Is your home almost paid off?

Wondering if using a HELOC will still benefit you?

Why not let the numbers tell you what to do?

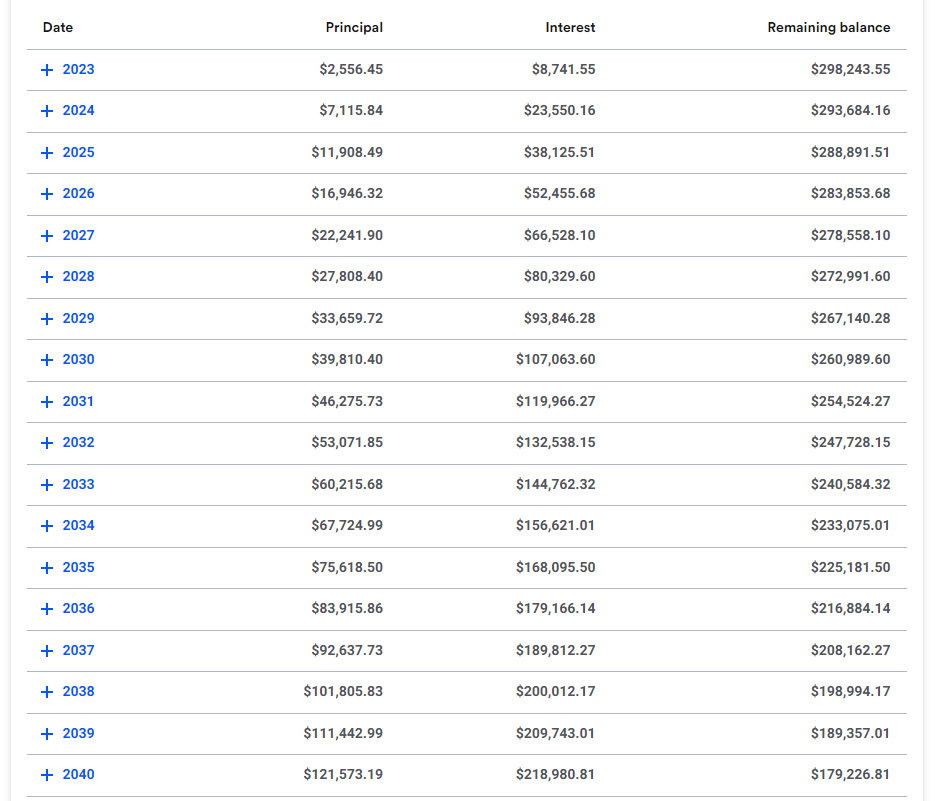

Look at your mortgage amortization schedule…

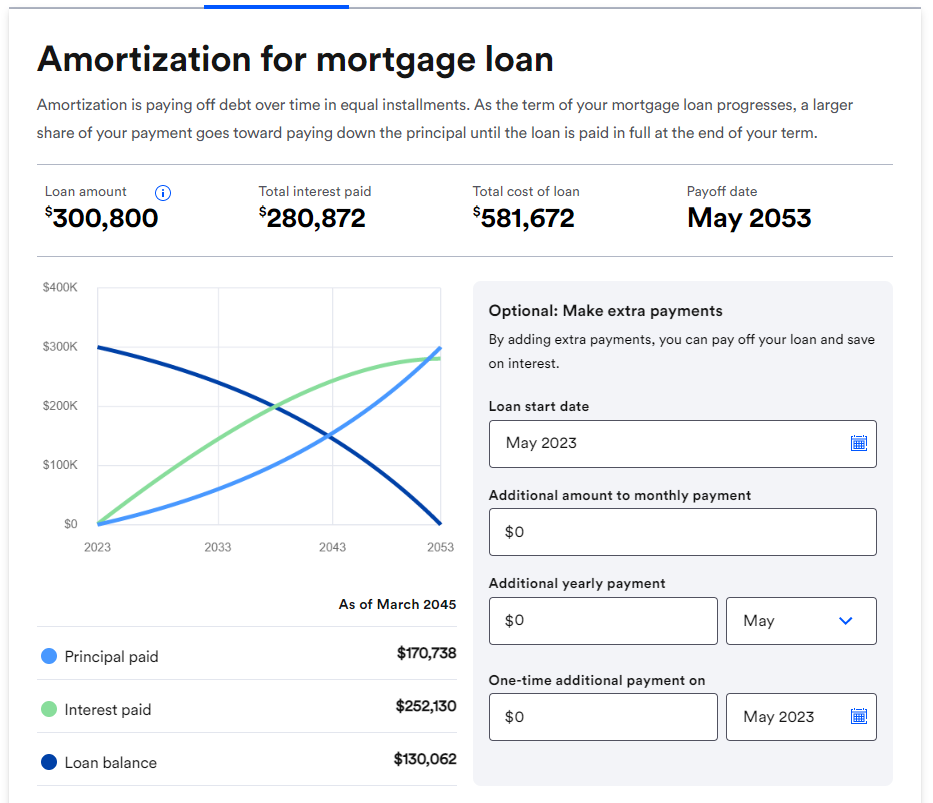

Add up how much is left for you to pay in interest and remaining principal. For this example, we’ll say $130,062 is left on the $300k mortgage.

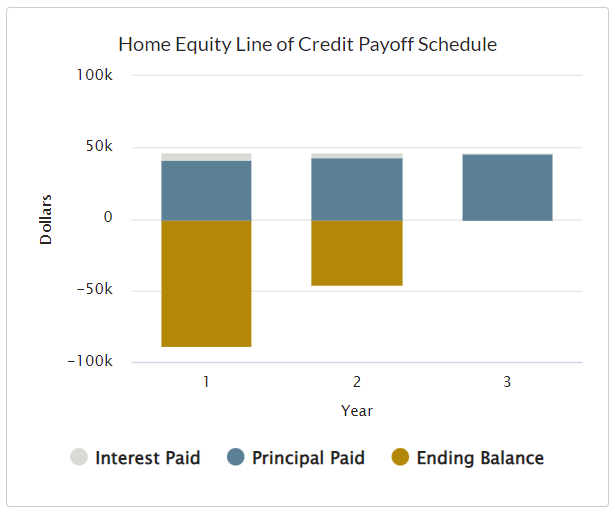

Now let’s go to the HELOC calculator and see how much you might be able to save…

With the HELOC schedule above you’d be able to pay off the remaining $130,062 mortgage balance in a little over 3 years and only have to pay $10,268.71 in interest (with a 5% interest rate.)

In the event that you’ll save more by sticking with your mortgage (or if you already own your home free and clear) – that doesn’t mean that you won’t be able to benefit from a home equity line of credit…

After all, the ability to pay off a home in just a few years is only ONE of the MANY BENEFITS that a home equity line of credit can offer.

Ask yourself…

“Is there anything I need cash for right now or in the near future?”

Are there repairs or renovations you’ve been putting off?

Or do you have high-interest debt or medical bills that need to be paid off?

Do you need extra capital to grow your business or invest with?

Do you have a 3-6 month emergency fund? Or extra money for retirement?

Whatever your goals may be, a HELOC can be a more affordable way to get the funding you need.

A Few Ways of Using a HELOC

And the best part is – you usually don’t have to withdraw funds right away and you are only charged interest on the amount you borrow. So it’s the perfect credit weapon to have in your back pocket if you ever get in a financial pinch.

From quickly paying off a property to consolidating high-interest debt, to serving as capital for investing to simply providing access to more funds…

No matter how you choose to use your HELOC…

The Half Your Mortgage program can maximize your cash-flow & help you save tens to hundreds of thousands of dollars over the course of the loan.

Wouldn’t you like to have immediate access to THOUSANDS of dollars, knowing it’s there if you ever need it?

That’s what a HELOC can do.

This program will help you secure a HELOC with all the right features that’ll allow you to save a SIGNIFICANT amount of money.

We’ll show you how to prepare your finances, how to calculate payments and interest (so you know how much you’ll be saving), how to shop for lenders, what questions to ask, how to ensure you’re getting the best rates and we’ll even share a few major tips to knock your investment game out of the park!

Best of all…

The Half Your Mortgage program will show you the absolute fastest way to pay off the loan. Most pay it off in 5-7 years without changing their income. In case that isn’t fast enough – we’ll even show you how you can pay off a first lien HELOC in as little as 3 years!

Click the link below to start today so you can get into your HELOC as soon as possible. You can start tapping into your equity in as little as 45 days or less.

Learn More About the Half Your Mortgage Program

You can Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE! Book a call TODAY!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.