Have you been separating business and personal finances?

By now you know it’s not a good idea to mix business and personal finances.

But what are the main differences between using personal and corporate credit?

In fact, it comes with 1-tenth the limits corporate credit offers…

Why Some Don’t Bother Separating Business and Personal Finances

Some owners don’t know the benefits of separating business and personal finances and opt to use their personal credit thinking it will be easier since they don’t really have to do anything new. They think they’ll be able to secure offers faster with lower interest rates and without the need for collateral.

The truth is though, that by separating business and personal finances and having both a personal and business credit profile – you’ll be able to reduce the burden on your personal credit. PLUS…

Getting approved for higher credit limits means you can reduce your credit utilization and improve your credit scores. It’s a WIN-WIN from both sides!

And you can get approved for MUCH HIGHER credit limits for your business than you could by relying on your personal credit alone. Not to mention, that business credit often comes with lower interest rates.

When it comes to separating business and personal finances and funding a business with personal credit…

To us, the cons out weight the pros…

One of the MAJOR con’s is combined personal and business finances.

We touch on this a lot but that’s because it’s important.

By not separating business and personal finances you’re doing yourself a huge disservice…

When you use your personal credit for small business capital, the separation between your business and personal finances essentially disappears. This is important for three main reasons:

1) Personal credit score damage: Small businesses are associated with a significant amount of risk, so using personal credit to fund one means you’re adding more weight to your personal credit score than is necessary.

2) Personal liability: In the event you default or can’t pay, debt collectors can come after BOTH your company and your personal finances to recoup what you owe. Additionally, mixing personal finances with your business could increase your personal liability if your company is sued for any reason.

3) Lower credit limits: Personal credit generally provides lower spending limits than business credit because they’re not meant to support entire companies. Potentially, you could get lucky and secure a high-limit card, but rarely do individuals get approved for more than $30K-$50K (max) per credit account.

Now let’s move on to credit scores for a moment…

A business credit score operates much the same way as a personal credit score does in that it measures your business’ creditworthiness.

Lenders use your business credit profile when you fill out a financing application to decide how much credit to extend to you and to help them determine your credit terms.

By separating business and personal finances you treat each credit profile as it’s own so each can form their own separate credit history.

There are a few key differences between personal credit scores and business credit scores:

1. Credit Limits

Small-business credit cards often come with more spending power than personal credit cards, giving your business more spending power.

Why the difference? Business cards consider both personal income and business revenue when determining your credit limit, while personal credit cards only consider personal income. However, many small-business lenders and credit card issuers still consider your personal credit when extending terms to you (unless you know how to avoid this).

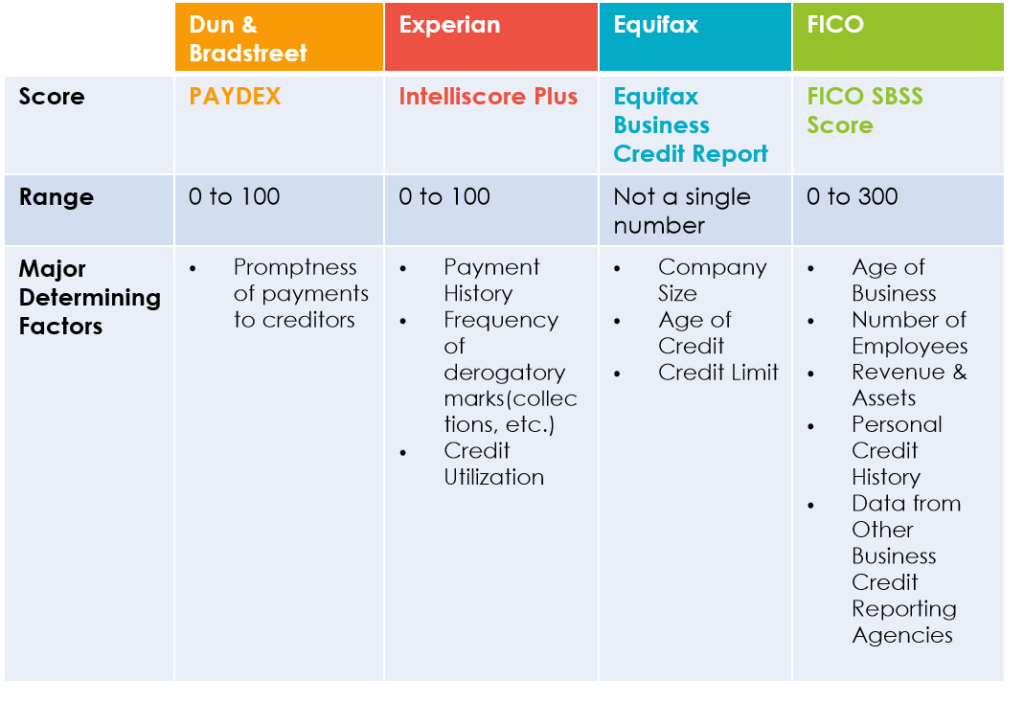

2. Standardization: Consumer credit bureaus generally use FICO’s algorithms to calculate a credit score. Business credit score algorithms don’t follow an industry standard and vary from bureau to bureau. There are 3 major business credit bureaus: Dun & Bradstreet, Equifax Business, Experian Business (plus FICO Small Business used for SBA loans).

3. Credit reporting policies

Personal credit cards typically report card activity to the three major consumer credit bureaus — Experian, Equifax and TransUnion — and changes to your credit limit, credit usage and payment history (positive or negative) will impact your personal credit score.

Small-business credit cards, on the other hand, primarily report only to business credit bureaus and have little impact on your personal credit score.

*The exceptions are business credit cards that rely on personal credit score for approval. Or card issuers that report negative activity to consumer credit bureaus (in which case late payments and serious delinquencies can lower your personal and business credit score.)

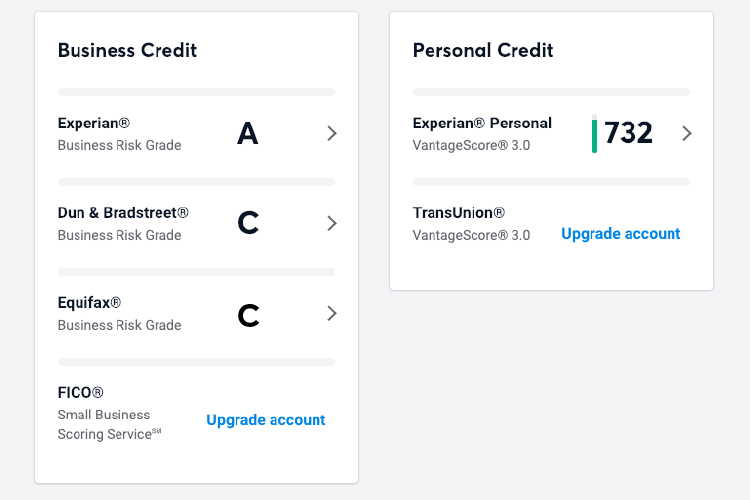

4. Access: Every 12 months, you have the right to a free personal credit report from each of the three major consumer credit bureaus. But this isn’t the case for corporate credit. You’ll need to register and pay to see your company’s credit report and score at the three major corporate credit bureaus, Dun & Bradstreet, Experian and Equifax.

*We recommend using NAV – you can get all 3 reports instead of paying per report! They’ll also report your FICO Small Business score when you upgrade your account.

5. Data Sources: Personal credit agencies draw information from public and court records, lenders, credit card issuers and collection agencies. While business credit reporting bureaus get their information from public records (including online sites & legal records), lenders, vendors, other credit reporting bureaus and often your personal bank records and credit report.

6. Privacy: Only you and some select parties (like creditors) have the right to see your personal credit reports. But with corporate credit reports, all information is public.

Hopefully that gives you a better idea of the benefits of separating business and personal finances and credit profiles.

Learn more what about Corporate Credit Secrets can do for you.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.