In today’s economy, cash transactions at stores have become rare. We frequently rely on our credit cards, especially for online purchases. Moreover, cash is often no longer a viable option due to frequent cash shortages. So, why should you prioritize improving your credit score?

Why Improve Your Credit Score

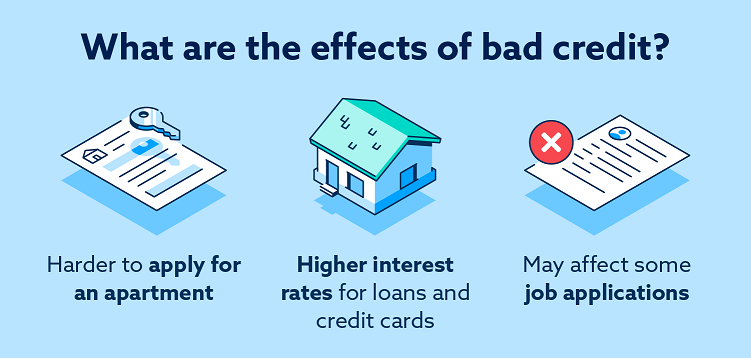

The contemporary world operates on credit, and there are compelling reasons to enhance your credit score. For instance, potential employers may scrutinize your credit history during the hiring process. Landlords are more inclined to rent apartments to individuals with good credit, and often, utility deposits can be waived for those with a favorable credit history.

More Reasons to Improve Your Credit Score

A higher credit score not only increases your likelihood of loan approval but also allows you to secure lower interest rates compared to someone with a lower credit score.

By far, the greatest benefits of high credit are financial. Having good credit can make your life more efficient, convenient and economical in a myriad of ways. Here are just a few…

- Credit applications are readily approved: Lenders are more likely to approve your credit applications with a higher credit score, expediting decisions on credit cards, loans, and mortgages.

- Lower interest rates: A high credit score often leads to lower loan and credit card interest rates, resulting in substantial long-term savings.

- Improved loan terms: Higher credit scores can result in increased credit card limits and more favorable fixed-rate mortgage options.

Because your payment history makes up 35% of your personal credit score it is imperative that you make payments on time, if not early.

Your credit score may drop if you have a history of late payments or if you carry large amounts on your credit cards.

One missed payment can make your score plummet. High Credit Secrets provides you with all of the knowledge needed to cultivate your finances. All the information you need to improve your score is included along with insider tips to speed up the process.

With improved loan terms, reduced interest rates, and increased credit application approvals, utilizing this course is a financially astute move. Building your credit score through High Credit Secrets enables you to pay less interest on your debts and achieve long-term financial savings.

With strong credit using High Credit Secrets, you’ll have access to a wide range of financial options.

Learn More About High Credit Secrets

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.