Wondering how a personal loan stacks up against a HELOC?

It’s always good to know your options. When it comes to comparing a personal loan to a home equity line of credit – let’s go over the pros and cons of each…

Personal Loan vs HELOC

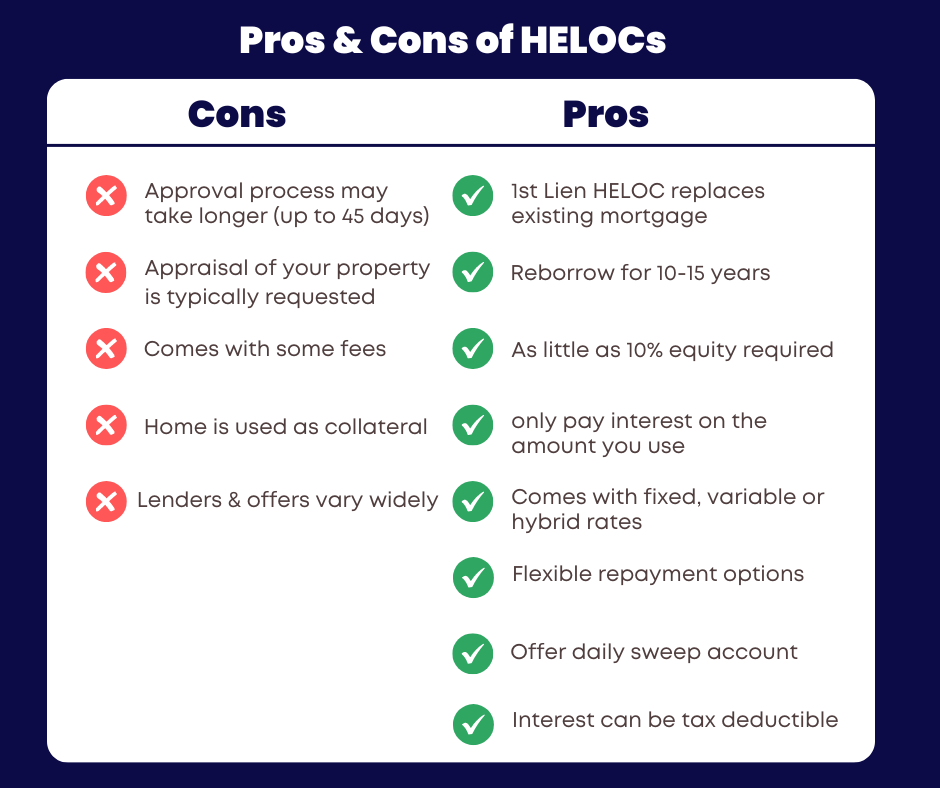

A First-Lien Home Equity Line of Credit (HELOC)

A first lien HELOC is a refinancing option that replaces your existing mortgage giving you the perks of a refinance without all the headaches of traditional refinancing options.

A revolving credit line that you can reuse consistently for 10-15 years depending on the terms. As you pay down the amount you borrow, it becomes available again.

Come to the table with as little as 10% equity (the more the better.) Qualified borrowers with ample equity may be able to get approved for amounts up to $2,000,000.

You only pay interest on the current balance – not the entire limit.

The interest is calculated based on the average daily balance (not amortized.) *This is what allows you to have MASSIVE SAVINGS in interest over the loan term.

Comes with fixed, variable or hybrid rates – varies based on lender.

Tax deductions are available if the money is used for home improvements.

The repayment flexibility is unmatched! You have the option for interest-only payments during the draw period.

Although we highly recommend you take maximum advantage of HELOC “sweep accounts” by making interest + principal payments during the draw period allowing you to pay off the loan at hyper-speed compared to any other home financing option. Following our proven strategy you can pay off the loan in 5-7 years (or less!) This can free you from debt and open new doors for investing or meeting other goals.

First-Lien Home Equity Line of Credit (HELOC) Cons

Approval process may take longer (up to 45 days)

Appraisal of your property is almost always requested by the lender

Comes with some fees (origination, document preparation, notary, etc.)

Your home is used as collateral

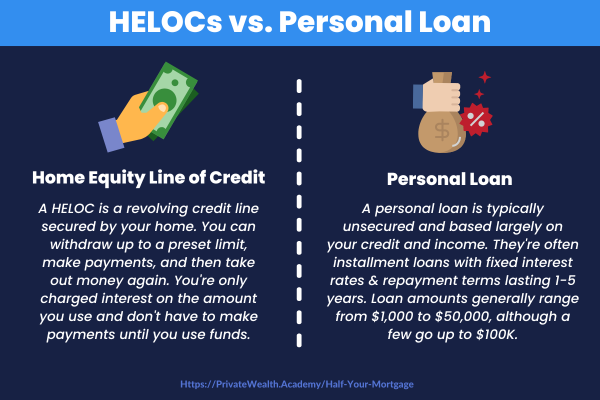

Personal Loans

Unsecured installment loan

Comes in one lump sum

Some personal loans may require collateral depending on your financial situation and loan amount. Loan amounts generally range from $1,000 to $50,000, however, some lenders do offer loans up to $100,000.00.

Typically comes with fixed interest rates and repayment terms.

Personal loans are ideal for one-time expenses or when you don’t want to use your home as collateral.

Funds are disbursed within 5-7 business days typically.

Personal Loan Cons

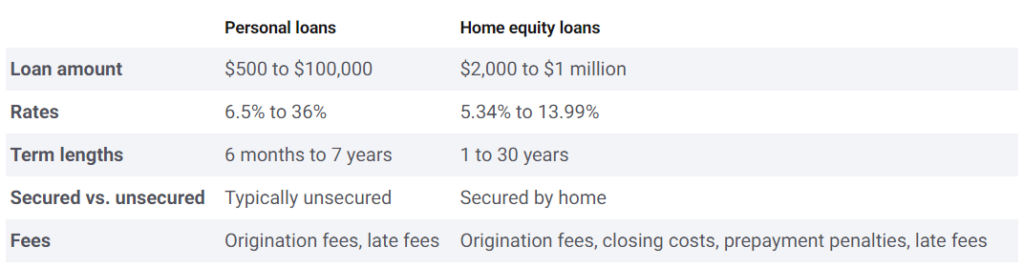

Borrowers must have exceptional credit. Even those with the highest credit scores will pay more in interest on a personal loan than they would a HELOC. This is because…

Personal loans tend to have higher interest rates than HELOCs

Receive funds in one-time lump sum & pay interest on entire amount

Origination fees are charged

Short borrowing period – common terms are 1-5 years

The interest you pay on a personal loan is never tax-deductible

Some common uses for each are emergency expenses, investing, business expenses, home remodels and debt consolidation.

Personal loans can be a back-up option if you don’t have enough equity in the property, need funds in less than 2 weeks or if you own your home free & clear and don’t want to put your house up as collateral. Just be sure to shop around so you get an interest rate you can manage.

If you need a sizable loan, don’t know the exact amount you’ll need, want access to funds over a longer period of time or have an ongoing project that will require multiple withdrawals – a HELOC will be the best option for you.

Due to the interest, HELOCs will also be the more cost-effective choice that will save you more money than a personal loan.

One of the largest advantages of the HELOC over a personal loan is that borrowing from your HELOC is an option, not a requirement.

If a HELOC comes with a maintenance or annual fee it’s usually $50 or less, so if you end up not using your line of credit, it’s basically FREE! This can save you hundreds to thousands in interest compared to a personal loan.

If you’re looking for a funding option that…

- Offers some of the lowest interest rates available

- Is easier to get approved for and doesn’t rely solely on your credit score

- Can give you access to a large amount of money

- You only requires you to pay interest on the amount you withdraw

- Can allow you to withdraw funds over a long period of time

- Can give you the ability to deduct the interest on your taxes

Then a home equity line of credit is the right tool for you!

The Half Your Mortgage program will show you how to maximize your cash-flow & help you save tens to hundreds of THOUSANDS of dollars in interest by helping you find the perfect first lien HELOC.

We’ll show you how to prepare your finances, boost your credit score,

calculate your debt-to-income ratio, the criteria your HELOC needs,

how to compare lenders, the questions to ask to ensure you’re getting the

best rates, what to do in the event your application gets denied and more!

You’ll also get access to our proprietary calculators to make the math super-duper easy. A list of state-specific lenders that will save you hours of research time. Plus, our proven HELOC Hyperdrive Strategy that will show you how to pay off a home in as little as 3 years.

Click the link to get access today & learn everything you need to know about HELOCs so you can begin using your home equity like cash.

Learn More About the Half Your Mortgage Program

Leave the guesswork at the door and see if a HELOC is right for you…

You can Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.