Ever been tempted to get a “$0 down” mortgage?

Not having to put a down payment on a property may seem alluring at first and there are a few choices out there that give you the option to do so…

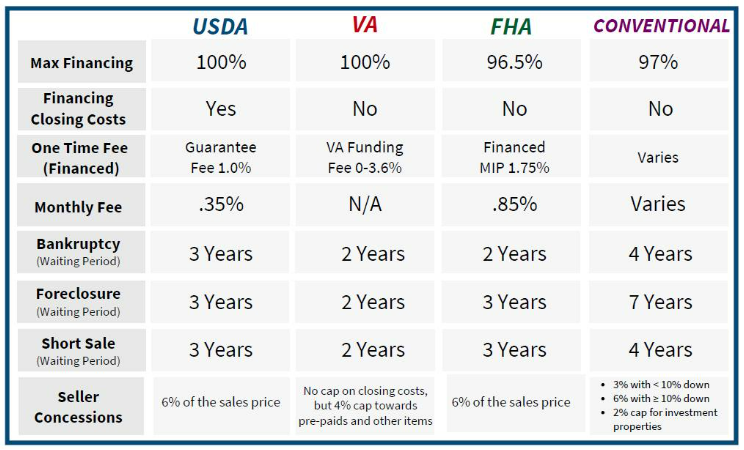

The easiest way to avoid a down payment is if you qualify for one of the no-down payment government-backed mortgage programs: USDA or VA loans.

One problem is though, USDA and VA loans won’t work for everyone.

For example: USDA home loans are only for those buying a home in a designated rural area, they’re often farm-related and come with other restrictions. And VA loans are only available for eligible military service members, veterans or surviving spouses. Also…

While USDA and VA loans don’t require traditional down-payments, they do come with other fees. For USDA loans, there is an upfront guarantee fee, which borrowers can also roll into the cost of the mortgage.

Government Hand-Outs Almost Always Come with Strings Attached…

While you won’t pay any money initially, keep in mind that it adds to the balance and will accrue more interest over the loan term, which means you’ll pay more overall.

The same is true for VA loans – while there is no mortgage insurance (like a USDA loan) you do have to pay an upfront funding fee, which adds to the total cost. There’s also the ability to qualify for a no-money down mortgage through a local credit union but you should be aware that…

If any lender advertises “no closing costs”, “no down payment” or “no mortgage insurance” what they do is mark-up the interest rate to pay those fees on your behalf.

So if you qualify for a 5% interest rate, the bank offering this “special deal” will charge you 6%+ and pay for the ‘mortgage insurance premium’ or ‘closing costs’ on your behalf from the profits of the mark-up.

The banks always make their money one way or another – immediately at closing or over time with higher interest rates.

The majority of profits made on mortgages come from the interest and various service fees (wrapped into closing costs), so closing costs are virtually 95-98% profit for the lender.

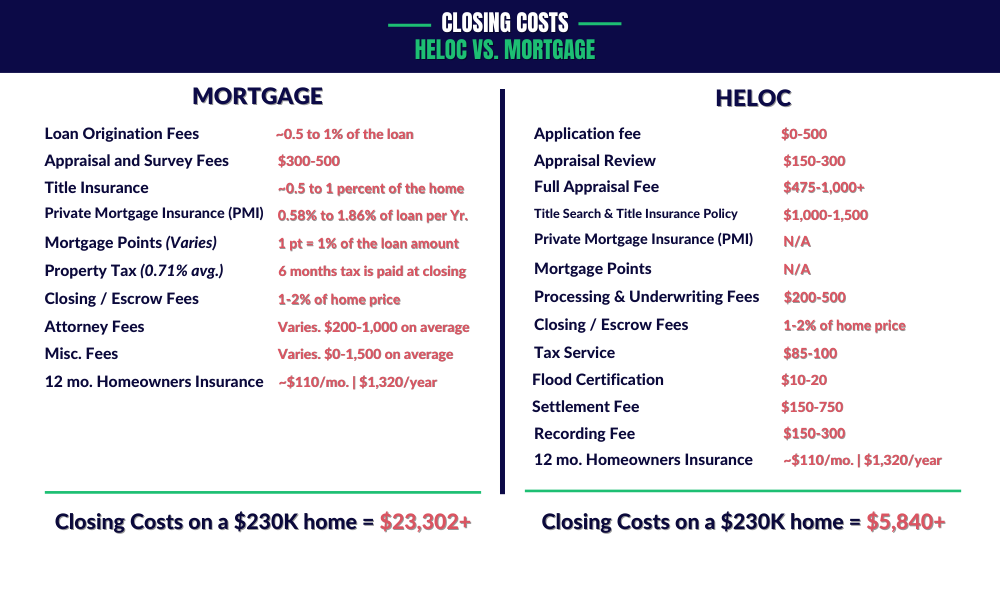

Don’t many HELOC providers cover a majority of the closing costs?

It’s common for HELOC lenders to cover up to a certain amount of closing costs. HELOCs usually have lower closing costs than mortgages.

How Much Are Closing Costs?

Mortgage closing costs are typically 3-6% of the loan amount but can often end up closer to 10% after all fees have been added in.

If your credit score is lower, you put less money down or also borrow more – the closing costs will be higher. For HELOCs the closing costs range from

2-5% of the total loan amount on average.

Where Do Those Closing Costs Come From?

As a quick refresher, here’s how the fees are typically broken down.

NOTE: However, title search, broker, attorney and appraisal fees are not profits for the bank. So expect to see these fees for a HELOC as well since these are not lender fees.

Luckily many lenders pay 100% of HELOC closing costs but…

Don’t let that be a make or break factor.

In fact, having a daily sweep account or longer draw period is preferable over $0 in closing costs. Make a decision based on what the total interest paid will be, the lower that number – the better.

Ready to lock-in the RIGHT HELOC and quickly pay it off in 5-7 years?

The Half Your Mortgage program will show you how to do that and also increase your cash flow to achieve true freedom.

Inside the program, we’ll take you through the process of securing the right HELOC for you. We’ll show you how to prepare your finances, calculate the interest (to know how much you’ll be saving), compare lenders, the questions to ask to ensure you’re getting the best deal and also much more! Click the link to get started with the best HELOCs available today.

Learn More About the Half Your Mortgage Program

Worried about trying to do this ALL yourself?

We get it. There’s a lot to know and it can feel overwhelming…

That’s why we’re here! If you want personal attention and also one-on-one help to walk you through every step from finding the right HELOC lender to closing on the loan, the Half Your Mortgage coaching program is exactly what you’re looking for!

Rebecca was one of our first coaching students to enroll when we opened up this program to our inner circle last year. Here’s what she thought about going through the Half Your Mortgage Coaching program.

As a Half Your Mortgage Coaching Client You’ll Receive…

- Half Your Mortgage Program [$4000 VALUE]

- “Done For You” Qualification Testing [$2000 VALUE]

- “Done For You” Bank List [$5000 VALUE]

- Calling on Your Behalf to Find the Right Lender [$3000 VALUE]

- High Credit Secrets Program [$300 VALUE]

- 12 Weeks Video and Audio Coaching [$5000 VALUE]

- Week 1: Strategy Call + Half Your Mortgage Overview

- Week 2: Boosting Your Credit Score

- Week 3: How To Half Your Mortgage

- Week 4: Creating A Custom Bank List For You

- Week 5: Calling Banks, Qualifying Questions & HELOC Disclosures

- Week 6: Private Banking Secrets Overview

- Week 7: Whole Life Insurance & Investing

- Week 8: Real Estate Secrets Overview

- Week 9: Obtaining a Land Patent & Removal From Tax Roll

- Week 10: Fighting A Foreclosure Proceeding

- Week 11: Advanced HELOC Q&A

- Week 12: Wrapping Up

- Personal Kickoff Strategy Session [$1000 VALUE]

- 12 Weeks Open Office Hours [$1500 VALUE]

- Twice-A-Week Virtual Masterminds [$6000 VALUE]

- (3) 1-Hour Private Consultations [$3000 VALUE]

- Opportunity To Join The Inner Circle [PRICELESS]

By the time you’re finished with the 12 week program you’ll…

- Have also boosted your personal credit score

- Have also found & closed on the perfect HELOC for you

- Be able to withdraw funds to use however you need

- Be also saving money on interest each month

- Also Have your own land patent to ensure your property is legally YOURS

- Have removed your property from the tax roll (no more property taxes)

- Ensure your property also is NEVER able to be foreclosed on

- Also Understand how to refinance your HELOC if desired

- Have a private banking account setup to earn a 12%+ ROI each year

This coaching program is like getting Half Your Mortgage, High Credit Secrets, Real Estate Secrets and also Private Banking Secrets ALL together – AND having our team help you implement all of it!

If you’re the type of person that gets things done faster with a team(or you’re also prone to procrastination) – HYM Coaching is perfect for you!

But don’t wait around too long…

Our coaching program is limited to 100 people every 12 weeks. And once our queue is full, you’ll be pushed to the next coaching class.

We don’t want you to have to wait – because with a HELOC every 6 months the average student saves $14,000!So time is money.

With 0% introductory HELOC terms for 6 months – our coaching program will more than pay for itself in that time! Book a call today to see if you qualify.

Want to talk with one of our team members?

You can also Book a FREE Discovery Call to discuss how a HELOC can half your mortgage (whether it’s new or existing) we’ll run through the numbers with you using our proprietary software, see how much you’ll be saving in interest & determine YOUR EXACT PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.