If you’re like most business owners, you’ve probably applied for credit that was “out of your league” (at least once), right?

Like picking a piece of fruit too soon – the results can be sour.

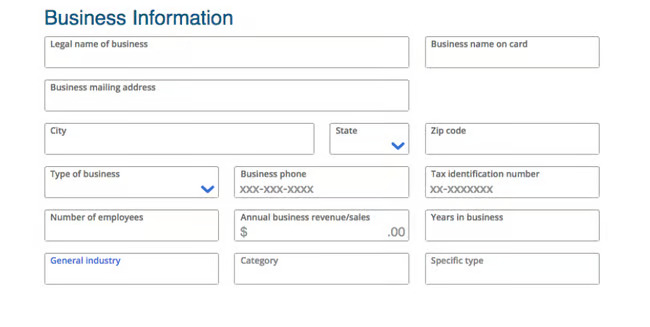

Let’s walk through how to properly fill out the basic components of a standard business credit application…

*It’s a long one today but we’re dropping some gems so take notes.

Tips When Filling Out Business Credit Applications:

► Name on the application – Typically there will be a place for the company name and the owner’s name.

►Type of Business – Includes corporations, partnerships, LLCs, etc.. You must also put down your role in the business.

*NOTE* If you are a sole proprietor: you and your business are treated as one in the same according to lending institutions. For the purpose of establishing a strong business credit profile – sole proprietorships are NOT recommended.

► Owners – if you’re registered as a corporation or partnership, you may be asked whether your business has beneficial owners. Beneficial owners are individuals, other than yourself, who own at least 25% of your company, directly or indirectly. To clarify, “indirect ownership” means owning equity in a business through another business. For example, if you own 100% of Company A, which owns 25% of Company B, then you’re an indirect owner of Company B.

► Employment – NEVER put ‘Retired’ or ‘Self Employed’ – state that you are ‘Employed’ (because banks like stability). If you ARE self-employed, when they ask for the employer, write the name of your company.

► SSN – You can use your SSN if you choose to. However, inside our Corporate Credit Secrets program we give tips to avoid using your SSN and ONLY USE your EIN (Employer Identification Number)instead which you can get for FREE at IRS.gov.

*DO NOT PUT YOUR EIN IN THE SSN SPACE ON THE BUSINESS CREDIT APPLICATION – PUT IT IN THE DESIGNATED EIN SPACE.

► Business Information – Includes date the business was opened/number of years in business, number of employees, contact information, and more.

*Be sure to keep this information the same across the board as well. Even a simple change like using a different company email can lead to denials sometimes. You must enter this information on the application even if you’re applying as a sole proprietor, your business has been open for less than a year, or your business has yet to open.

*We give special tips to startups to help them seem larger on paper inside Corporate Credit Secrets. But bottom line is: STAY CONSISTENT!

Remember the open banking & database sharing we mentioned earlier? That’s the reason staying consistent in your information is VITAL for getting approvals.

Keep a master file of your information so it’s EXACTLY the same.

► Revenue – Revenue is the money your business brings in from sales, services, etc.

- Gross annual revenue — that’s revenue before taxes and other expenses are taken out. This is different from profit, which is revenue minus costs. Typically, figures should be from the previous year.

Filling Out a Business Credit Application with Little to No Revenue

“What If I’m Not Earning Revenue Yet?”

In a recent email, Chase stated that “applicants should report $0 in revenue if the business has no actual revenue.”

Dan Arellano, vice president of small business cards at Capital One, says, “You should only report actual revenue that has been generated by the business on the application.”

The truth is – exact policies vary by issuer.

While reporting a big goose egg ($0) for revenue will often result in lower credit limits, it doesn’t necessarily mean your application will be flat out rejected. However, for best results we DON’T recommend putting $0 for revenue.

Generally, most credit applications ask for both income and revenue. With this distinction, one can choose to rely mostly on income for approval.

For example Discover stated that…

“We require both income and revenue in our application. For new businesses that don’t have revenue, we will rely on the income for decision-making.”

With some issuers, it’s OK to include sales projections too.

When businesses are new, “generally, clients will report projected revenue based on their business plan, projected sales and potential contracts,” Bank of America says.

Here’s What Some of the Biggest Banks Said Overall:

- American Express: American Express asks for “Annual Business Revenue” on its small-business credit card applications.

- Bank of America: “For credit requests, clients typically report last year’s sales when providing gross annual sales figures,” says Dolor of Bank of America.

- Capital One: “For [the revenue] section, business owners should include the gross revenue collected by the business over the past year,” says Arellano of Capital One.

- Chase: The revenue you report on your credit card application should be “what you last reported for your business revenue before any expenses or taxes.”

- Citi: Citi asks for “Annual Business Revenue” on its small-business credit card applications.

- Discover: “Applicants should include the latest available annual revenue that can be verified.”

What’s Our Advice?

Typically, it’s fine to use a mix of your annual income + projected revenue for the year on most business credit applications.

Follow our steps in Corporate Credit Secrets and you’ll do fine.

► Income – *Using sales projections or ‘stated income’ as revenue, is OK if your business is new and doesn’t yet have revenue to report yet.

NEVER state that you make more than $100K (unless you really do).

Stay below $90K. Otherwise, the system is going to flag you and require that you send the lender Income Verification Documentation.

Just keep in mind that the more credit you’re seeking to borrow, the more income/revenue you’ll most likely need to verify.

No matter what school of thought you follow, stay consistent and be sure to keep documents handy, in case the issuer follows up with any questions.

Learn More About Corporate Credit Secrets

A few other things they make initially ask for on a business credit application is…

► Housing – If you don’t own a home. Put that you rent. If you do rent, put your actual rent. If you don’t currently rent, put whatever the average rent in your city is.

► High Risk Industries/NAICS/SIC Code – The NAICS/SIC Codes help lenders classify the industry (including how risky it is and how much money a business in that industry needs to operate.) The most obvious industry code may be too risky for lenders. Choose the most relevant, least-risky industry that best represents your company. Credit repair, real estate investing, transportation, restaurants, night clubs, cannabis, adult materials, etc. are just a few examples of very high-risk industries.

► Estimated Monthly Spend -This is the estimated amount you’re currently spending on business expenses each month. This helps the lender understand how much credit you need extended.

► What the Funds Will Be Used For, say something like:

Marking, working capital, or business expansion – these are the types of answers lenders want to hear.

► Desired Credit Limit: Be realistic here – if this is for a business credit card, $10K to 25K is realistic. If you’re looking for a business line of credit or loan, definitely keep it under $100K ($50K-75K is more realistic to start).

While you CAN build business credit without a revenue-generating business, having a LEGITIMATE business in place is the real idea behind business credit…

It’s the funding that allows you to fuel your dreams.

Even a little bit of revenue can help you secure more credit but without a solid plan to make at least SOME revenue over the course of the year, then you may find yourself eventually hitting a wall…

Regardless of where you are in your business credit journey…

Whether you have some company credit, none at all, or haven’t even registered your business yet, our Corporate Credit Secrets program will meet you where you are and take you to the world of high fundability.

If you’re ready to learn all of our little-known business credit secrets…

Join Corporate Credit Secrets Today

We’ll walk you through the process step-by-step and give you all the insider tips you need to improve your creditworthiness to get approvals.

Discover how to establish a strong credit profile and secure $50,000-100,000+ in business credit in 6 months or less.

This is just the beginning…

Learn More About Corporate Credit Secrets

Curious what types of funding might be right for your company? We’ll be covering the options tomorrow – so keep an eye out for the new post.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.