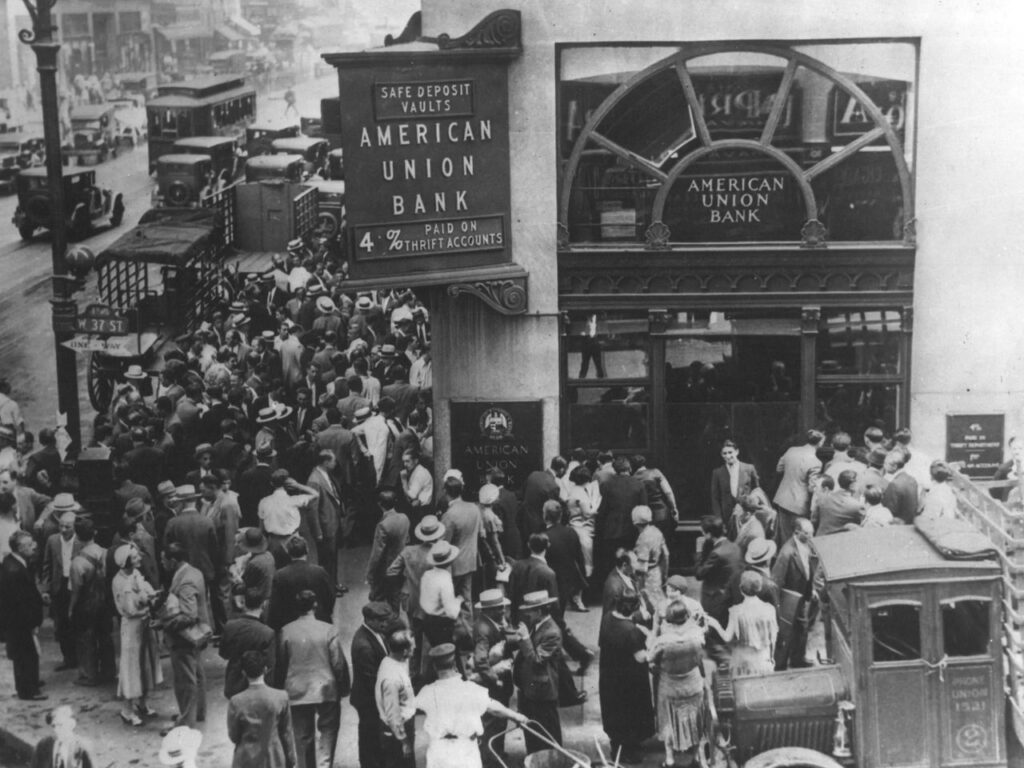

Did you know that HELOCs have been around since 1929?

Home Equity Lines of Credit got their start during the Great Depression when many farmers needed loans to avoid foreclosure. Despite their long history, the popularity of HELOCs have come and gone over the past several decades.

They’ve also evolved over the years, conforming to the needs of consumers – transitioning into a more flexible funding alternative.

Lenders don’t make as much money (through interest) on HELOCs.

They should be professional but they only get paid $200-500 per HELOC closed, compared to $4,000-5,000+ per mortgage closed.

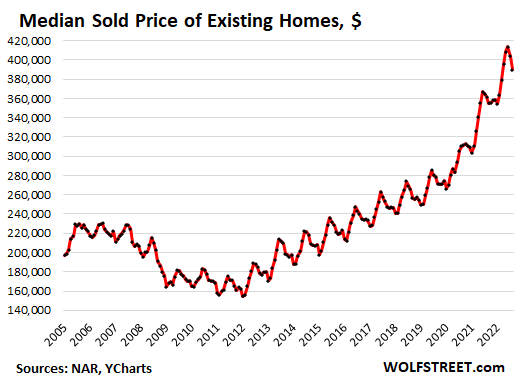

As interest rates have continued to rise and the economy continues to make various corrections, more people have been steering clear of conventional mortgages and looking for more flexible and affordable options.

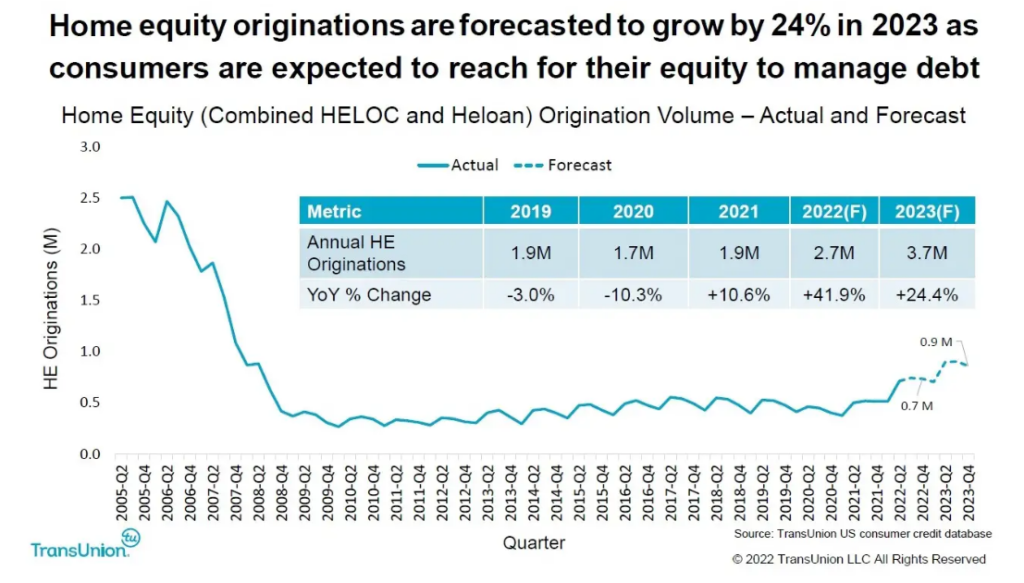

Home prices have been on the rise over the last few years. Homeowners have accumulated substantial equity that they can tap into.

Since lenders know that a 30-year mortgage is out of the question for many people right now – they’re willing to offer them the next option: home equity line of credit and home equity loans.

Although this doesn’t make them as much money, many banks & credit unions are well-positioned to take advantage of the opportunity. It’s the reason HELOCs are becoming popular again.

“Lenders can still increase their profit margins through home equity loans & HELOCs. Plus the shortage of real estate inventory also makes this an ideal time for lenders to offer home equity loans. Especially those that can offer a more personalized solution than megabanks with “one-size-fits-all policies,” said Omar Jordan, CEO and founder of Lender Close.

And that’s not all…

While HELOCs used to come exclusively with variable interest rates, due to such a rise in demand – fixed-rate home equity loans and HELOCs are becoming easier to find.

HELOC Demand Is Also Surging Because…

Homeowners can use home equity funds for any purpose.

Lenders still benefit from home equity loans because of interest and fees. If the homeowner does not make the payments, the lender can foreclose.

Over the next few years you’re likely to see more home equity loans.

Families need to make financial decisions that maximize cash-flow. When homeowners require repairs, face unexpected bills, or need a little extra money, a Home Equity Line of Credit can be an excellent (and more affordable) option.

Why Big Banks Aren’t Always the Best Source for HELOCs

Despite the growing demand, national banks value profit-first above all else. When the economy slows and lenders begin to tighten their lending policies. One of the first things to go is issuing new HELOCs.

For example: banks such as JPMorgan Chase and Wells Fargo have suspended or have stopped accepting HELOC applications.

However, there are still options for homeowners who want to tap into their equity through a line of credit.

Some large banks, such as Bank of America, PNC, Fifth-Third and U.S. Bank are still offering HELOCs but have simply increased their borrower requirements to protect their interests.

Hopefully by now you’re beginning to understand the real benefits that come with a HELOC and tapping into the equity you’ve so diligently paid into your home.

Not sure where to begin? Don’t worry – tomorrow we’ll show you which lenders provide the most affordable HELOC rates & terms. So keep an eye out for it. Until then…

If you’re ready to get started, the Half Your Mortgage program will walk you through the steps of getting the right HELOC for you. From calculating your borrowable equity and debt-to-income ratio to finding the perfect offer…

You don’t have to go on this journey alone…

We’ll show you how to find the right first lien HELOC, teach you the exact criteria to look for, how to prepare your finances, how to calculate the interest (so you know how much you’ll be able to save), how to find the best HELOC lenders, how to lock-in the best rates and so MUCH MORE!

Click the link below to Half Your Mortgage and pay off your HELOC loan in 5-7 years without changing your current income.

Learn More About the Half Your Mortgage Program

Still have a few questions? We’re here to help!

Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.