Want to learn the truth behind reducing your tax liability and also not paying taxes?

That’s what we’ll dive into today but first, a quick story…

It was a brisk September morning and I walked out to check my mailbox.

As I’m sifting through the mail, I find a letter from the IRS. My hearts’ racing.

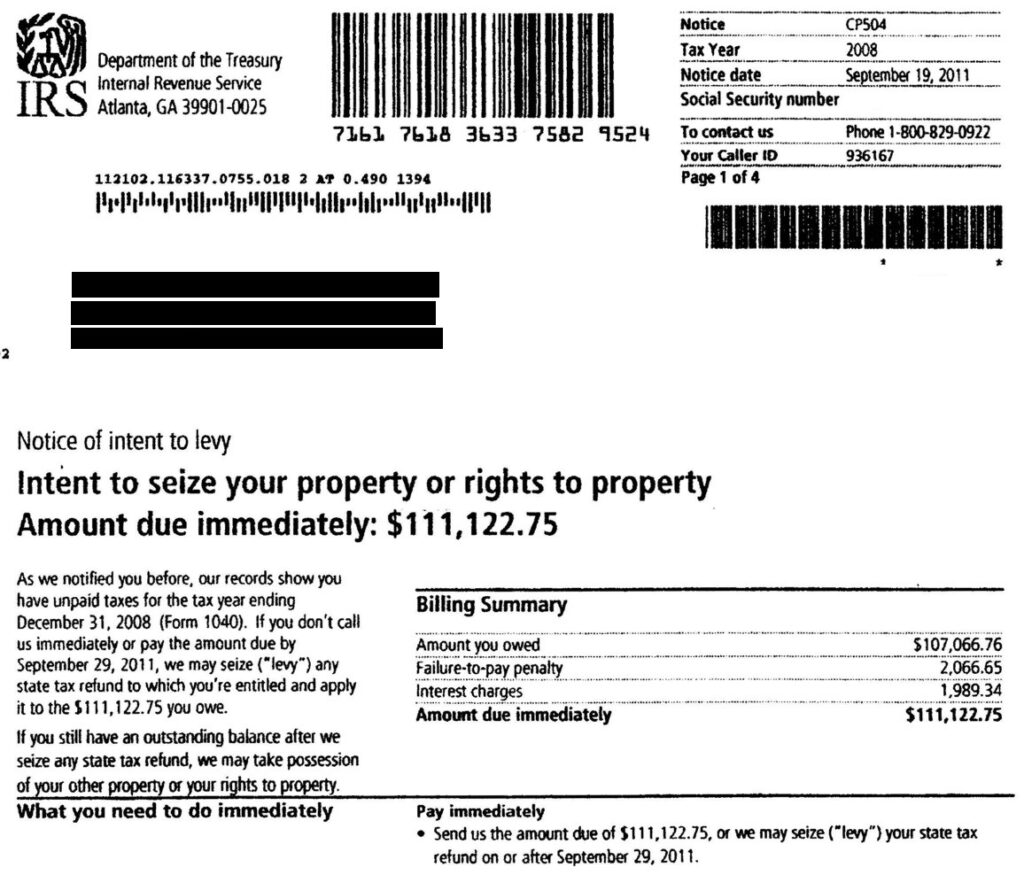

I was dreading to open the envelope in fear of what I might find, but tore into it immediately. There it was in big bold letters…

“Notice of intent to seize your property…”

I could feel the knot in my stomach tighten.

I was afraid, unsure and to be frank – pretty pissed off…

My friend and coworker Jon, had told me about this special tax redemption he’d been using successfully for YEARS that could supposedly allow you to keep ALL of your money without having to legally pay income taxes.

I was skeptical but he showed me the supporting laws, supreme court cases & even his own tax returns so I felt confident and thought I was in the clear…

“It’s really quite simple.” Jon said. “Anyone can legally avoid income tax by following a special redemption method.

“Who can use this ‘special redemption’ method?” The bartender chimed in.

“Actually, anyone can do this – person, business, trust, or faith-based organization.” Jon replied.

Not Paying Taxes is Legally Possible By…

“What makes this possible?” I asked Jon curiously.

You’re given the choice of citizenship every time you handle a dollar bill. I bet you didn’t know you even had a choice of being U.S. Citizen or State Citizen! It’s been there all along and there are substantially significant differences in rights between the two classes of citizens. We have both citizenships naturally, but you must prove you are a State Citizen and NOT a citizen of the United States. You can study the case law for yourself in Elite Tax Secrets that proves it all.”

“So you barely pay anything in income taxes and the IRS never came after you?…” the bartender asked Jon in disbelief.

“When the IRS inquired, all I had to do was show them that I knew the law and had been avoiding income taxable events using this simple redemption. Once they reviewed it, they back off with their tail between their legs. They don’t want this info out there in the public, that’s for sure.

I admit it was nerve-racking dealing with the IRS initially, but it was so empowering when I received that letter with a big fat $0 in taxes owed. After that first filing – I knew the remedy was truly real and I haven’t looked back since – that was more than 20 years ago.” Jon replied.

When the IRS inquiries… (I thought to myself). Right, I do remember Jon saying the IRS would get in touch sooner or later…

Still slightly panicked, I called Jon and told him what happened.

He got me started with Elite Tax Secrets and told me the next step to take after receiving the letter.

I was worried I’d have to pay the bill but Jon reassured me and explained that everything on the front-end is automated at the IRS and the letter I received was completely normal and part of the process.

After following all the steps, within a few weeks of completing the redemption, I got a letter back from the IRS confirming I owed $0!

The very first time I did the secret redemption was back in 2012 and I’ve never looked back since!

In tomorrow’s email we’ll reveal the truth about income taxes that most people will never know, what people get wrong when seeking ways to avoid taxes and why many believe it’s not possible.

Learn More About Elite Tax Secrets

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.