Hey, did you see our blog post yesterday?

Hopefully so – it was an important one because we explained the difference between how interest is calculated on a mortgage vs. a HELOC.

We showed how a home equity line of credit (HELOC) can save you hundreds of thousands of dollars with its repayment flexibility, by calculating interest based on the daily balance, and the ability to provide you with immediate cash, but we know what you’re thinking…

There must be a downside somewhere, right?

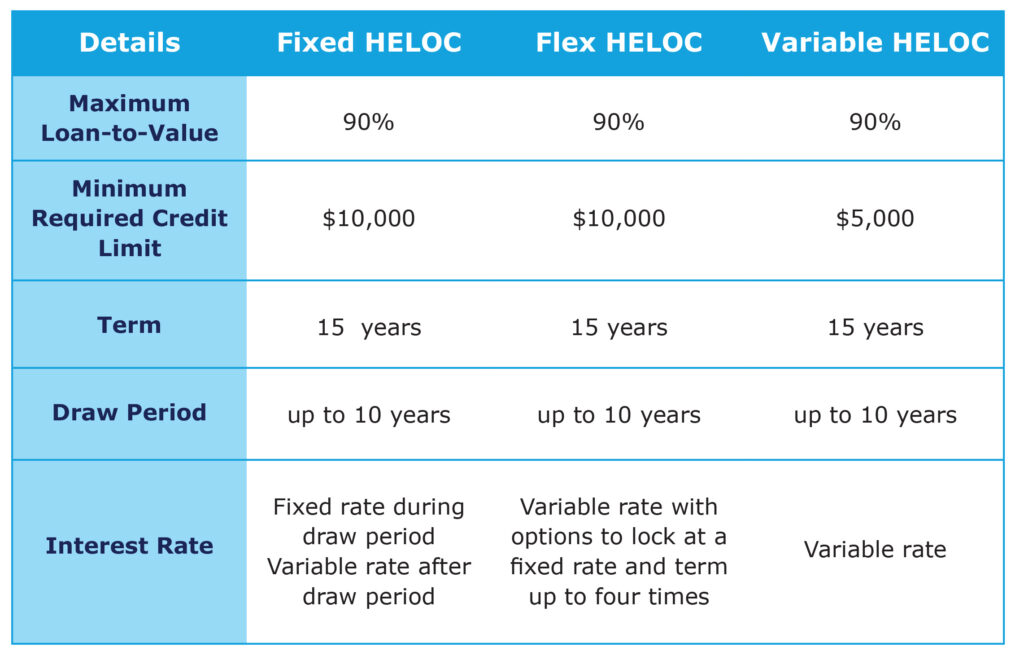

HELOCs used to only come with variable interest rates… (and that was a slight drawback.) But the great news is…

home equity lines of credit are making a comeback and as a result lenders are offering different rate options for HELOCs!

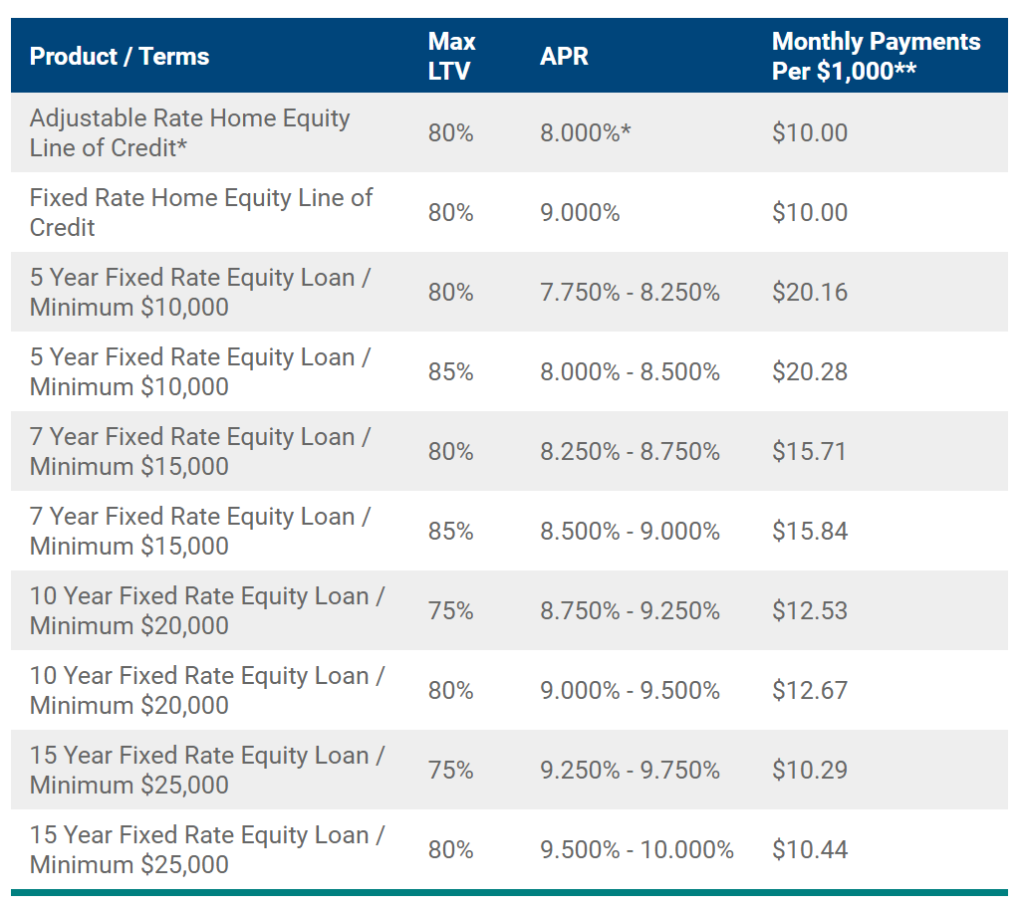

While many still come with variable rates, some offer fixed or a hybrid of variable and fixed. Obviously, rates vary a lot from lender to lender so it’s imperative that you find the right HELOC (that’s why we’re here!).

Interest is a major factor when considering any sort of financing so understanding how a lender determines your rate is an important step to pay off your loan in less than 10 years.

What Determines HELOC Interest Rates?

When a lender determines your qualification there are several factors that influence what your rates will be: your income, debt-to-income ratio, credit score, home value, current equity and property type all play major roles in assessing your risk level and determining your rates.

Besides your personal finances, interest rates are also affected by factors in the market including: the Federal Reserve’s monetary policy, the bond market, the Secured Overnight Finance Rate, the Constant Maturity Treasury, the state of the economy, and inflation.

Rates increase in times of economic growth and fall when the economy is weak. Rates go up because borrowers can afford more in a bustling economy than in a downturn. Conversely, lenders will lower the interest rates to entice borrowers to take out loans during economic downturns.

People have flocked toward mortgages in the past is because they offer fixed interest rates with “fixed” monthly payments. This appeals to the stability we all seek.

But a mortgage(even with a low & fixed interest rate) will still force you to pay almost DOUBLE for a home…

Are HELOC Interest Rates Fixed or Variable?

HELOCs can have fixed or variable interest rates, (depending on the lender.)

Variable rates mean your rate could go up or down at different points in the HELOCs term.

Nearly all lenders offer the option to lock-in rates.

Locking-in your rate relieves any pressure of an increase in rates. And gives you peace of mind in case your financial situation changes over time. If the interest rates go down, one can always unlock the rate and capture a lower rate. It’s that simple!

The best part is, you don’t have to figure this out all on your own…

We’ve already done the heavy lifting for you!

By joining the Half Your Mortgage program you’ll learn how to pay off your home in just 5-7 years. And get access to your very own list of state-specific HELOC lenders with the best rates and terms and SO MUCH MORE.

But you don’t have to take our word for it…

Check out Hamilton’s experience. How many YEARS he was able to shave off his housing payments with the Half Your Mortgage program…

Wondering how monthly HELOC payments work? We’ll cover that in tomorrow’s email.

Until then… click the link to learn how to Half Your Mortgage today!

We’ll teach you how to… find out how much borrowable equity you have in your home, prepare your finances, compare interest on your mortgage versus a HELOC (so you know how much you’re saving), the exact features your line of credit needs to have to save you the maximum amount of money, find the best lenders in your state, lock-in the most affordable rates. PLUS…

As a student of Half Your Mortgage you’ll get access to our High Credit Secrets program for FREE, which will help you boost your credit score by 100 points in just 10 days & up to 720+ in 90 days or less. AND MORE!

Learn More About the Half Your Mortgage Program

Or if you’d rather speak to someone first…

You can also Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) we’ll run through the numbers with you using our proprietary software, see how much you’ll be saving in interest & determine YOUR EXACT PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.