Prenup vs. Trust – which offers more protections?

Weddings… are such a joyous time! But even to hopeless romantics…

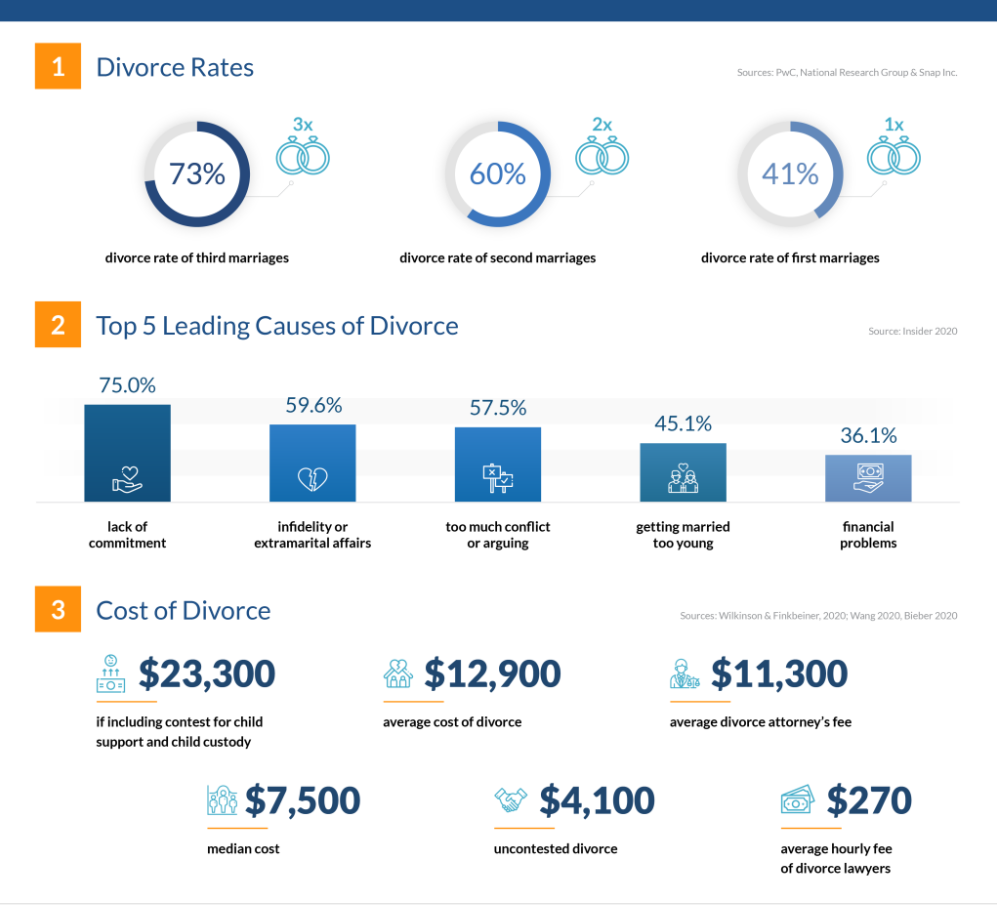

The average divorce rate is 41% – NOT GOOD!

No one can blame you for wanting to be sure that even if one of you eventually says ‘I don’t’…

…that you’ll still get to keep what’s yours (and not get taken to the cleaners in the process.)

Prenup vs. Trust – Which Is Better?

While it’s common belief that prenups exist to protect the “richer” spouse from losing their money and assets during a divorce…

They can also help to clarify financial matters such as understanding which rights you acquire and give up in a marriage.

When handled correctly, they can be helpful in establishing open lines of communication (especially about money matters) with your partnerright from the start.

The problem is – prenups are NOT sexy…

there’s just something about a prenup that really sucks all the romance out of the air, isn’t there?

Even TALKING about a prenuptial agreement may lead your partner to imply a lack of trust. Or a lack of confidence in the longevity of the relationship…

Prenup vs. Trust – Who Wins?

Contrary to popular belief prenups don’t always hold up in court!

There are a few reasons as to why a prenuptial agreement may be determined to be invalid by a Court:

► Inadequate Disclosure (one of the most common)

In all prenuptial contracts, both spouses must legally provide full and adequate disclosure of each person’s individual assets and liabilities that they are bringing into the marriage. If this is not done, the validity of the agreement may be challenged.

► Coercion at Signing

For a prenup to be valid, both you and your soon-to-be spouse have to enter the agreement willingly and without coercion.

This may also include situations where there was not enough time allotted for each party. Weddings often take months of planning. The same care should be given to a prenuptial agreement. If one spouse did not have time to fully read the document or was pressured to sign, the agreement may be held to be unconscionable and unenforceable by a Judge.

► No access to Legal Counsel

In prenuptial agreements, individual legal counsel is advised for both parties, and a lack of experienced counsel may be another reason why a prenuptial agreement may be unenforceable.

The laws surrounding divorce can be complicated and they are subject to change.

The state allows you to contractually give away rights you might otherwise be afforded if you did not have a prenuptial. However, the state wants to ensure that you understand the rights you’re giving up.

► It’s Unconscionable at the Time Entered or at the Time Enforced

This is a tricky one. If you’re the one who is giving up rights, you may feel like your to-be spouse is not being fair. But fairness is very different than unconscionableness.

► More reasons a prenup may not hold up in court:

The prenup wasn’t legally valid (for example the contract must be signed BEFORE the wedding date). It wasn’t stated in writing, or it contains fraudulent information, if it tries to get rid of child support, if it contains clauses that are ‘unconscionable’.

Also certain states may make a pre-nup invalid after a certain number of years.

What if there was something even better & more secure than a prenuptial agreement? There is! It’s called a Bulletproof Trust

With a Bulletproof Trust you can avoid spoiling the romance with the awkward ‘pre-nup’ conversation AND…

Ensure all your assets remain protected in the unfortunate event that the marriage doesn’t work out.

Best of all, a private irrevocable express trust stands up in court MUCH BETTER than a flimsy pre-nuptial agreement…

As long as you make your spouse aware that you own nothing and everything is in a trust, you’re good to go.

Just listen to what happened when Billionaire Ed Bosarge got divorced.

If you ask us – prenup vs. trust – a trust will ALWAYS be the better tool to choose.

TIP: If you are creating the trust for the purpose of protecting YOUR assets, we don’t suggest adding your soon-to-be-spouse as a trustee. However, they can be one of the beneficiaries if you so choose.

And if you establish your trust in tandem as equal partners, you can actively work together to create your Bulletproof Trust (the documents of which will serve as the ‘financial laws’ that will control your trust) – for better or worse. One of you can serve as Head Trustee and the other co-trustee.

Even if you don’t think a prenup (or a trust) is the right choice for you right now – it’s a good idea to have a plan for your assets & discuss sensitive money matters BEFORE you get hitched.

It’s an opportunity for you and your spouse to understand how each of you might respond in difficult financial scenarios.

It may not be an easy conversation but it can help you re-establish expectations and just might be an eye-opening experience in helping you learn more about your partner.

Learn More About the Bulletproof Trust

Oh, we almost forgot to mention – the Bulletproof Trust offers protection from State divorce laws because it is a private contract in which the State is not a Party to.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.