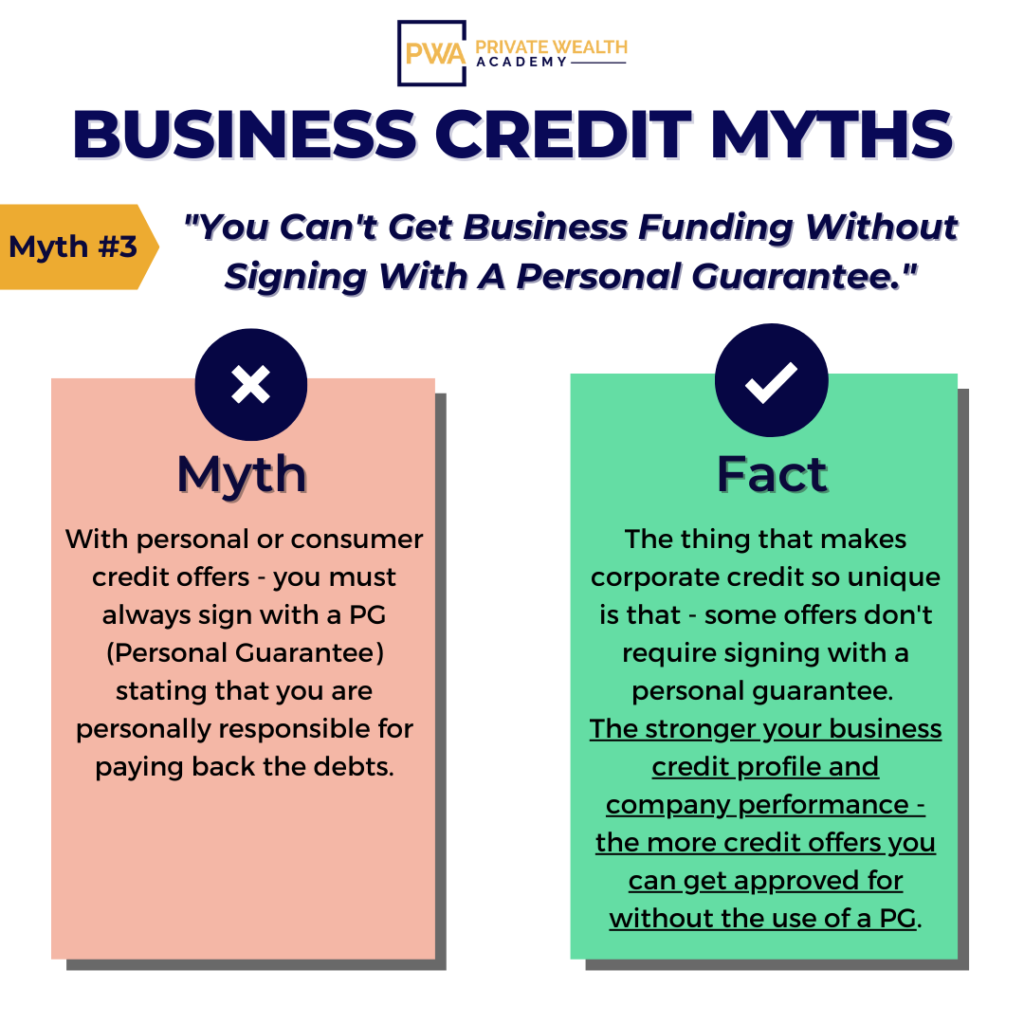

Have you ever heard of no PG business credit?

(that means a personal guarantee isn’t required). But is that really a possibility in today’s economic climate? We’ll be diving into that today…

Still think you can’t get corporate credit without supplying your SSN?

If so, you’re not alone. After all, you’re applying for credit for your business – so why would they need your SSN? They could just use your EIN, right?

Well, when you’re looking to obtain an unsecured loan or line of credit, lenders want to ensure you’ll be able to pay them back so if you don’t have an established company credit history, most will do a personal credit check using your SSN to see how fiscally responsible you are.

However, if you don’t want to give out your SSN…

There is a way to bypass that…

The First Thing to Remember with No PG Business Credit…

When it comes to no PG business credit, the first thing to do is to avoid supplying your SSN – simply use your company’s EIN when applying for company credit whenever possible.

For lenders, it’s all about minimizing risk…

This is where the personal guarantee (PG) comes in.

When you sign with a personal guarantee, if you don’t pay them back – the lender has the right to seize your personal assets to recover their money.

Another way to achieve no PG business credit, is that you may also be able to secure a credit offer that doesn’t require a personal guarantee… While uncommon… They are out there, especially if it’s a secured credit product.

Initially most unsecured credit and financing offers are going to require a personal guarantee. Although once you meet certain revenue and time in business requirements you can be approved for more offers that don’t require a personal guarantee.

Considering the fact that…

Less than 10% of businesses make it past 10-years!

Being able to get credit that doesn’t require a personal guarantee can help reduce some of that personal liability if things don’t work out.

No matter what you choose to do (PG or no PG business credit) – having a solid credit profile for your company will help you get the most and highest limit approvals since lenders will know that their money is in good hands.

And contrary to popular belief…

It is still possible to get no PG business credit.

Now we know what you may be thinking…

“Yeah, but you can’t get cash-credit like a Mastercard or Visa no PG”

Actually – you can!

While it can seem tricky, it’s possible with the right lender and credit offer.

That reduces your personal risk to basically nothing. If your business can’t repay, your personal finances and assets aren’t on the hook.

That is a huge perk of having a separate credit profile for your business.

Establishing corporate credit can be efficient and straight-forward and you don’t have to sacrifice your personal credit — or assets — to do it.

Luckily, we can show you the ways to maximize your company’s credit and reduce your personal risk at the same time. Plus, we’ll even shortcut your research time and show you all the best no PG business credit offers.

If you’re ready to become highly fundable and learn how to quickly secure $100,000+ in credit for your company in 6 months or less…

Join The Corporate Credit Secrets Program

Do you believe you can’t get approved for credit without revenue or income verification? Catch tomorrow’s post – we’ll reveal the truth and tell you everything you need to know to help you get approved.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.