Seeking to send a debt validation request or letter?

First, how well do you understand the difference between VALIDATION and VERIFICATION?

This is a very important distinction for debt removal.

If you’ve been following along with our emails you’ll know that debt validation and verification are two different things.

While they sound the same, have similar meanings and people constantly use them interchangeably…

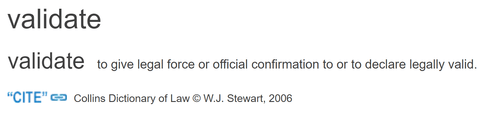

Legally speaking – they are different.

The reason we’re touching on this AGAIN is because the debt removal process itself is simple.

The Difference Between Debt Validation Request and Verification

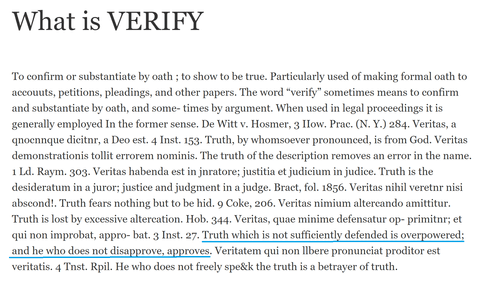

Let’s take a closer look at the meaning of the words, shall we?

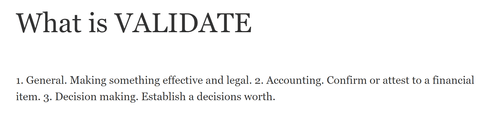

This is the whole point to VALIDATING THE DEBT.

*To confirm or attest to a financial item.

*We also included this definition from Collins Law Dictionary because it perfectly sums up the way we’re using validation in the debt removal process.

When we send off our Debt Validation request (not verification) Letters, we’re seeking to confirm the validity of the debt.

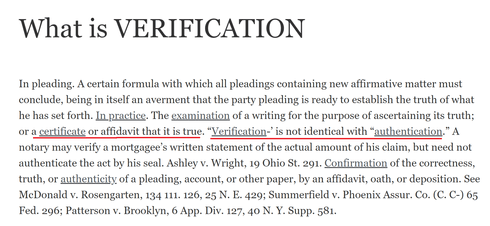

So if verification basically implies a certificate or an affirmation of what’s true…

Then validation is assessing an action to determine the correctness of said certificate or affirmation, make sense?

We know this may seem like a lot of semantics but we hope we’ve made the important distinction & clarified the difference.

Debt validation protects your rights!

Want Help With Your Debt Validation Request?

That’s what we’re here to help you do…

Your GOAL with validation is to prove the debt is not valid.

Remember – just because a debt collector says you owe a debt doesn’t mean it’s true (or that you must pay).

Learn More About Debt Removal Secrets

How Do You Prove the Debts Not Valid?

Remember the burden of proof first lies with the debt collector / creditor…

There’s a BIG difference between the proof debt collectors must provide to you and what they must provide to a court.

Debt verification is the process where the collections agency verifies and confirms in writing the amount owed (this is that ‘first letter’ you’ll get in the mail). They do not, however, have to provide supporting documentation that states how they came up with this amount.

What Makes Us Different…

We’re here to help you learn to PERMANENTLY REMOVE THE DEBT and get the account removed from your credit reports.

Most credit repair companies tell you to send Debt Verification letters – while that will get you information, it won’t remove the debt however, they can still stop the collections process.

We go one step further in asking for validation of the debt along with the request for validation, we also ask for…

- Why the collections agency thinks you owe that debt

- The age of the debt (this is important to see if the debt is beyond the statute of limitations in your state)

- The amount of the debt

- The agency’s authority to collect the debt (they should be licensed to collect debt in your state)

- Previous owners of the debt, date it was sold + contact information

- Current owners of the debt + contact information

*If you do not explicitly ask for information they are not required to provide it (except original creditor, amount owed, address & phone number).

This will not only provide you with the info you need, it’ll STOP COLLECTIONS & begin the process to eliminate the debt.

What Invalidates Debt?

If you find that there’s a mistake, lack of information, that the debts been sold numerous times or that they no longer have the original wet-ink signature – this can invalidate the debt!

Debt collectors are often able to easily validate debts with consumers that are more recent because the bar is set very low and they’re only required to provide limited information.

This is important to understand because as debts age, records are lost as accounts are sold and resold, resulting in further loss of records, which invalidates the debt.

Why should you pay for a debt that’s invalid or expired? You shouldn’t!

You have the RIGHT to demand validation with debt collectors (*You can’t validate debt with original creditors or the credit bureaus, you can only do it with 3rd party debt collectors.)

If the agency who conducted the investigation is unable to verify the information is accurate, complete, are unable to – or if the agency fails to respond to the verification request, they are required to delete it.

So let’s not waste any more time…

We’re ready to walk you through the process.

Aren’t you ready to get rid of that debt for good?

Get Started TODAY with Debt Removal Secrets

If you want to dive deeper into these rules, they’re clearly spelled out in section 809 of the FDCPA.

Do you currently have a loan you can no longer afford to pay? Be sure to watch out for tomorrow’s email we just might be able to lift that burden.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.