Have you avoided starting to build business credit because you’re worried it will take too much time?

Have you ever applied for credit only to see that you didn’t quite meet all the requirements?

There are tons of hurdles that you’ll face as a business owner.

One of the biggest, though, is ensuring you have enough working capital to get through the startup phases when cash is low.

We want to put your mind at ease, because even if you’re just starting out – it doesn’t have to take years to build business credit.

Why It’s Worth the Effort to Build Business Credit

Now let’s face it, it takes more time and money to get established and start making sales than we think it will and soon find our personal credit maxed out with nowhere to go.

Which is why corporate credit is vital for your business in the early stages, and will continue to be for years to come (your fundability will only get better as your credit profile grows in age). As it allows you more flexibility with both your personal and business credit.

Here’s How to Build Business Credit

When you build business credit, after your company’s credit profile is created with the commercial credit bureaus, then you can establish a credit score when those first initial credit lines begin to report your payment information.

Vendor accounts are often the starting point since they have so few requirements and basically no financial documentation.

Net vendor accounts and retail credit is NOT the goal, only a stepping stone. You only need a FEW of these accounts to get your business credit profile started.

For most vendor accounts, you must meet the following requirements:

•Have a business bank account

•Be a legal entity

•Have an EIN

•Have trade lines with credit reporting agencies

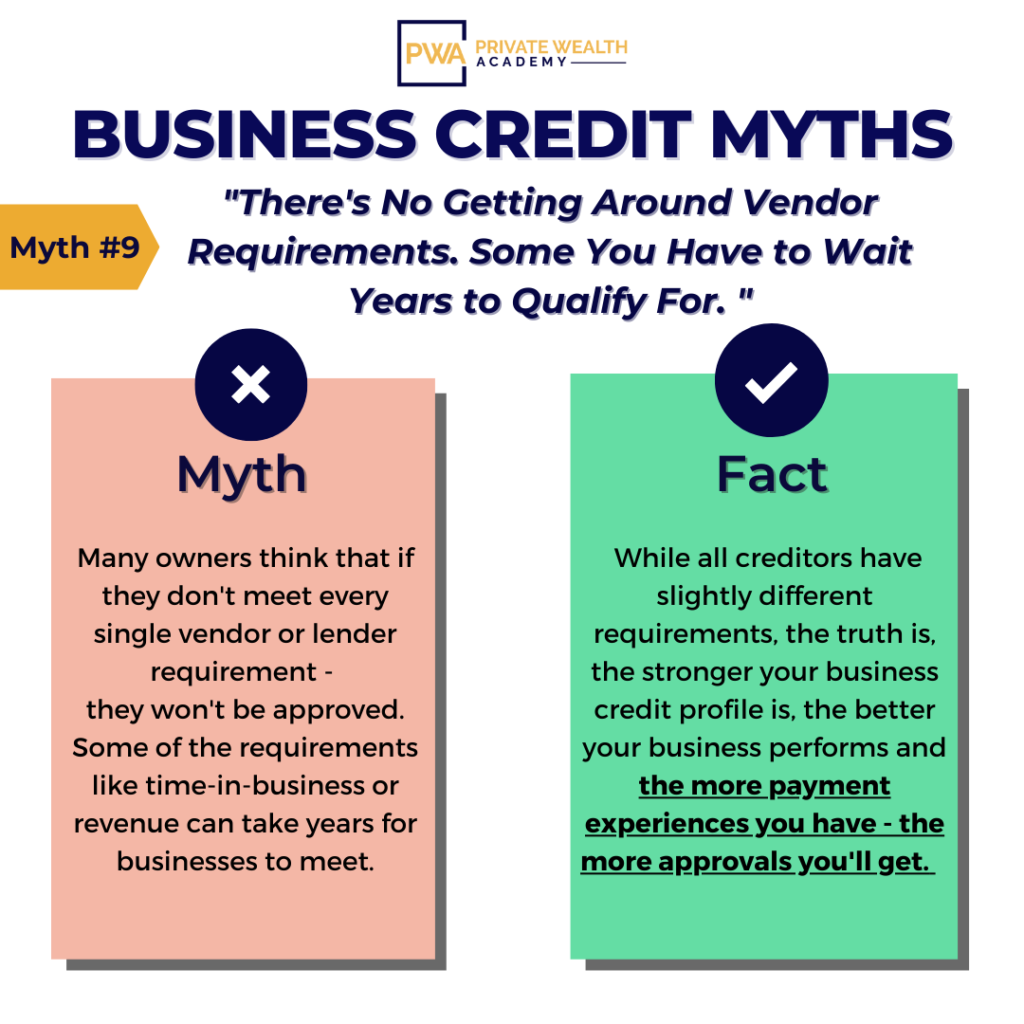

However, creditors often have other requirements, some of which you may not meet right away.

The problem is that these types of requirements can take years to meet. (For example: time-in-business or revenue requirements). This leads many new business owners to believe they are stuck waiting to qualify.

But what if we told you that there’s a way around these types of lengthy vendor requirements when you build business credit?

Want step-by-step course showing you how to build business credit?

There are ways you can get those first initial tradelines without the long wait… We spill the details inside Corporate Credit Secrets

You don’t want to be stuck waiting for access to credit (especially starter credit), which helps you to grow your initial business credit history.

The time spent stuck in “credit purgatory” can be extremely detrimental to the health of your business.

Without a way around these pesky requirements, your business may end up having to wait YEARS to qualify which could lead to serious financial issues.

In fact, an astonishing 6.5 million businesses launch every year, but less than 10% will survive the 10-year mark.

A lack of funding plays a huge part in the downfall of these businesses.

Don’t let your business become another negative statistic. We’re here to help!

We want to help you build business credit as effectively as possible so it can thrive – even during the tough times.

Our goal is to help you build business credit and become highly fundable as fast as possible (without cutting any legal corners).

That means no more waiting for years until your business can qualify.

In our Corporate Credit Secrets program we’ll show you how you can get around just about any vendor requirement (this trick alone can save you YEARS).

Join The Corporate Credit Secrets Program

In another post, we’ll be debunking one of the BIGGEST myths people often get wrong about business credit – getting this ONE THING wrong can add YEARS to the process so keep an eye out for that.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.