Keeping up with our blog posts?

Hopefully so! We’ve covered a lot of important information in the last couple days.

But what about closing costs and other fees, right?

There are always closing costs with any home loan. In case you didn’t know – closing costs can refer to any fee incurred when originating, underwriting, closing and recording a loan.

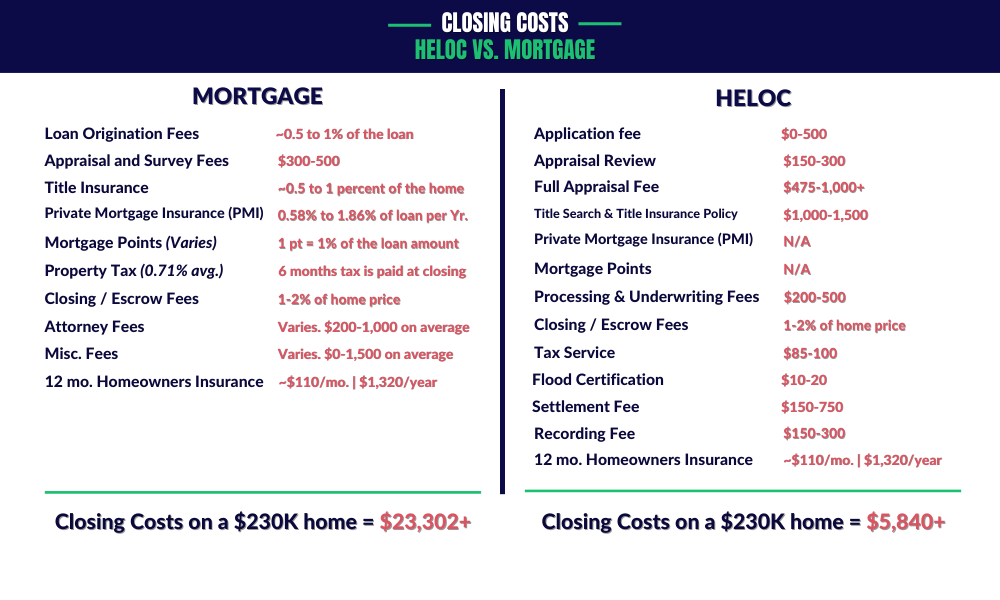

Wondering which is higher – mortgage or HELOC closing costs?

For mortgages, closing costs typically end up being ~4% of the loan amount. With a HELOC they’re ~2%.

Even better news is…

With a HELOC the lender will typically cover all or up to a certain portion of the closing costs but it does vary by lender (which is why you need our custom bank list).

But don’t let this alone be a make or break point…

Depending on your situation, you may want to accept a higher APR to minimize your upfront costs OR get a lower APR and pay more in closing costs.

Once you get quotes & run the numbers, the numbers tell you what to do!

What Fees Are Included in the ‘Closing Costs’?

The various fees included under ‘closing costs’ will vary. However the most common fees nearly all HELOC providers have are as follows:

- Credit report fee. Most lenders will pull your credit reports and scores to determine your creditworthiness. A lower credit score tells lenders you’re a high-risk borrower, which may increase your rates.

- Document preparation and attorney fees. Lenders also charge a fee to prepare all the legal documents. An attorney or financial specialist may complete this paperwork, but you may be able to avoid this cost. For example, some lenders waive their document prep and other fees for HELOCs.

- Loan origination or application fee. Depending on your lender, the origination fee and other costs associated with your home equity loan may be waived. Or you might pay them indirectly if your lender rolls them into the cost of the loan.

- Notary fee. Many lenders will verify paperwork by having it notarized by a notary public. Some states charge per signature, while others have set costs.

- Title search fee. A title search tells a lender that you are the rightful homeowner, and whether there are any outstanding taxes, liens, assessments or easements against the property.

The lender may also include these fees with HELOC closing costs:

- Tax service fee

- Flood insurance certification fee

- Appraisal fee (to determine your loan-to-value (LTV) ratio)

The “other fees” that may be included with a HELOC are: maintenance fees, annual fees, transaction fees, inactivity fees and/or cancellation fees. Not every lender has these and when they do – they are usually minimal (for example: annual fees are typically $40-50/yr).

Oh and by the way…

Unlike mortgages, HELOCs do not require Private Mortgage Insurance!

Does this all feel like a lot to grasp?

It is. But that’s why you’re here…

We’re here to help you get into the perfect HELOC to meet your needs!

Inside the Half Your Mortgage program we’ll give you even more smart investment ideas and teach you our proven HELOC Hyperdrive Strategy to help you improve your cash flow and pay off your home in 5-7 years.

Just listen to what Cedric had to say about going through the Half Your Mortgage program…

If you’re worried about finding the right HELOC lender, the most important criteria to look for and how to manage it all – you’ve come to the right place!

We’ve done the hard part for you and found the best HELOC lenders across the country. Our state-specific curated bank list alone will save you HOURS of research time.

So what are you waiting for?

Isn’t it time you learn the strategy to pay off your home in just 5-7 years?

Click the link to learn more about the Half Your Mortgage program.

We’ll show you how to… prepare your finances, boost your credit score,

calculate your debt-to-income ratio, access to our proprietary calculators, compare lenders, get all the right criteria your HELOC needs, the questions to ask to ensure you’re getting the best deal, and SO MUCH MORE!

Learn More About the Half Your Mortgage Program

Want to speak with someone before getting started?

You can also Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) we’ll run through the numbers with you using our proprietary software, see how much you’ll be saving in interest & determine YOUR EXACT PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.