Do you understand the difference between a revocable and irrevocable trust?

The world of trusts can be complex but we’re here to simplify and help navigate you through it.

Over the next few emails we’ll be debunking the TOP 6 most costly myths about trusts to keep you out of hot water (and even JAIL!)

Today though we’ll be talking about revocable and irrevocable trusts.

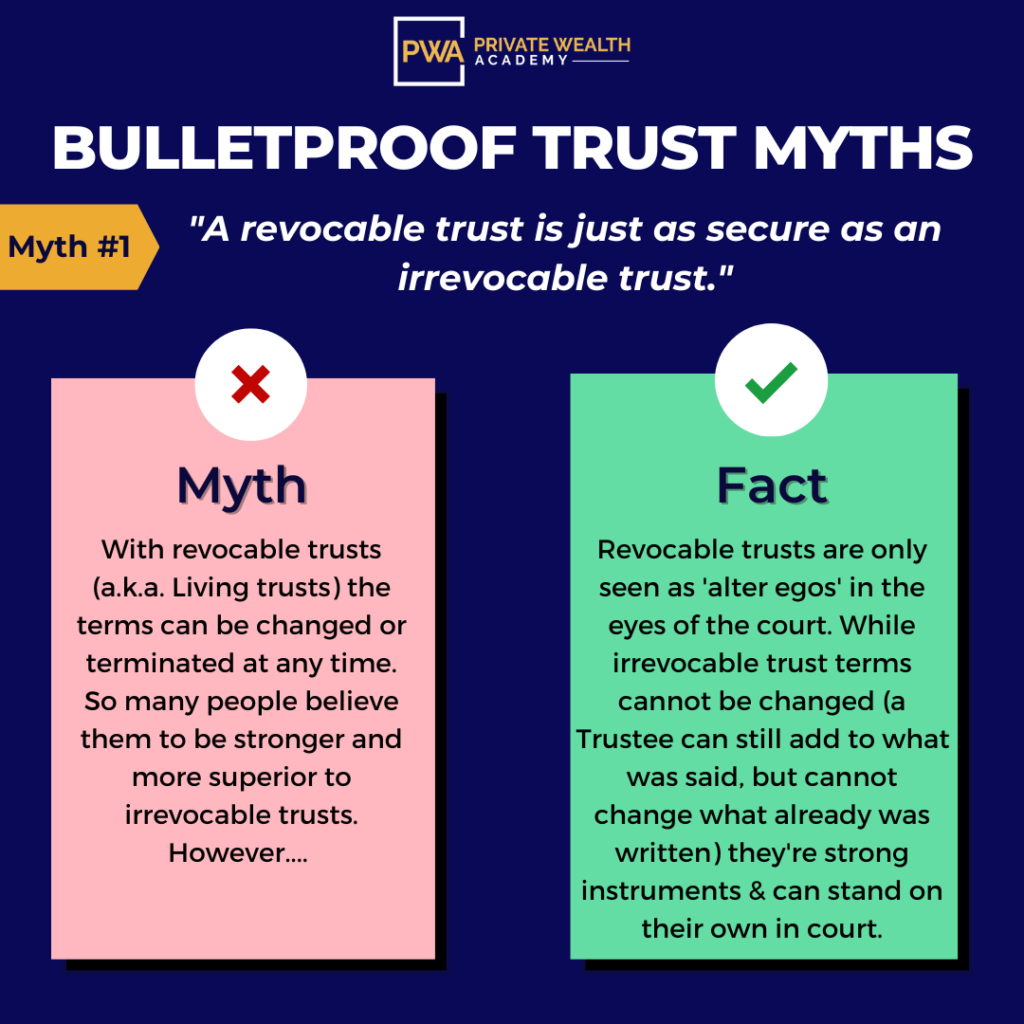

MYTH #1 – A revocable trust is just as secure as an irrevocable trust

FALSE. There are two primary types – revocable and irrevocable trusts.

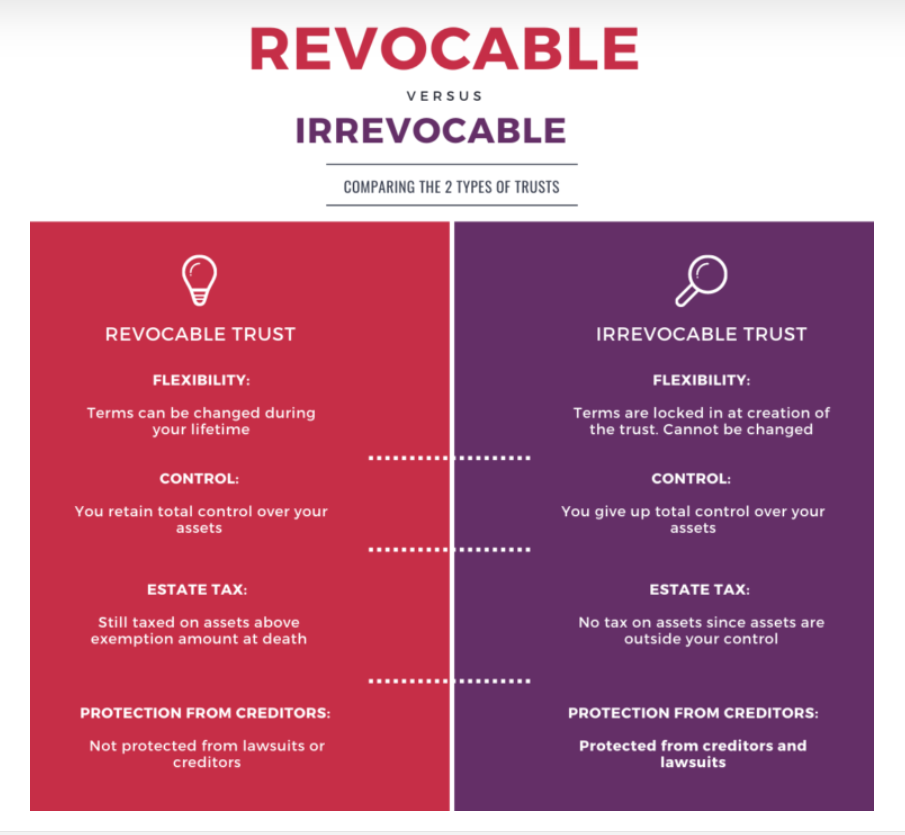

The Biggest Difference Between Revocable and Irrevocable Trusts.

…the biggest issue with a revocable trust is that it doesn’t offer much protection from creditors or lawsuits due to the fact that one maintains control over the assets and may act as the grantor, trustee and beneficiary. This is considered a ‘grantor trust’.

Irrevocable trusts offer the strongest asset protection possible.

This is one of the essential reasons that property within such a trust is so secure – there can be no claim made that the property still belongs to the former owner (grantor).

So we highly encourage you to familiarize yourself with the differences between revocable and irrevocable trusts and these common myths to ensure you know what kind of trust you’re establishing as well as how to operate it properly.

*For a fuller picture on properly establishing and managing a trust as a competent Trustee, if you haven’t had the chance to watch the entire free Bulletproof Trust workshop we highly recommend you that today.

Inside We’ll Show You…

• You Can Protect ANY Asset. No Matter How Big or Small It Is.

• It’s FREE To Do. And It Works FAST In Securing Your Assets.

• Anyone Can Do It Without Being A Lawyer Or Legal Expert.

If you’ve already watched the workshop – click the button below to see some of our customer testimonials & learn how the Bulletproof Trust program can work to protect your assets & reduce your tax liability.

Learn More About Bulletproof Trust Secrets

Lookout for tomorrow’s email where we dive into Myth #2…

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.