Are you ready to save BIG by switching to a HELOC?

The good news is – if you qualify for a mortgage — you’ll easily qualify for a HELOC since home equity lines of credit have fewer qualification requirements…

How Quickly Can You Apply For A HELOC?

You can apply for a HELOC 30-45 days after purchasing a home.

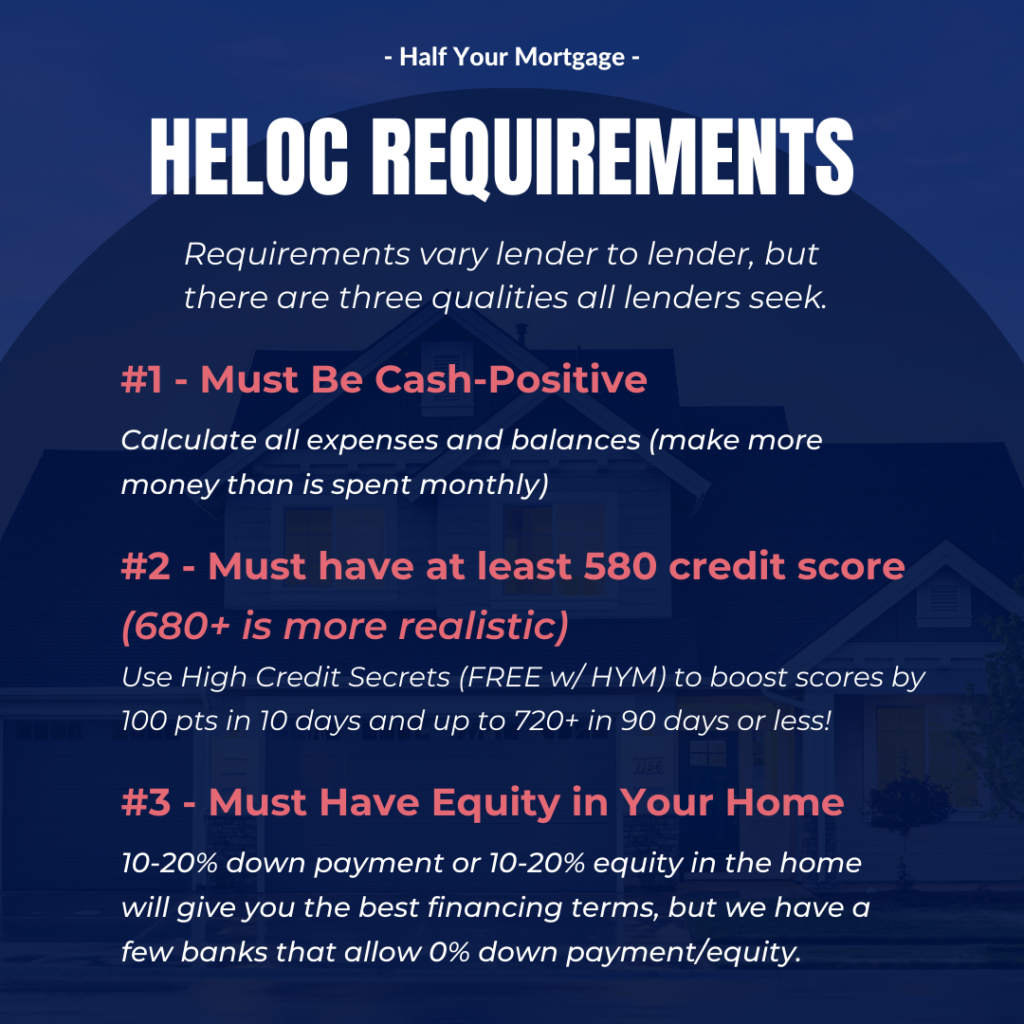

What Are the Main Requirements When Applying for a HELOC?

Applying for a HELOC is also very similar to applying for a traditional mortgage.

Income – Many lenders also don’t list specific income requirements, but they will evaluate your income to make sure you make enough money to repay your HELOC.

Debt-to-Income Ratio – Your debt-to-income (DTI) ratio is another factor lenders consider when reviewing a HELOC application. The lower your DTI percentage, the better. Qualifying DTI ratios will vary from lender to lender.

Credit Score – If you have a score of at least 640 you’ll most likely qualify, but most lenders prefer 680+. Even if you have a credit score of 540 – we can help you boost it up to 680+ in less than 90 days!

The funny thing is, once you begin using your HELOC account – your credit score may actually increase…We’ll talk about this more in tomorrow’s email.

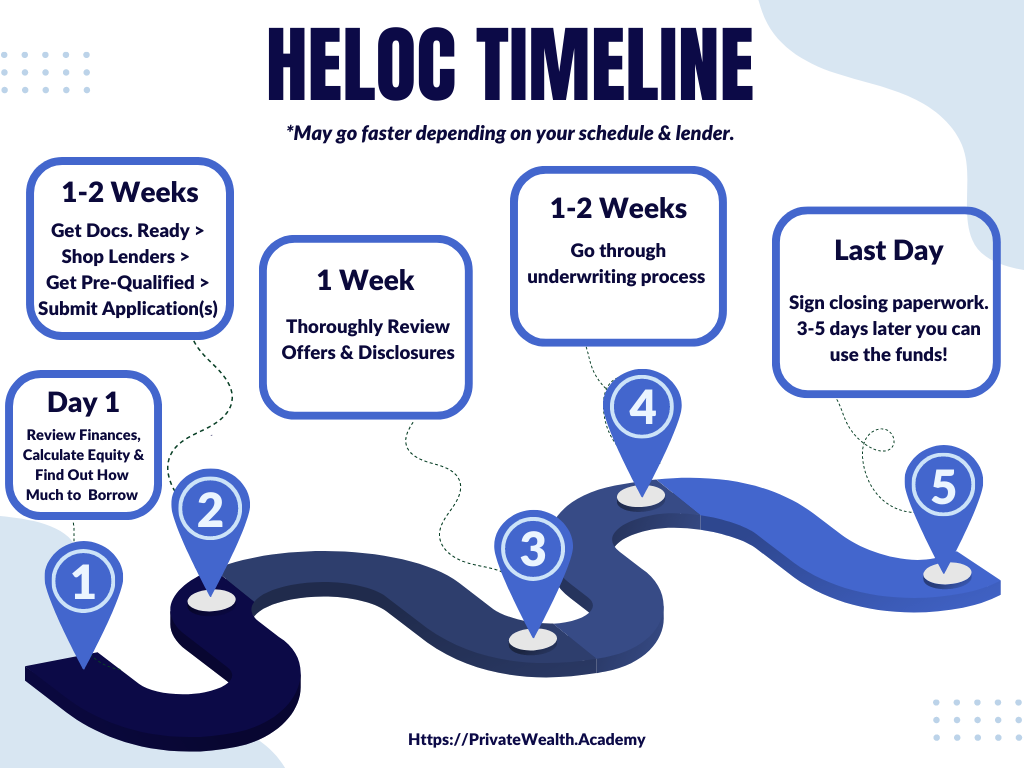

How Long Does It Take to Get Approved & Close on a HELOC?

With a HELOC the average time it takes to close is about 14 to 30 days.

Step 1: Review Finances, Equity & Loan AmountThe more prepared and organized you are, the faster the loan approval process will be. Be ready to also include all the documentation the lender requires when you apply.

Step 2: Prep Docs, Shop Lenders, Get Pre-Qualified

Finding the right HELOC lender is the most important step so take your time on this.

The documents typically needed for loan underwriting include:

- W-2 forms from the past two years

- Signed federal tax returns from the past two years

- Documentation of any other sources of income

- Your two most recent bank statements

- Documentation of your down payment source in the form of investment or savings account statements showing at least two months of ownership.

- Documentation of a recent name change, if applicable

- Proof of identity (drivers’ license or non-driver ID)

- Social security number

Step 3: Review Offers & Disclosure DocumentsOnce approved, the lender will coordinate final details with you(including closing costs) so that both parties can be prepared to close on the loan. This also usually happens within a matter of days.

It’s crucial you understand all the terms and conditions of the loan before signing anything. Feel free to also take your time and review the documents multiple times if needed.

Once you’re ready to move forward, your lender will ask you to approve a certain interest rate. As you also already know, HELOC’s usually have a variable interest rate tied to the Prime Rate.

The good news is – most lenders offer the ability to lock-in rates and even if you get a higher interest rate, you’ll still end up paying less in total interest with a HELOC.

Step 4: Underwriting

How long this step takes will vary depending on how organized you are and the lender. Underwriting is the lender’s process of assessing the risk of lending money to you. During this time, your Loan Officer will order and receive the appraisal and will submit the loan to the underwriter. The underwriter will then give the “clear to close.”

Step 5: Close on Your HELOCAfter the details of your loan are in place, it’s time to schedule the closing, pay the closing costs, and, finally, close on your loan.

We hope this email wasn’t too overwhelming. There is a lot to know before applying for a HELOC but we’re here to help you every step of the way and make the process as smooth as possible.

The Half Your Mortgage program will show you how to get the right HELOC in place and teach you our proven HELOC Hyperdrive Strategy to pay off the loan in just 5-7 years!

Take a second to listen to Mike’s experience going through the Half Your Mortgage program and how much money he’s been able to save.

Wondering how a HELOC impacts your credit score? The answer isn’t quite what you’d expect, we’ll share the details in tomorrow’s email. Until then…

Click the link to learn more and get started with Half Your Mortgage today.

Learn More About the Half Your Mortgage Program

Want to speak with someone before getting started?

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.