Do you know who you want your estate to go to when you’re gone?

While a will is a common estate-planning tool, it isn’t always the best way to bequeath your assets to your heirs. In fact, leaving your estate plans in a will can be downright risky.

There are more people than you think who want to get their hands on assets that don’t belong to them. And a will leaves your estate open to this type of legal theft.

All it takes is one good argument to get a will changed. Leaving your beneficiaries holding nothing, despite what you would want.

Irrevocable Trust vs Will

But if a will isn’t iron-clad, what other option do you have to protect your assets?

The only way to protect your wealth is to make it untouchable in an irrevocable express trust.

►How a Will Puts Your Assets at Risk

The issue with wills is that they aren’t iron-clad. Your will can express your wishes after you’re deceased, including where your cash and other assets go.

But, unlike a trust, a will isn’t active until after you’re deceased. What that means is that you can outline the plans for your estate, and you won’t be around to make sure your wishes are met.

►Adding To The Issue Is… Probate

Every will has to go through the process of probate, which requires an authorized court administrator to examine the will.

As part of this process, your estate becomes public record — leaving privacy off the table.

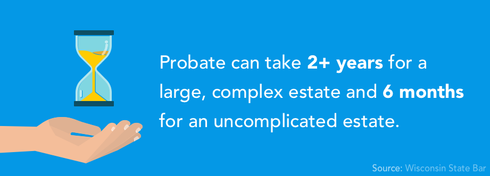

Plus, the process of probate can be lengthy and potentially contentious — especially if family members contest the will.

If your will is contested, your wishes for the inheritance you pass down may not be met. And, you won’t be around to protest the changes that are made. The decision will be made for you.

That is not something you want for your estate.

You also don’t want your beneficiaries to be saddled with expensive taxes, which have to be paid on inheritances passed down by wills.

In fact, the average beneficiary loses 5 to 30% of their inheritance through probate. Which can end up being quite a bit of money…

Luckily, a trust has the power to protect your assets from these types of high tax penalties while ensuring your estate ends up right where it should.

Where an Irrevocable Trust vs Will Comes Into Play…

►How Trusts Protect Your Assets

To ensure that you’re truly in charge of how your assets are handled, you need a Bulletproof Trust.

This type of private trust is not required to go through probate. Private irrevocable express trusts cannot be contested, either — nor can they be altered in any way.

What this means is that your assets will be handled exactly how you want, even after your death.

Your assets and other valuables contained in your estate will be protected from legal interference, and will keep them out of the hands of parties who shouldn’t have access to your estate. It’ll also expedite the process of passing your assets to your beneficiaries.

Probate can take months — even without any issues — but with a trust, your assets are handed down quickly by the executor of your estate.

Just listen to Martha’s story and how much money an irrevocable trust vs will was able to save her family from probate & fees when her grandfather passed…

And with an express irrevocable trust you can be sure your affairs will remain private, too. Probate makes your estate public, while a trust keeps your estate information under lock and key.

And, it does all of this while shielding your beneficiaries from the high cost of estate taxes.

What that means is this: Your estate, your assets, and your beneficiaries are all protected by one simple tool — a Bulletproof Trust.

Don’t wait until it’s too late to protect your estate. Your wealth is at risk after you’re gone if you’re relying on a will.

If you want to pass along what you’ve rightfully earned, you need to take steps to protect your estate with a trust instead. Don’t leave decisions up to the legal system or fate.

A well-established private irrevocable trust will put you in control of what happens with your wealth, even after you’re gone.

Learn How the Bulletproof Trust Can Protect Your Estate and Assets

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.