Wonder how often you can beat debt collectors without going to court?

After all, no one likes going to court except maybe when you’re looking at REMOVING THOUSANDS IN DEBT, right?

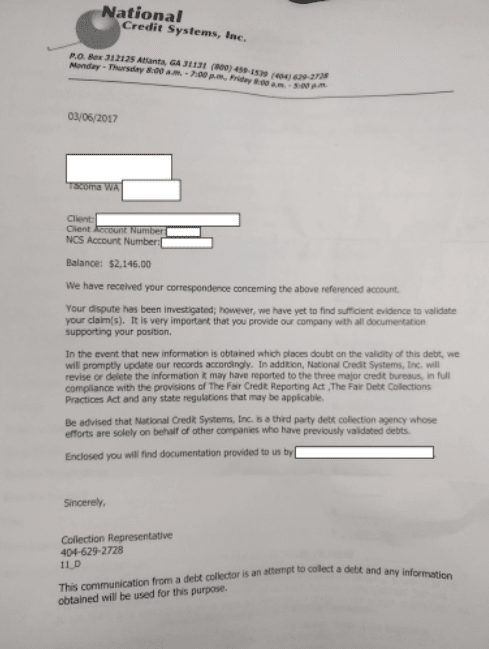

The United States Federal Trade Commission report states: “The information submitted in the study further provides insight into debt buyers’ verification of debts that consumers have disputed.

Beat Debt Collectors Without Going to Court

[With nearly 49% invalidated without a single letter in reply – consider the rest how many more are invalidated despite a reply being given.]

In addition, debt buyers reported that they were more likely to verify debts that they had obtained from the original creditor (55.7%) than debts they had acquired from other debt buyers (35.9%).

Regression analysis, indicates that debt buyers were significantly less likely to report verification of disputed medical, telecommunications, and utility debt, as compared to verification of credit card debt.

Debt buyers also were significantly less likely to verify debt that was more than six years old, as compared to debt less than three years old.”

Whose the least likely to end up in court?

People that have had their debt sold multiple times, those with older debt (6yrs+) and specialized debt (like medical, telecommunications, and utilities) have debt that is harder to validate meaning, it’s easier to get erased.

Ready to Beat Debt Collectors Now?

Even if your debt is new – don’t also let that discourage you.

Inside Debt Removal Secrets we walk you through it step-by-step so you know what to expect and exactly what to do next.

Also, our letter templates are unique and unlike any others you’ll find for free online.

Learn More About Debt Removal Secrets

Every debt case is slightly different – but generally speaking, the higher the amount of debt, the higher the chance you’ll need to go to court OR also the longer the process will take.

To increase the chances of NOT having to go to court…

►Start the Process Early – the sooner the better! (Clock starts within 30 days of when the debt collector notifies you).

►Stick With It! – Don’t forget to send off the rest of the mailings – the power is in the ENTIRE PROCESS.

►If You Have Large Debts Consider Hiring a Lawyer

If you owe five or six-figures in debt, you can also look into hiring a lawyer to send the letters on your behalf. When debt collectors see you’re working with a legal expert, sometimes they’ll back off more quickly.

No matter what, this process is very simple, won’t take much of your time to do and could end up saving you UNLIMITED DOLLARS in debt (forever!), pretty sweet, right?

Don’t let debt control your life…

Let us help you take back your financial freedom.

Get Debt Removal Secrets & Start the Process TODAY

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.