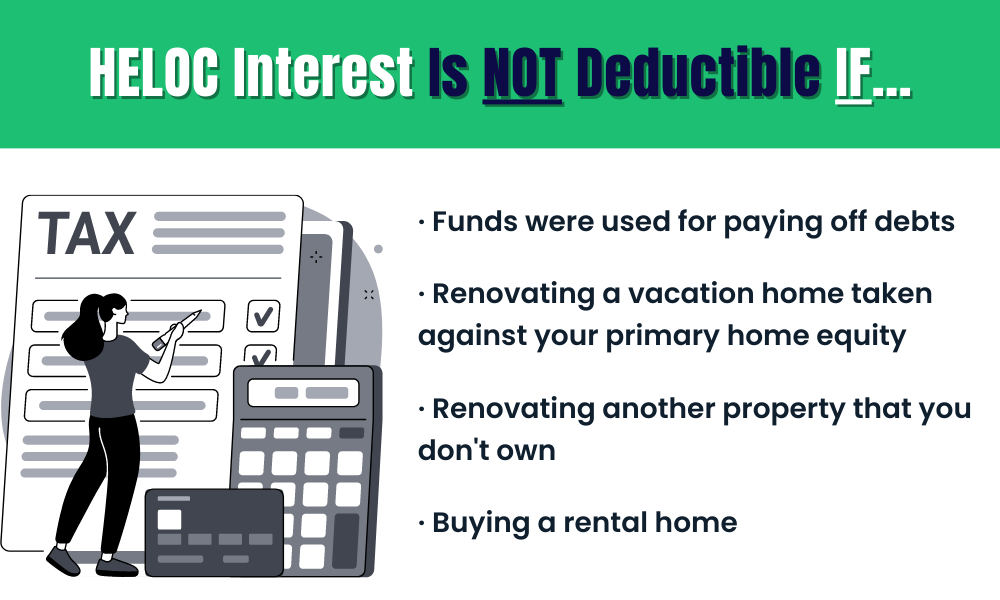

“Is HELOC interest tax deductible?”

It all depends on how you use the funds.

As long as the proceeds are used for home improvement or business purposes, the interest IS tax deductible.

Another cool fact – there is a $750K interest deduction cap per year!

You do not have to get a second mortgage or sell your home to convert your equity into cash! With a HELOC, you can replace your mortgage and instantly access your equity without a refinance or selling the home.

Just listen to what Cody had to say

The ability to Half Your Mortgage is a mathematical certainty with us!

The Half Your Mortgage program offers our extensive knowledge, video training, a detailed written guide, teaching you the proven techniques for paying off the HELOC faster, along with a curated list of lenders in your State (created just for you) to help you get the best terms, one-on-one support to make sure the bank correctly sets up your HELOC, and much more. And also as a member of Private Wealth Academy, you’ll also get access to updates and also lifetime support.

Wondering how this will improve your cash flow in the short term? We’ll be talking about that in tomorrow’s email. In the meantime…

Click the link to learn more about the Half Your Mortgage program.

Learn More About the Half Your Mortgage Program

You can also Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing).

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.