Wondering if it’s really the best time to get corporate credit?

Despite experiencing a tumultuous economy over the past few years, owners & lenders alike are feeling a lot more optimistic…

That’s not to say business is 100% back to normal for small business owners…

Millions of companies have been struggling and due to inflation, many have been forced to permanently close their doors. But, the good news is the ones surviving will have more financing options than were previously available.

“We’re starting to see more progressive card issuers increase lines again. Credit issuing partners are telling us they have big plans this year and come to us for help figuring out when it’s safe to lend and increase lines again.” Said Sameer Gulati, President and COO of Plastiq.

“And it’s not only business credit card issuers that are increasing lending this year. Banks, credit unions, online lenders, and fintechs are willing and able to extend cash again to small business owners.” said Lendio CEO, Brock Blake.

Goods News for Those Looking to Get Corporate Credit…

Sure, there are more restrictions in certain industries and tighter underwriting standards, but lenders have an appetite to lend and that’s a good thing.

Blake also mentioned loans currently doing well on Lendio include cash flow, asset-backed, and Small Business Administration loans.

“We expect the SBA to increase the guarantee from around 85% to 90%,” said Blake. “That will increase confidence on the part of lenders to issue SBA loans.”

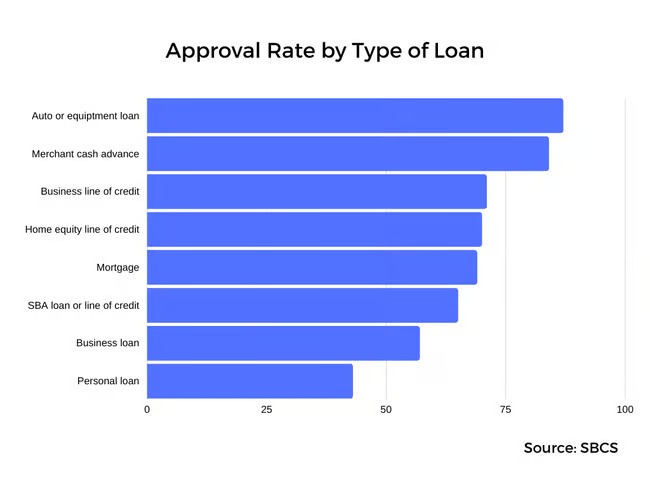

The chart below shows approval rates by loan type.

With increased liquidity, more lenders will continue to serve small businesses. Which means borrowing will be affordable for business owners with good credit.

Banks and credit unions also play their part in business lending, but alternative lenders and fintechs are expected to be the major issuers in coming years.

“A lot of money is flooding the non-bank lending market because bond yields are low. The new year is exciting for alternative lenders. There will be a lot of liquidity but not necessarily in the form of traditional bank financing.” said Matthew Gillman, CEO of SMB Compass.

“I’m looking to get Corporate Credit – Which Lenders Have the Highest Approval Rates This Year?“

Alternative lenders tend to have the highest small business lending approval rates. Approval rates are hovering at around 27.5%. This is a lot higher than the approval rates of credit unions, which is only 20.4%.

*However, when you consider the number of alternative lenders to credit unions and the fact that credit unions are more personal to work with & serve as their own underwriters – you can see how that 7% may not make such a big difference.

Getting a loan from a big bank on the other hand, can be a very difficult task. Only ~13% of national bank loan requests were approved, leaving 87% disappointed and looking for alternative solutions.

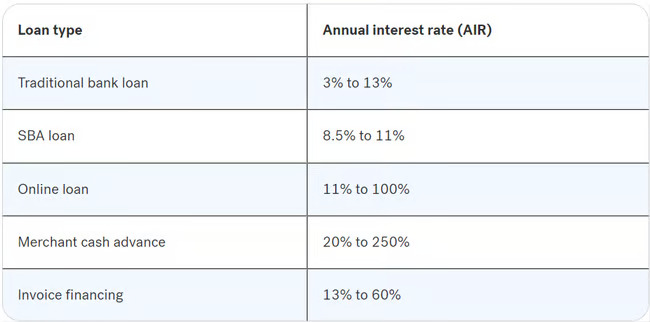

What About Current Interest Rates?

Interest rates will vary depending on the exact lender, your financial situation and the current national interest rates. Here are the average interest rates one may expect to see.

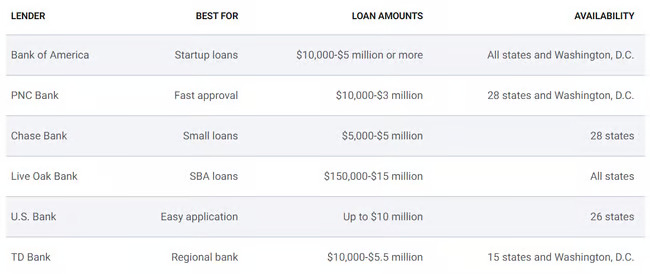

Here are a few of the best national banks to get corporate credit and small business loans this year.

So what does all this mean for you if you’re looking to get corporate credit?

As you can see, lenders are currently in a pretty good lending mood which is great news and as long as you play your credit cards right, you can still walk away with decent interest rates. There’s truly never been a better time to get credit for your company than RIGHT NOW.

If you’re worried because you’ve heard banks are tightening their lending, just know that not all lenders are created equal… Some RELY on lending to survive.

We’ll be discussing this more in a few days, but the bottom line is – some lenders will pull back and others will see it as an opportunity to lend when others won’t. So the credit game won’t come to a grinding halt but we recommend establishing credit for your company NOW instead of waiting for limited options.

Just one example is the Ramp corporate card (a popular favorite.)

If you want a program that’ll walk you step-by-step through the process of becoming a highly-fundable company & securing $50k-100k in credit…

Join Corporate Credit Secrets and Get Started Today

If you’re lost as to where to begin – Join the program! We provide everything you need. But if you’re not quite ready yet – be on the lookout for our post tomorrow where we share how to choose the right bank for your business.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.