Ever wonder what the debt collector/lender needs to provide in order to count as proof of debt validation?

Unfortunately, the law isn’t crystal clear about this…

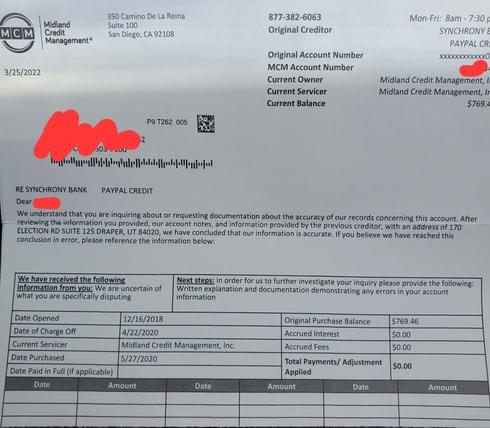

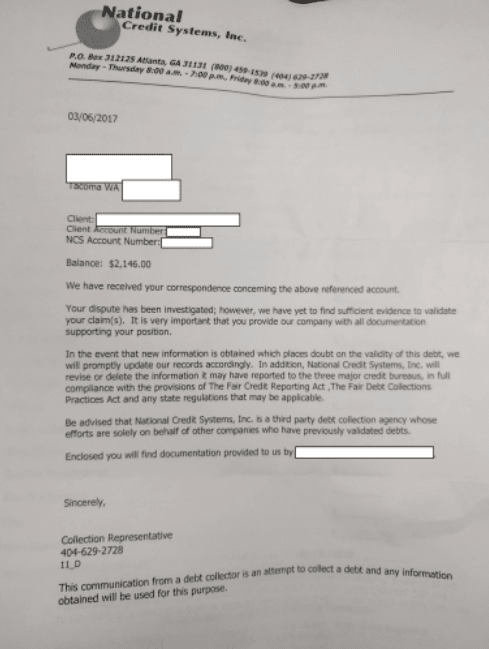

Which can often result in collectors/lenders repeating information that was previously provided to you.

While this can be frustrating, often times they think they are doing the correct thing (and it helps buy them more time.)

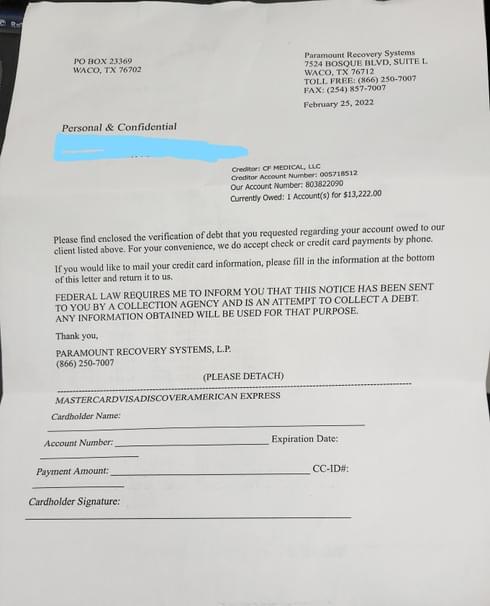

…or even something like this…

Debt Validation Rules

The CFPB’s Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) states that..

A debt collector must tell you…

the name of the creditor, the amount owed, and that you can dispute the debt or seek verification of the debt.

Even if you still want to pay the debt off – the truth is…

There are LOTS of debt collection scammers out there so asking to validate the debt, is protecting you from accidently paying the WRONG PEOPLE.

To be legally valid, your request for proof must be made in writing. A verbal phone request for debt validation is not enough to protect your rights under the FDCPA.

In your debt validation letter, you can dispute the entire debt, part of the debt, or request the name of the original creditor.

*If you have to file a lawsuit against the debt collector, the certified and return receipts will help strengthen your case.

Once the debt collector receives your validation request, they cannot contact you again until they’ve provided you with the proof you’ve asked for.

Is Repeating Initial Information Provided, Considered A Debt Validation Response?

In Chaudhry, the Fourth Circuit Court of Appeals ruled that…

verifying a debt “involves nothing more than the debt collector confirming in writing that the amount being demanded is what the creditor is claiming is owed; the debt collector is not required to keep detailed files of the alleged debt.”

But since we are asking for ‘validation’ of the debt…

In reality, the answer is no.

Allowing a debt collector to validate a debt by merely repeating the information in its initial communication would be the same as allowing the collector to say “because I say so.”

It would be redundant & contrary to the language in 1692g(b) and would render that subsection meaningless.

Once you mail off your validation request letters and the debt collector sends you back a letter (probably including a statement or bill of “what you owe”), don’t get discouraged.

This is to be expected. So time to send off the next letters.

Remember, they’re going to supply some sort of ‘certificate’ such as a statement or bill as verification that you owe debt.

But that is not sufficient evidence to validate the correctness of debt(that the debt actually belongs to you, that the amount is actually correct, etc.)

All you’re doing from this point on is getting it across to them that THEY broke the rules which means you’re debt is invalid.

What Types of Debt Does This Work For?

Personal, medical, bank loans, credit cards and MORE.

This process works for personal, family and household debts are covered under the FDCPA. This includes money owed for medical care, charge accounts, and credit cards.

Don’t worry, we’ve got everything you’ll need…

Simply customize the documents, print & mail!

Just remember debt removal is a time-sensitive process.

The longer you want – the more effort it will take…

Why wait?

Aren’t you ready to start getting rid of the debt TODAY?

Learn how Debt Removal Secrets can set you free.

Want a sneak-peek inside Debt Removal Secrets? You can look forward to this and more in tomorrow’s email.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.