Curious how operating a business through a trust works?

While that could be a rather complex question depending on the type of trust, your industry, business structure and what you’re hoping to accomplish however, for the sake of this email – let’s assume we’re talking about your average small business with no special licenses required.

First and foremost you need to understand that an Express Trust can maintain its high level of protections because it’s entirely in the PRIVATE realm.

Rules When Operating a Business Through a Trust (Express Trust)

A Private Express Trust is a private contract.

However, when entering the ocean of commerce – rules apply.

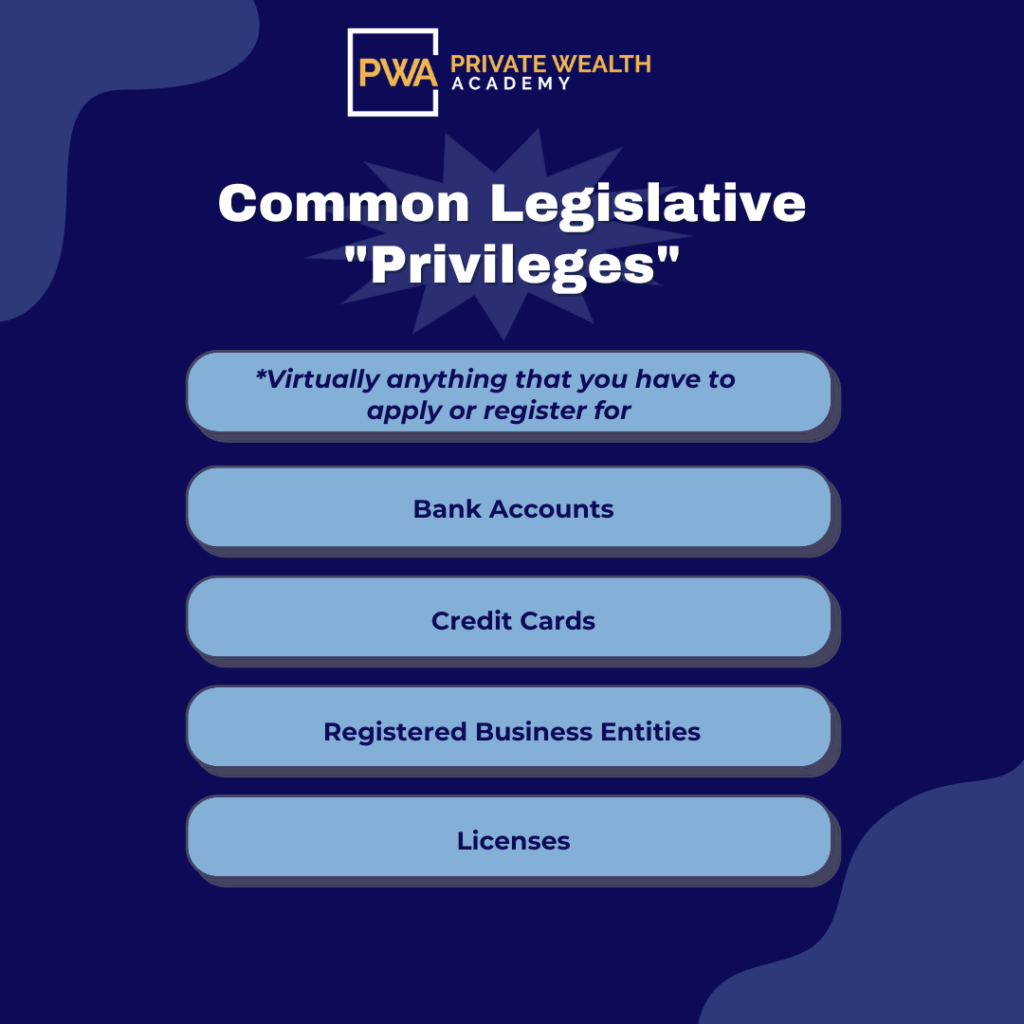

IF the trust directly receives a privilege, benefit or franchise from the Federal, State government or other legislative party – it opens itself up to said jurisdiction (and depending on the severity could allow the trust to be pierced).

Just like we show inside The Bulletproof Trust Secrets program, you want to avoid taking any benefits or privileges directly with the trust to preserve all powers & protections.

Other Things to Know When Operating a Business Through a Trust

If you already have a business established or if having a license is a “MUST” (contractor, broker, brewery, etc.), we would hold the PUBLIC COMPANY in an LLC or C-Corp (due to receiving the privilege of a license & the legislative nature of the business entities.)

Then you can pay your trust like an “independent contractor”, thereby allowing reporting of taxes for your business BUT often with little to no income leftover, giving you the best tax rates.

There are also some neat ways you can setup a Trust Web by connecting a public Operating Trust or Pass-Through Trust to your private Express Trust but you can learn more about that inside Bulletproof Trust Secrets.

Can the Trust Own a Business?

Yes, a Bulletproof Trust can also own a business, either as majority stockholder (Corporation, S or C) or as owner (LLC).

How Do You Transfer A Business into the Trust?

One can sell the asset (company and equipment) for $1.

The alternative is to have the Bulletproof Trust hold a UCC-1 Lien over the business, so if there were ever a lawsuit – the trust would liquidate all assets to obtain its debt.

This follows the Debtor’s Rule: First in lien/line, first to be paid.

Meaning: that anything leftover after the trust liquidates the businesses assets, then goes to pay off any other creditors/lawsuits next in line (usually leaving nothing for them).

Beyond this, it’s also as easy as keeping a paper-trail and changing names on your state’s website regarding ownership.

NOTE: If the business is owned by multiple parties, all equitable owners of interest must be notified of said changes. Depending on the contract signed by all parties, an approval may be required as well.

Can I Have a Sole Proprietorship with a Trust?

One can only transfer the assets of the sole proprietorship into the trust. Because a sole proprietorship only consists of one person and does not have its own separate identity, one cannot simply sell or transfer the business itself as one could when dissolving a limited liability company (LLC).

NOTE: If you pay expenses from a personal account after you made the private transfer, you are establishing ‘Points of Contact’ (a.k.a. ‘obtaining privileges’), which allow lawyers to establish jurisdiction over your trust due to mixing the PERSONAL and the TRUST issues/assets together. So be sure to separate finances before transferring assets into the trust.

Don’t worry. We’ll explain all this and much more inside The Bulletproof Trust Secrets program.

We’ll also show you how one can set up a simple trust web structure that allows assets to be securely protected.

Learn More About the Bulletproof Trust

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.