Looking for the fastest HELOC payoff strategy that will help increase your cash flow without changing your income?

This isn’t a riddle or gimmick… Think about it…

A first lien HELOC is the tool that can make your financial freedom a reality by helping you quickly pay off what most likely is your largest debt.

Our HELOC Payoff Strategy Gets the Job Done Super Fast!

A home equity line of credit (HELOC) can be used to reduce the total interest cost of the loan and reduce monthly payments over time. Giving you a realistic strategy to pay off your home MUCH FASTER than you’d ever imagine.

How fast?

Using strategy we can teach you inside the Half Your Mortgage program with a first lien HELOC, you can pay off your home in 5-7 years on average without changing your lifestyle or income.

And if you follow our HELOC Hyperdrive Strategy, you can pay off the loan in as little as 3 years! Compared to a mortgage, that’s 27 LESS years of housing payments! You want to experience that too, don’t you?

YES – PLEASE!

The faster you pay off your home, the faster you can achieve other financial goals.

Things You May Not Know About First Lien HELOCs:

A first lien HELOC only requires managing ONE LOAN, the loan only closes once, and doesn’t require paying closing costs multiple times like second mortgages or cash-out refinances.

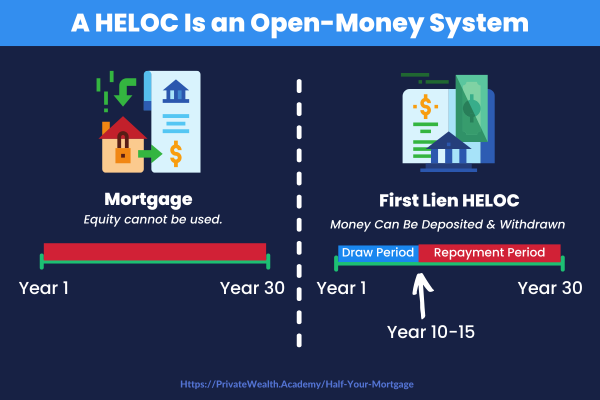

A first lien HELOC is an open account – allowing money to go in and out of the account, this is KEY to improving your cash flow.

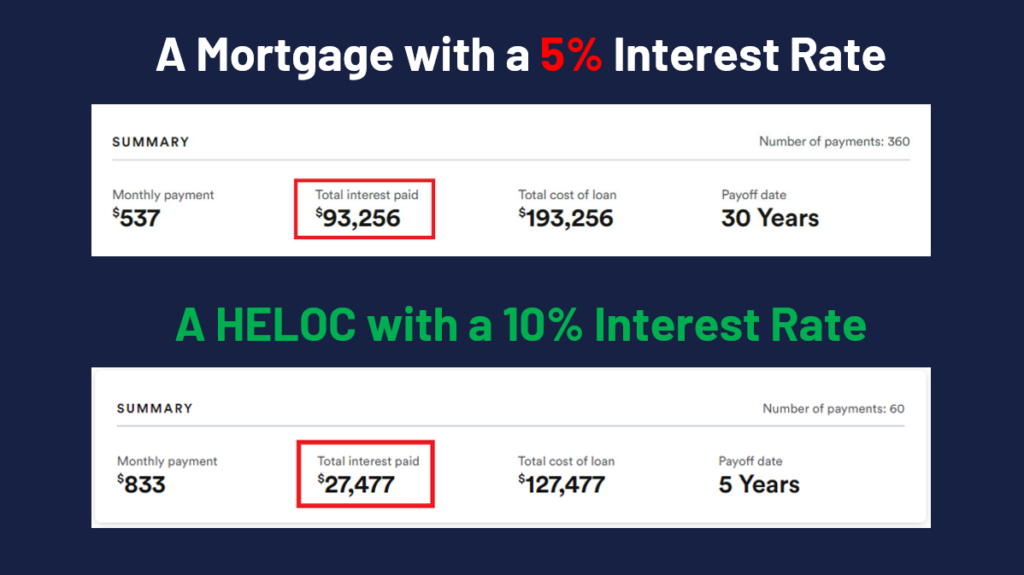

Even if you get stuck with a home equity line of credit with a higher interest rate than a mortgage, when using our proven repayment strategy, your EFFECTIVE INTEREST RATE is much lower. Because…

Contrary to popular belief, low interest rates aren’t everything…

Even though mortgages often come with lower interest rates, the total amount of interest you’ll pay on a 30 year mortgage is substantially larger – usually as much as the original loan amount! Just take that in…

Proof Our HELOC Payoff Strategy Saves the Most Money!

With the Half Your Mortgage program you’ll be able save tens of thousands to hundreds of thousands of dollars over the loan term. Isn’t that awesome? Just think of what you’ll be able to do with ALL that money!

This is why it’s important to understand how the interest is calculated.

You go ahead and buy that banker an extra house if you want to…

But if you’re tired of getting taken to the cleaners by your mortgage –

We can help you reduce your mortgage by 50% – guaranteed.

Being able to half your mortgage and pay it off in a fraction of the time will allow you to skyrocket your wealth (and investment portfolio) in no time.

How does the strategy work?

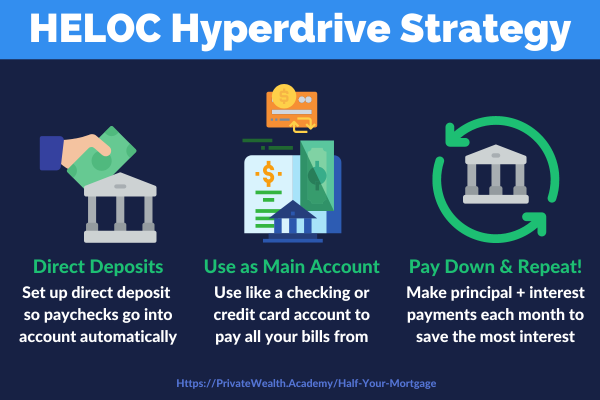

Our HELOC Hyperdrive Strategy utilizes the way that interest is calculated for Home Equity Lines of Credit (accrued on the average daily balance), using leftover funds each month to accelerate paying down the principal. If you need money or need to pay a bill, just withdraw what you need or make a payment from the account.

It’s that simple.

We suggest that all expenses that you normally pay for your household (utilities, groceries, gas, etc.) be paid from the HELOC operating account.

Any paychecks can be directly deposited into this account, and you can set up automatic ACH payments to pay bills directly from the HELOC. Plus, at the end of the term once the balance is paid down, the HELOC can be left open for future use without having to paid additional origination or closing costs.

The first lien HELOC is awesome because it’s the embodiment of good financial habits…

Pay off your most expensive costs (house payments) first, always make payments on the principal, and if you’re following the recommendations we provide – the account will include a sweep to ensure your balance remains as low as possible (so you’re paying as little in interest as possible.)

The hard part is… Not just any HELOC will work.

Most lenders don’t offer first lien HELOCs, or one with a sweep and online banking. To take advantage of all the benefits we talked about, you need the right home equity line of credit with features that make it easy for you to manage, pay bills, with no prepayment penalties, and no additional sweep account fees or charges.

Don’t worry – we’ve got everything you need…

We’ve created the Half Your Mortgage program to help you go through the entire process of securing a HELOC (and lock-in the most affordable rates.)

We’ll show you how to find the right first lien HELOC to go after, the exact criteria to look for, how to prepare your finances, how to calculate the interest (so you know how much you’ll be able to save) get access to our proprietary calculators to make the math super easy & so much more!

We’ll even put you in touch with affordable HELOC lenders in your state plus a list of the right questions to ask lenders to you can be sure you’re getting the best deal. And most importantly – we’ll teach you our proven HELOC Hyperdrive Strategy to pay it off in as little as 3 years!

Click the link to learn everything you need to know about securing an affordable first lien HELOC and transform your equity into cash.

Learn More About the Half Your Mortgage Program

Does this all sound like too much to take on yourself?

Let’s face it, you could have closed on your HELOC and been withdrawing funds by now – but it’s okay to reach out for help…

That’s why we’ve created the Half Your Mortgage Coaching program! We’ll pair you with one of our knowledgeable coaches to help you get the right HELOC for you. From finding the right lender to ensuring you’re getting the right terms, we’ll be there helping you every step of the way all the way through closing. *HURRY – this round of coaching spots are filling up FAST!

As a Half Your Mortgage Coaching Client You’ll Receive…

- Half Your Mortgage Program [$4000 VALUE]

- “Done For You” Qualification Testing [$2000 VALUE]

- “Done For You” Bank List [$5000 VALUE]

- Calling on Your Behalf to Find the Right Lender [$3000 VALUE]

- High Credit Secrets Program [$300 VALUE]

- 12 Weeks Video and Audio Coaching [$5000 VALUE]

- Week 1: Strategy Call + Half Your Mortgage Overview

- Week 2: Boosting Your Credit Score

- Week 3: How To Half Your Mortgage

- Week 4: Creating A Custom Bank List For You

- Week 5: Calling Banks, Qualifying Questions & HELOC Disclosures

- Week 6: Private Banking Secrets Overview

- Week 7: Whole Life Insurance & Investing

- Week 8: Real Estate Secrets Overview

- Week 9: Obtaining a Land Patent & Removal From Tax Roll

- Week 10: Fighting A Foreclosure Proceeding

- Week 11: Advanced HELOC Q&A

- Week 12: Wrapping Up

- Personal Kickoff Strategy Session [$1000 VALUE]

- 12 Weeks Open Office Hours [$1500 VALUE]

- Twice-A-Week Virtual Masterminds [$6000 VALUE]

- (3) 1-Hour Private Consultations [$3000 VALUE]

- Opportunity To Join The Inner Circle [PRICELESS]

If you’re looking for the most affordable way to purchase a home, consolidate debt, or pay for large or on-going projects – this program IS IT!

By the time you’re finished with the 12 week program you’ll…

- Have boosted your personal credit score

- Have found & closed on the perfect HELOC for you

- Be able to withdraw funds to use however you need

- Be saving money on interest each month

- Have your own land patent to ensure your property is legally YOURS

- Have removed your property from the tax roll (no more property taxes)

- Ensure your property NEVER is able to be foreclosed on

- Understand how to refinance your HELOC if desired

- Have a private banking account setup to earn a 12%+ ROI each year

NOTE: Today is the cut off date to join our current coaching class.

We don’t want you to have to wait – because with a HELOC every

6 months the average student saves $14,000! Our coaching program will more than pay for itself in that time!

The faster you make the switch to a HELOC – the faster you can save money!

So HURRY – today is the last day to Book Your Discovery Call otherwise, you may have to wait a few weeks until the next class starts.

Get started by Booking a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) we’ll run through the numbers with you and find out how much you’ll save in interest, determine your payoff date & see if you’re a good fit for the Half Your Mortgage Coaching Program. Click the link below to schedule now.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.