Have you been wondering how to increase your chances to get approved for business credit?

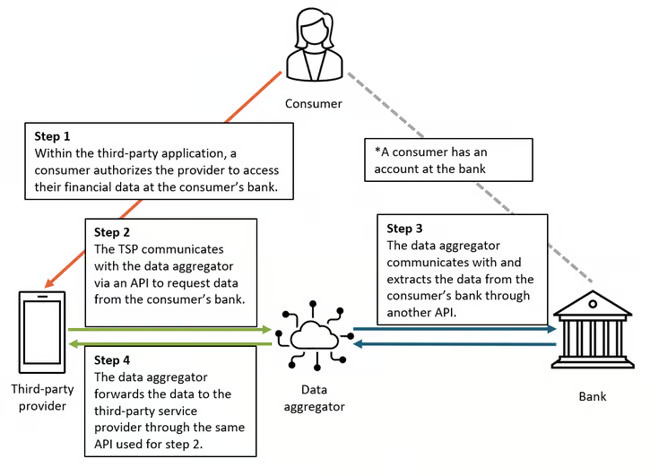

Do you know where banks and lenders get their information from?

While much of the data banks use is voluntarily provided by you (when opening an account or filling out an application), there’s data they use to check that this information is in fact correct.

You may not know this, but banks and underwriters often share the same databases with each other.

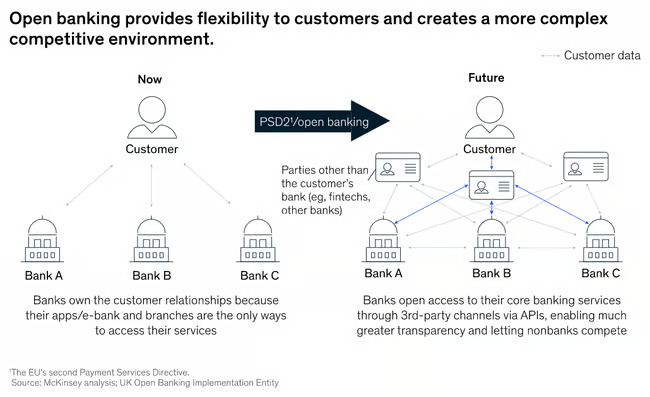

As open banking continues to grow and evolve…

it’s going to be a LOT harder for you to get approved for business credit.

Especially with large banks like Chase which do automated checks.

For example: large national banks are often a part of the Small Business Financial Exchange (SBFE).

Who are some of these SBFE certified vendors?

Bank of America, American Express, Dun & Bradstreet, Equifax and Experian are just a few out of the hundred of vendors in the Small Business Financial Exchange.

We cover more hidden credit databases like this in even more depth inside our Corporate Credit Secrets program.

Not only will our proven process speed up your business credit approvals, we’ll also show you how to secure $100,000+ in 6 months or less…

Learn More About Corporate Credit Secrets

If you still have some questions about the program, we do offer a

FREE 15 minute phone consultation which you can book HERE.

Watch out for our post tomorrow -we’ll show you the hidden credit score (you’ll never actually see) that can affect certain loan approvals.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.