Looking for a HELOC Mortgage Strategy to pay off your home in HALF the time?

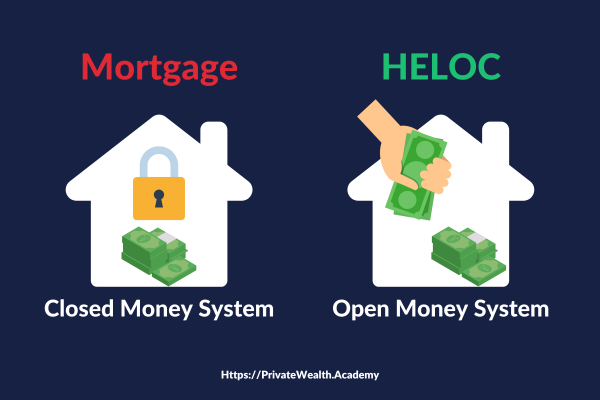

Do you know what a closed money system is?

A mortgage is a “closed money system” meaning any money put in, can never come back out unless you perform a costly refinance (45 to 120 days) or sell the home (~124 days).

So when it comes to a mortgage you do not have liquidity or access to your home’s equity.

Closed Money Systems = House Poor

Further, a mortgage has a fixed payment for the life of the loan, based on an amortization schedule where the bank front loads interest-heavy payments.

While this may seem like a good thing since you’re dealing with “fixed payments” – it’s as much of a drawback as it is a benefit…

This gives the bank full control of the allocation of principal versus interest on each payment. So if your payment is $2,000 a month – 15-20 years later your payment will still be around $2,000 a month (even if you make additional payments on the principal).

Avoid Becoming House Poor With This HELOC Mortgage Strategy

What the bank quietly disclosed in your amortization schedule was something like this, “Out of this $2,000 a month, we’ll take 90% of it and also apply it towards interest for the first 15 years and apply only 10% towards principal.”

Some people say, “I’ll utilize 100% of my income and just leave some money for bills with my mortgage.” But if you put all your income into a mortgage and have an expensive emergency bill to pay, what are you going to do?

Your money is trapped. This is what we call being “house poor”.

HELOC = Open Money System = Liquidity + Flexibility

A HELOC is an “open money system” accruing interest only on the daily remaining balance.

So you can put 100% of your income into a HELOC operating account and move money freely during the “draw period”. And with Half Your Mortgage, you’ll always pay off your loan before the draw period ends.

Our HELOC Mortgage Strategy is an Open Money System

Since the bank cannot control the allocation of principal versus interest on each payment – as the balance decreases, your interest and monthly payment amount decrease as well.

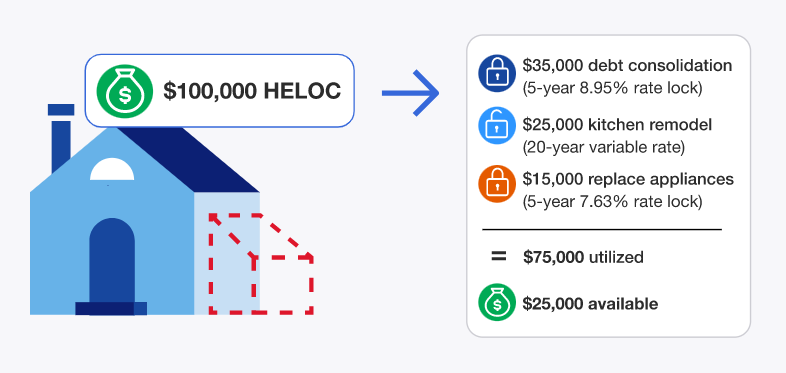

Simply deposit all your money into the HELOC operating account, pay your bills from that same account, and withdraw from the HELOC just like it were a checking account.

The bank will offer debit cards and also checks to withdraw money like any other checking account. So if you owe $200K on a $300K HELOC, you could withdraw up to $100K – same day – based on the original loan-to-value (LTV) amount, usually between 80% to 100%.

A Mortgage Can Never Do What A HELOC Does…

You will never find a mortgage that lets you liquidate your home’s equity into cash because the disclosure agreement you signed and the amortization schedule makes that illegal to do.

The HELOC saves you so much money because you’re utilizing 100% of your income with the loan being recast every single day – automatically!

The bank also will recalculate that day’s interest based on the new day’s balance, saving you cents each day that add up to tens of thousands of dollars over the years.

A mortgage never recasts! In fact, if you manually recast a mortgage the lender will charge ~$200 per recast – if they even allow it.

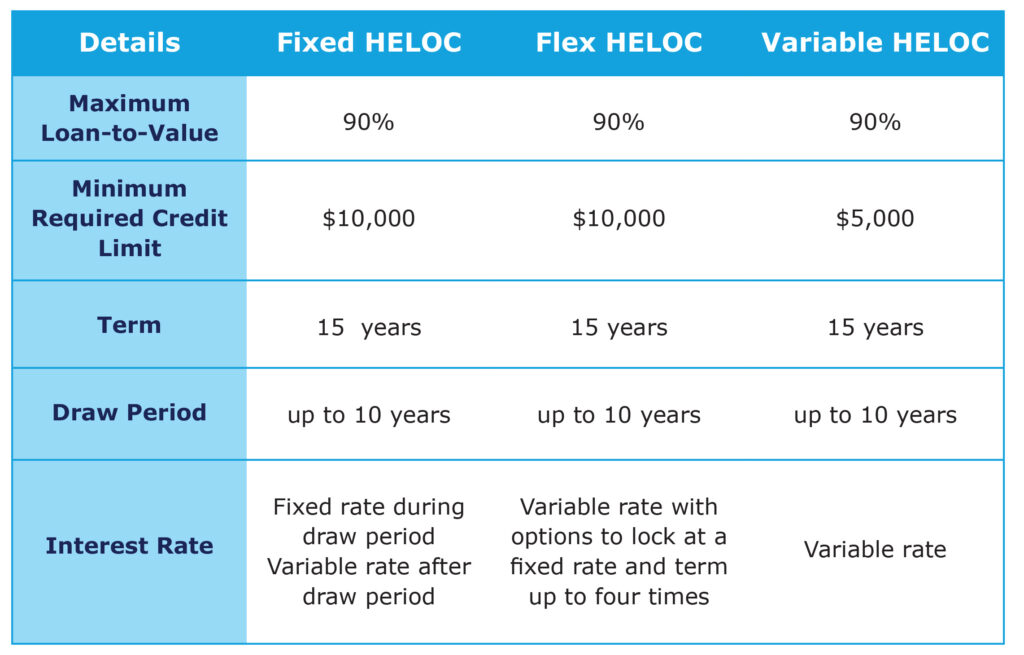

Plus, many lenders are offering fixed rate HELOCs now so you can have the best of both worlds!

Are you beginning to see how mortgages are a glamorized “scam”?

The way they’re contracted, the regulations, how the interest is calculated – is all to ensure the banks make as much money from you as possible (and for as long as possible). Why do you think they recently introduced 40 and 50-year mortgages?

Just curious, why haven’t you decided to take action on this yet?

Is it the money?

It is a good chunk of change to shell out but as we’ve shown you, this program will MORE than pay for itself within a matter of months.

But you don’t have to take it from us…

Brandon was on the fence about getting the Half Your Mortgage program but was ultimately glad he made the leap – just listen to what he had to say (and how quickly he’ll be able to pay off his home!)

Forget having your money (and equity) held hostage by the banks for decades. Instead…

Learn how to pay off your HELOC quickly (5-7 years) and make room for true freedom with the Half Your Mortgage program.

We’ll show you how to… prepare your finances, boost your credit score,

calculate your debt-to-income ratio, get the right criteria your HELOC needs,

compare lenders, the questions to ask to ensure you’re getting the

best deal, what to do in the event you get denied and much more! Plus…

We’ll teach you our proven HELOC Hyperdrive Strategy so you have the ability to pay off the loan in as little as 3 years!

Learn More About the Half Your Mortgage Program

Want to speak with one of our team members?

You can also Book a FREE Discovery Call to discuss how a HELOC can half your mortgage (whether it’s new or existing) we’ll run through the numbers with you using our proprietary software, see how much you’ll be saving in interest & determine YOUR EXACT PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.