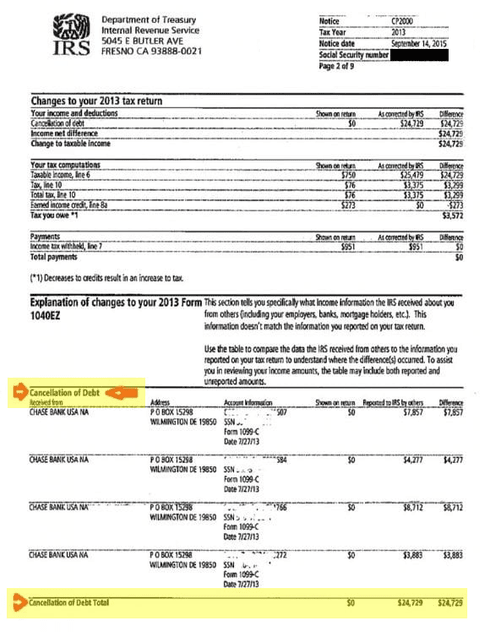

Did you know that even the IRS recognizes debt removal?

They call it ‘Cancellation of Debt’ (a slightly different process) but when it comes to accounting, they’re treated the same.

Getting any letter from the IRS can make your heart skip a beat but some correspondence can come as good news.

If you’ve gone through the debt cancellation or debt removal process and receive a letter similar to the following, this is another confirmation that THE PROCESS WORKED and the debt is erased. *Typically this will be the last letter you’ll receive.

What Happens After A Debt Cancellation

After a debt has been erased or cancelled – here’s what happens:

Creditors write off debts after a set period of time—one, two, or three years after you default. The creditor stops its collection efforts, declares the debt uncollectible, and reports it to the IRS as lost income to reduce its tax burden.

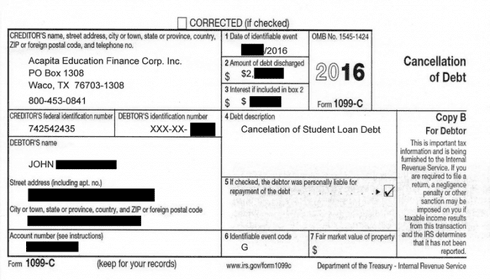

Any financial institution that forgives or writes off $600 or more of a debt’s principal (the amount not attributable to interest or fees) must send you and the IRS a Form 1099-C at the end of the tax year.

The same is true when you negotiate a debt reduction. The creditor will report the amount you didn’t pay to the IRS.

When you get that IRS letter in the mail you know you’ve WON but…

You also know there’s ONE LAST STEP to take.

Obviously, the IRS still wants to collect tax on the money, and it will turn to you for payment. Since you no longer have to pay the full amount of the debt, the IRS treats the forgiven amount as gained income.

The question is…

Is This Debt Cancellation Amount Taxable?

That’s more than we can cover here today – watch out for tomorrow’s email, we’ll spill ALL the nitty gritty details.

If you can’t wait for the answer and you’re ready to start removing your debt today – Get Debt Removal Secrets

Learn More About Debt Removal Secrets

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.