Do you remember “Truth in Lending” agreements?

Now they often call them “Loan Estimates”.

Today we go deeper down the rabbit hole. Soon you’ll understand how a mortgage has been used to keep us in a continuous cycle of financial indebtedness. And prevent us from achieving real ownership for as long as possible.

It’s noteworthy that many HELOCs in the first lien position still use the term Truth in Lending!

You receive a Truth-in-Lending disclosure TWICE: an initial disclosure when applying + another disclosure before closing. On the Truth in Lending statement the first pages show your Interest Rate, Monthly Payment, Amount Financed (loan amount), Total Closing Costs, Lender Fees and Title Fees. It also includes your annual percentage rate (APR).

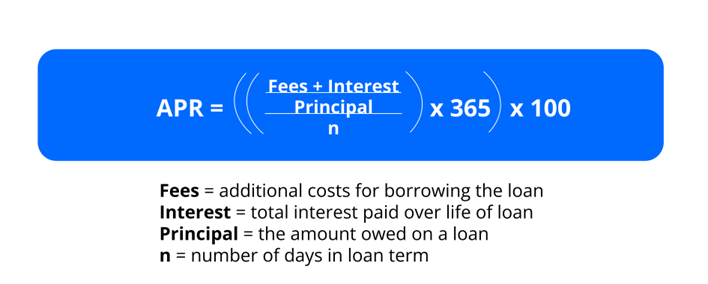

NOTE: Annual Percentage Rate (APR) is different from the interest rate.The APR is the true effective interest rate because it includes all of the costs associated with that loan.

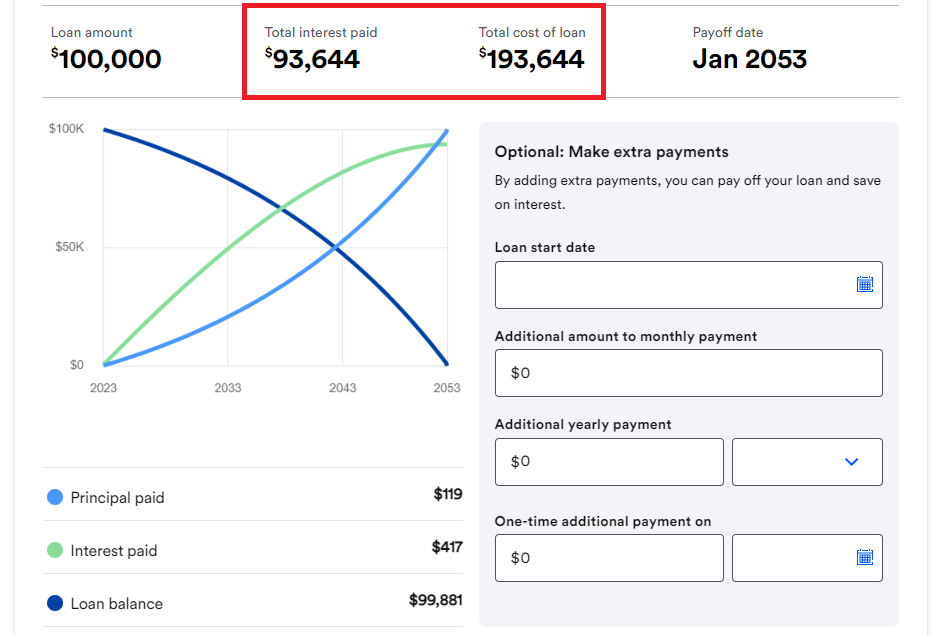

Thankfully, the “Finance Charge” reveals the ugly truth. Including, how much interest you pay over the entire mortgage term. It is typically a number almost as high as the loan amount.

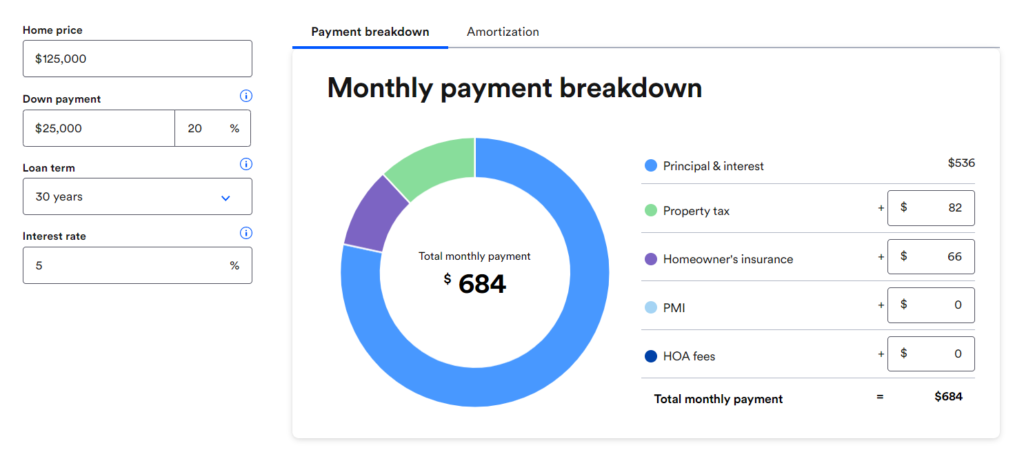

Lenders try to gloss over this and have you focus on small numbers. The interest rate, the monthly payment and the closing fees because most people are living on a monthly budget.

The ol’ Kansas City shuffle (if you will)…

While you’re focused on the monthly payments, you may lose focus of what you’re actually paying. This subterfuge draws you away from the fact that the bank is ripping you off.

The Mortgage Scam

How much are they ripping you off? By A LOT!

The Total Interest Percentage (TIP) shows this amount as a percentage, so on a 30-year 5% interest rate loan, you’ll see a TIP of 94%. We like to think of this as the bank’s auto-gratuity fee. That’s how they treat it anyway…

So for a $100K loan, you will have to pay an EXTRA $93K – that’s $193K you have to pay back. In other words, you’re paying almost 200% for your home! Doesn’t quite seem fair, does it?

That wealthy banker wasn’t lying when he said, “…you’re buying a home for yourself and another one for me [the bank].” But this disclosure legally allows a lender to say, “We told you we’d rip you off… and you agreed!”

If that weren’t enough, at the closing table for your mortgage you signed a disclosure called a “Mortgage Acceleration clause” that means, “The lender can call the loan due, in full, at any time for any reason.”

Which means you have to pay the mortgage 100% in full within 60 days or lose the home.

Why? So you refinance with another bank & they can take you off their books. A typical First Lien HELOC does not have this acceleration clause.

Ready to find the perfect HELOC for you?

Inside the Half Your Mortgage program, we’ll help you secure the right HELOC for you. We’ll show you how to prepare your finances, calculate the interest (so you know how much you’ll be saving), compare lenders, the questions to ask to ensure you’re getting the best deal and much more!

Now you can learn how to pay off your home quickly (5-7 years or less) and make room for true freedom. Click the link to get started today.

Learn More About the Half Your Mortgage Program

You can also Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) we’ll run through the numbers with you using our proprietary software, see how much you’ll be saving in interest & determine YOUR EXACT PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.