Have you ever heard of a bank rating?

A bank rating is an internal credit score that’s only available to large national banks. This is not a credit score you’ll ever see. It’s only available for banks to help them determine how fiscally responsible your company is based on your banking habits.

How does the bank rating scoring system work?

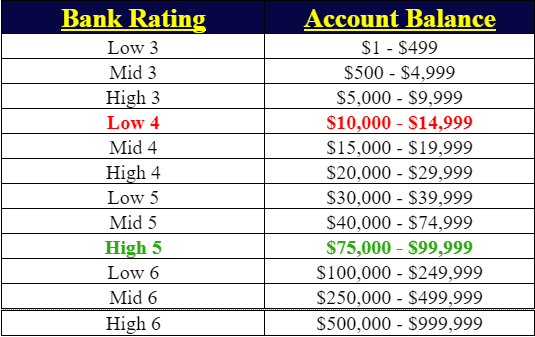

Bank ratings on a 3-6 scale and is mostly comprised of your average bank account balance over a 90-day period. *Going below a low 4 will generally lead to denials.

How Is A Bank Rating Score Calculated?

Here are the factors that go into calculating a bank rating score:

- how you manage your business bank account

- amount of money in an account (one of the heaviest weighed factors)

- how long you’ve had the account open

- how many account & types of accounts

How Can One Boost Their Bank Rating?

- Make sure you don’t overdraw!

- Have consistent deposits

- Maintain a positive monthly balance

- Keep a minimum of $10,000 in the account

- Use multiple bank products (i.e. different types of account, etc.)

When are Bank Ratings Used for Decision-Making?

Bank ratings aren’t really used by alternative or FinTech lenders.

Now you know the first thing to do in that 90-day window before applying for a loan.

If you want more tips like these in an easy-to-follow, step-by-step program proven to help you access business credit faster – Get Corporate Credit Secrets

We’ll show you all the credit tips we’ve learned over the years that can help even startups access $50,000-100,000+ within 6 months or less…

Learn More About Corporate Credit Secrets

Worried what might happen to corporate credit when a recession hits? That’s exactly what we’re covering in tomorrow’s post so keep an eye out!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.