We know taxes suck – and if you haven’t learned how to remove your income tax liability yet (or still owe taxes from past years) you’re probably looking for the best ways to keep those taxes as LOW AS POSSIBLE this year.

We’re here to help!

Today we’re going to give you over 14 tax deductions you might be eligible to claim this season…

1. Child Tax Credit

The CTC (Child Tax Credit) is worth a maximum of $2,000 per qualifying child. Up to $1,400 is refundable. To be eligible for the CTC, you must have earned more than $2,500.

Eligible dependents include:

- Child

- Stepchild

- Foster child

- Sibling

- Step-sibling

- Half-sibling

- Grandchild

- Niece/nephew

- Adopted child

However, if you received advance payments for the child tax credit this year, you won’t be able to claim the full deduction at tax time.

The IRS will send you Letter 6419 to let you know how much you received in advance child tax credit disbursements and also how much you have left to claim. As well as, if you opted out of advance payments, you’re eligible for the full amount of the credit. If you’re not sure where you stand with this credit, you can review more at the Child Tax Credit Update Portal on the IRS website.

2. Earned Income Tax Credit

The earned income tax credit reduces the amount of taxes owed for low- to moderate-income workers and also families. The IRS typically notifies households that might qualify for EITC, but if you aren’t contacted by the time you sit down to do your taxes, you can check the IRS’ website for EITC details & to see if you qualify.

3. Lifetime Learning Credit

The lifetime learning credit, or LLC tax deduction, applies to higher education candidates. To claim it, you, your spouse or a dependent must also be footing the bill for qualifying higher education costs.

The lifetime learning credit (LLC) is for qualified tuition and related expenses paid for eligible students enrolled in an eligible educational institution. This credit can also help pay for undergraduate, graduate and professional degree courses — including courses to acquire or improve job skills. There is no limit on the number of years you can claim the credit. It is worth up to $2,000 per tax return. Check the IRS’ website for LLC details & to see if you qualify.

4. American Opportunity Tax Credit

The American opportunity tax credit, or AOTC tax deduction, is exclusively for first-time college students for their first four years of college or other higher education, which makes it different from the LLC (above). If you’re pursuing a degree and also haven’t had a felony drug conviction, you could qualify if you meet income thresholds.

The American opportunity tax credit (AOTC) is also a credit for qualified education expenses paid for an eligible student for the first four years of higher education. As well as, you can get a maximum annual credit of $2,500 per eligible student. If the credit brings the amount of tax you owe to zero, you can also have 40 percent of any remaining amount of the credit (up to $1,000) refunded to you.

The amount of the credit is 100 percent of the first $2,000 of qualified education expenses you paid for each eligible student and also 25 percent of the next $2,000 of qualified education expenses you paid for that student. Check the IRS’ website for AOTC details & to see if you qualify.

5. Child and Dependent Care Credit

If you care for a child or another dependent in your household, you may be able to receive a tax deduction or refund for your child care-related expenses. The total expenses that you may use to calculate the credit may not be more than $3,000 (for one qualifying individual) or $6,000 (for two or more qualifying individuals).

Expenses paid for the care of a qualifying individual are eligible expenses if the primary reason for paying the expense is to assure the individual’s well-being and also their protection. If you also received dependent care benefits that you exclude or deduct from your income, you must subtract the amount of those benefits from the dollar limit that applies to you. Check the IRS’ website for CDCC details and to see if you qualify.

6. Saver’s Credit

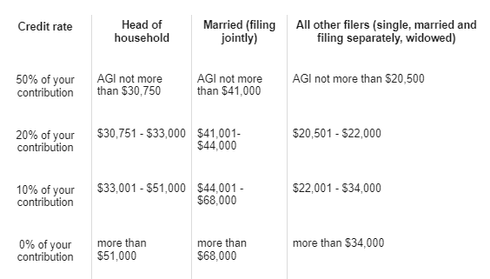

If you make contributions to an individual retirement account or employer-sponsored retirement plan, such as a 401(k), you may qualify for the saver’s credit. You must be at least 18 years of age, you can’t be a full-time student and no one else can claim you as a dependent on their tax return. Also, depending on your adjusted gross income reported on your Form 1040 series return, the amount of the credit is 50%, 20% or 10% of:

- contributions you make to a traditional or also a Roth IRA,

- elective salary deferral contributions to a 401(k), 403(b), governmental 457(b), SARSEP, or SIMPLE plan,

- voluntary after-tax employee contributions made to a qualified retirement plan (including the federal Thrift Savings Plan) or 403(b) plan,

- contributions to a 501(c)(18)(D) plan, or

- contributions also made to an ABLE account for which you are the designated beneficiary.

Check the IRS’ website for Saver’s Credit details & to see if you qualify.

Here are the rates for 2022:

Here are the rates for 2023:

7. Adoption Tax Credit

Tax deduction for adoption include both a tax credit for qualified adoption expenses paid to adopt an eligible child and an exclusion from income for employer-provided adoption assistance. The credit is nonrefundable, which means it’s limited to your tax liability for the year. However, any credit in excess of your tax liability may be carried forward for up to five years. The maximum amount $14,890 (2022), $15,950 (2023) per child. Check the IRS’ website for details & to see if you qualify.

8. Medical and Dental Expenses

If you itemize your tax deductions for a taxable year on Schedule A (Form 1040), Itemized Deductions, you may also be able to deduct expenses you paid that year for medical and dental care for yourself, your spouse, and your dependents. However, you may deduct only the amount of your total medical expenses that exceed 7.5% of your adjusted gross income. Medical care expenses include payments for the diagnosis, cure, mitigation, treatment, or prevention of disease, or also payments for treatments affecting any structure or function of the body.

Possible expenses include:

- Fees to doctors, dentists, specialists, mental health professionals and even nontraditional medical practitioners

- Hospital care, residential nursing home care and acupuncture treatments.

- Treatment for alcohol, drug addiction, smoking-cessation programs and prescription drugs for nicotine withdrawal and related addiction needs.

- Payments for insulin, eyeglasses, contact lenses, hearing aids, crutches, wheelchairs, guide dogs and other service animals

- Funeral expenses, over-the-counter medications and most cosmetic surgery can’t be deducted. Check the IRS’ website for details & to see if you qualify.

9. Residential Energy Credit

The amount of the credit is equal to 30% of the sum of amounts paid by the taxpayer for certain qualified expenditures, including (1) qualified energy efficiency improvements installed during the year, (2) residential energy property expenditures during the year, and (3) home energy audits during the year.

The credit includes:

- Energy-efficient windows and doors

- Roofs

- Insulation

- Energy-efficient heating and AC systems

- Water heaters

- Biomass stoves

- Qualifying solar electric property and solar water heaters

Check the IRS’ website for details & to see if you qualify.

10. Student Loan Interest Tax Deduction

Student loan interest is interest you paid during the year on a qualified student loan. It includes both required and voluntarily pre-paid interest payments. You may deduct the lesser of $2,500 or the amount of interest you actually paid during the year. The deduction is gradually reduced and eventually eliminated by phaseout when your modified adjusted gross income (MAGI) amount reaches the annual limit for your filing status.

You claim this deduction as an adjustment to income, so you don’t need to itemize your deductions. Check the IRS’ website for details & to see if you qualify.

11. Health Savings Account Contribution

If you have a health savings account, contributions made to your HSA are not subject to federal income tax. You can also claim a tax deduction for making contributions to your HSA.

Contribution limits vary by your high-deductible health plan, your age and also the date you become eligible. The maximum contribution to an HSA in 2023 increases from $3,650 to $3,850 for self-only coverage and from $7,300 to $7,750 for family coverage. Check the IRS’ website for details & to see if you qualify.

12. Charitable Contribution Tax Deductions

Generally, you can only deduct charitable contributions if you itemize deductions on Schedule A (Form 1040), Itemized Deductions. Gifts to individuals are not deductible. Also, only qualified organizations are eligible to receive tax deductible contributions. In some cases, you can deduct up to 100% of your AGI, but there are other cases where you might be limited to 20% or 30%. Check the IRS’ website for details & to see if you qualify.

13. Self-Employment Tax Deduction

The self-employment tax refers to the Medicare and Social Security taxes for self-employed people. This also includes freelancers, independent contractors, and small-business owners.

If you’re a sole proprietor (including an independent contractor), a partner in a partnership (including a member of a multi-member limited liability company (LLC) that is treated as a partnership for federal tax purposes) or are otherwise in business for yourself. The term sole proprietor also includes the member of a single member LLC that’s disregarded for federal income tax purposes and a member of a qualified joint venture.

Self-Employment Tax

The law sets the self-employment tax rate as a percentage of your net earnings from self-employment. This rate consists of 12.4% for social security and 2.9% for Medicare taxes.

Additional Medicare Tax

Additional Medicare Tax applies to self-employment income above a threshold. The threshold amounts are $250,000 for a married individual filing a joint return, $125,000 for a married individual filing a separate return, and $200,000 for all others. Also, for additional information, refer to the Instructions for Form 8959, Additional Medicare Tax and Questions and Answers for the Additional Medicare Tax.

Reporting Self-Employment Tax

Compute self-employment tax on Schedule SE (Form 1040). When figuring your adjusted gross income on Form 1040 or Form 1040-SR, you can deduct one-half of the self-employment tax. You calculate this deduction on Schedule SE (attach Schedule 1 (Form 1040), Additional Income and Adjustments to Income. The Social Security Administration also uses the information from Schedule SE to compute your benefits under the Social Security program.

Paying extra taxes to be your own boss is no fun. The good news is that the self-employment tax will cost you less than you might think because you get to deduct half of your self-employment tax from your net income when calculating your income tax. The Internal Revenue Service (IRS) treats the employer portion of the self-employment tax as a business expense and allows you to deduct it accordingly.

It is important to note that the self-employment tax refers to Social Security and Medicare taxes, similar to Federal Insurance Contributions Act (FICA) tax paid by an employer. When a taxpayer takes a deduction of one-half of the self-employment tax, it is only a deduction for the calculation of that taxpayer’s income tax. It does not reduce the net earnings from self-employment or reduce the self-employment tax itself.

Check the IRS’ website for details & rates.

14. Common Business Deductions

Other common business deductions include: Internet, phone, home office, business insurance, rent, health insurance premiums, meals, business travel, vehicle use for business purposes, interest on business loans, startup costs (you can deduct up to $5,000 in business startup costs in the first year of active trade or business), advertising costs, retirement plan contributions, education, specialized magazines, journals, and also books directly related to your business are tax deductible as supplies and materials.

Office supplies, credit card processing fees, tax preparation fees, and repairs and maintenance for business property and equipment are also deductible. There are more deductions available than those listed here, but these are some of the biggest ones.

Bottom Line

Remember, anytime when you’re not sure whether a cost is a legitimate business expense, ask yourself, “Is this an ordinary and necessary expense in my line of work?”

This is the same question that the IRS will ask when examining your deductions if you are audited. If the answer is ‘no’, then don’t take the deduction.

The unfortunate thing is – even with all these deductions, you may find that you STILL owe money…

While the IRS laughs straight to the bank – don’t you wish there was an easy way to LEGALLY remove your income tax liability?

There is! Did you know that…

Also, almost all income taxes can legally be avoided through a special redemption method…

This is what Section 4 is all about inside The Bulletproof Trust Secrets program.

We’re also not talking about withholding taxes, Social Security taxes or Medicare taxes…Or evading or protesting taxes – we’re NOT tax protesters – NO!…

We’re talking about removing your income tax liability – LEGALLY!

(Tax evasion is ILLEGAL – Tax avoidance is perfectly legal)

And what if this little-known redemption method could continue to reduce your tax liability every year from now on?

It can!

The best part is…

The process is FREE & legal to do

It’s easy to learn

It’s FAST to do

It can remove up to 100% of your income tax liability!

April 18th will be here before you know it…

NOW is the absolute best time to get Bulletproof Trust Secrets and learn how to reduce your income tax liability FOREVER!

This is THE #1 simplest, easiest, FASTEST method to reduce your income tax liability down to ZERO.

Unlike other methods to avoid taxes, this method doesn’t involve any special business structures, NO sneaky ways of transferring funds, NO foreign or off-shore accounts and

NO confusing paperwork. It’s as simple as writing a check!

Even if you never use the Bulletproof Trust itself…

this ONE tax secret alone is worth MUCH MORE than the cost of the ENTIRE program!

The only question now is – what will you do with all that money you’ll save in taxes year after year?

Your friends in finance,

Private Wealth Academy

Information contained in our websites, products and emails does not constitute legal, financial or medical advice. With respect to any particular matter, students should seek legal advice from counsel in the relevant jurisdiction.

Leave a Reply

You must be logged in to post a comment.