How’s your small business credit journey going so far?

What’s the highest limit you have on your personal credit cards?

A thousand dollars? A few thousand dollars? $10,000 or more?

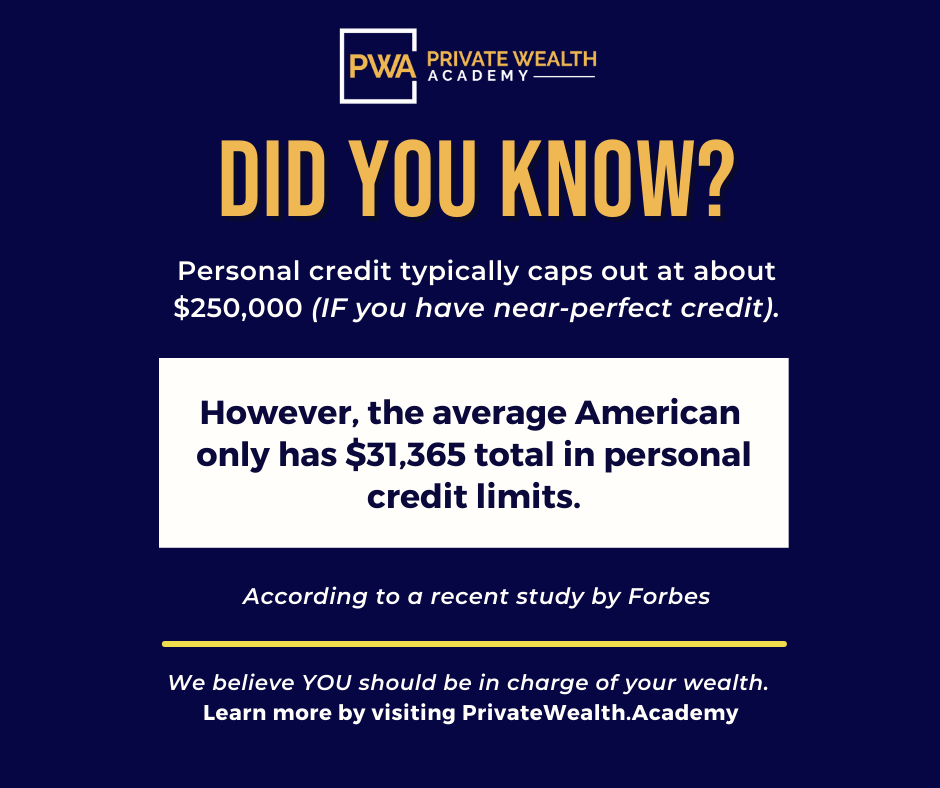

$10,000 and $20,000 limits may seem high for personal credit cards, and it is. But you should never assume that you can get just as much money with your personal credit as you could with small business credit.

Many business owners make that mistake, and in turn, opt to rely solely on their personal credit to fund their business ventures.

The fact is, personal credit isn’t meant to carry the weight of a business – and lenders know this.

Lenders offer MUCH HIGHER limits for small business credit…

That’s because they understand that companies need more money than individuals.

That may seem like a lot of money — but considering the average SMB spends $30,000-$40,000 their first year in business, you can see how as a business owner, you can max out your personal credit real FAST.

Small business credit is the much smarter way to go because you’re not risking your personal credit and it allows you to obtain 10 to 100X’s more credit & financing than you as an individual!

With that kind of credit, you’ll be able to fund whatever needs come your way. You may want to use it to buy more inventory, expand your team, or cover any other business-related expense.

With small business credit, you have the ability to grow faster and a safety net if things go wrong.

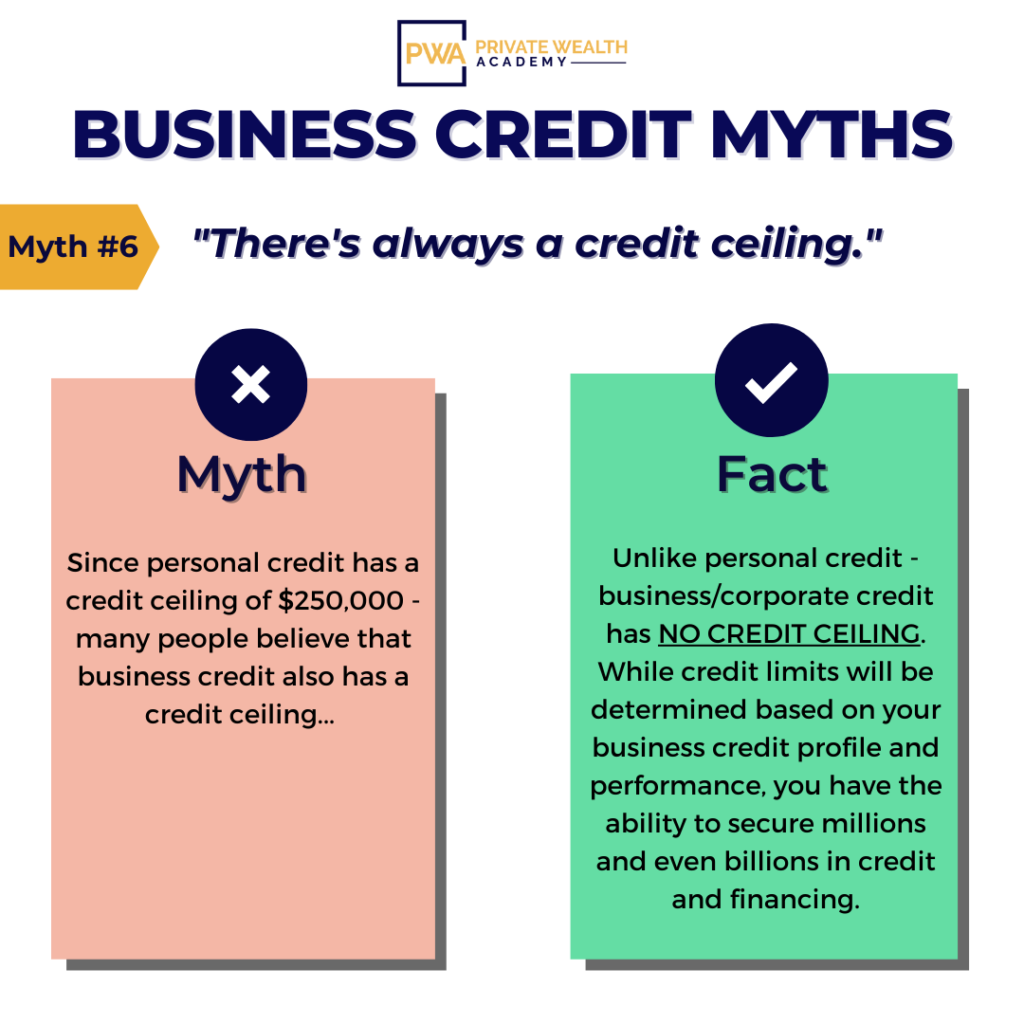

And, in case you didn’t know – there’s NO CORPORATE CREDIT CEILING.

With a strong enough credit profile, your company can get approved for literally millions and even BILLIONS in financing. Want proof?

Brex Inc.

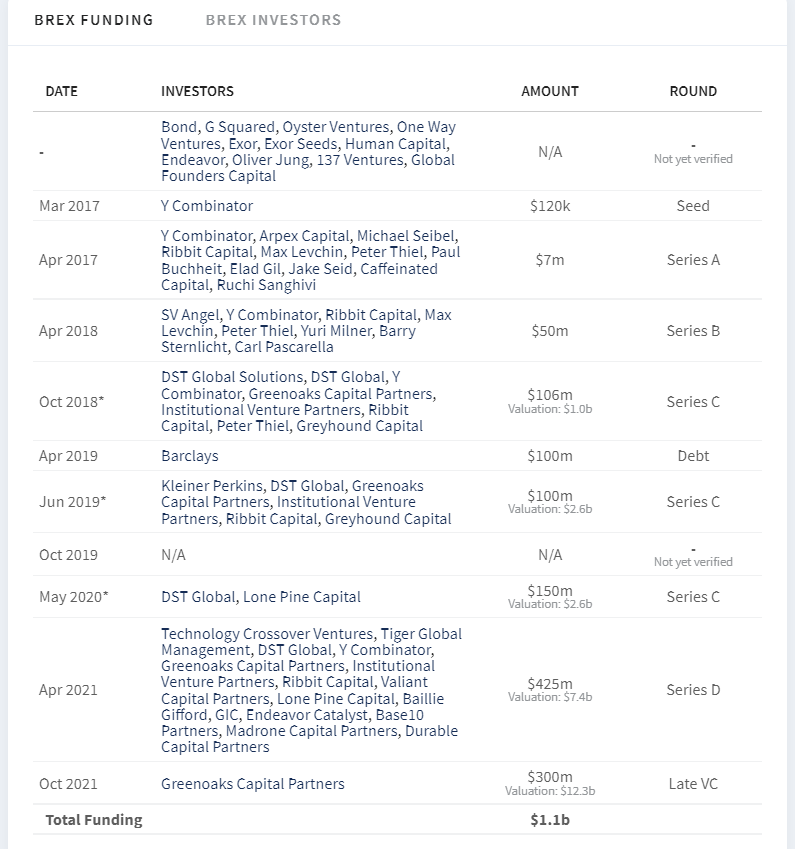

Did you also know that Brex got started with seed funding of only $120,000? That may sound like a lot to you now but once you dive into the world of corporate credit you’ll see that obtaining $120K+ in financing really isn’t that difficult.

The chart below shows their first rounds of funding. Notice how that in less than two weeks, they went from $120K in funding to $7M in funding!

Most companies do not see this dramatic of an increase in funding that fast! But it is possible. Remember how we mentioned that lenders get the most funding? Brex is just one example of this. They’re a FinTech Lender (an industry that sees more funding that almost any other business category).In just 5-6 years Brex went from being worth $0 to now in 2022, they are valued at $12.3B (Billion).

Shopify

Shopify is another fascinating company to analyze. They’re known for their super-fast growth and valuation. The chart below shows their first rounds of funding until they went public in 2015. In fact, they’ve grown so much that in 2016 they even started their own lending company (Shopify Capital) where they help small businesses get access to funding. As of 2022, Shopify is valued at $75.5B.

Other Perks That Come with Having Small Business Credit

Plus, having a strong business credit profile will also lead to better credit offers, terms and interest rates.

And, there are a number of other ‘perks’ to building your company’s small business credit profile, like tax write-offs.

*Check with your accountant, but in many cases, corporate real estate property, company vehicles, and company credit card expenses can be tax deductible.

You may even get access to better insurance rates via your high business score. And, you’ll reap in the business credit card rewards and loyalty program bonuses, too.

What if you could quickly secure $100,000+ in corporate credit?

And what if you could repeat this process over and over with any business you owned?

What would that allow you to do?

Corporate credit is the tool you need to fund your goals – no matter how MASSIVE they might be. We hope we’ve proved that here to you today.

Remember…

“The people who are crazy enough to think they can change the world are the ones who do.” – Steve Jobs

If you’re ready to establish a business credit profile and learn how to quickly get approved for $100,000 in credit in 6 months or less…

Join The Corporate Credit Secrets Program

“Will closing old, unused credit accounts help my credit score?” We’ll reveal the answer in tomorrow’s post… So be on the lookout for that.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.