Trying to get business credit in high risk industry?

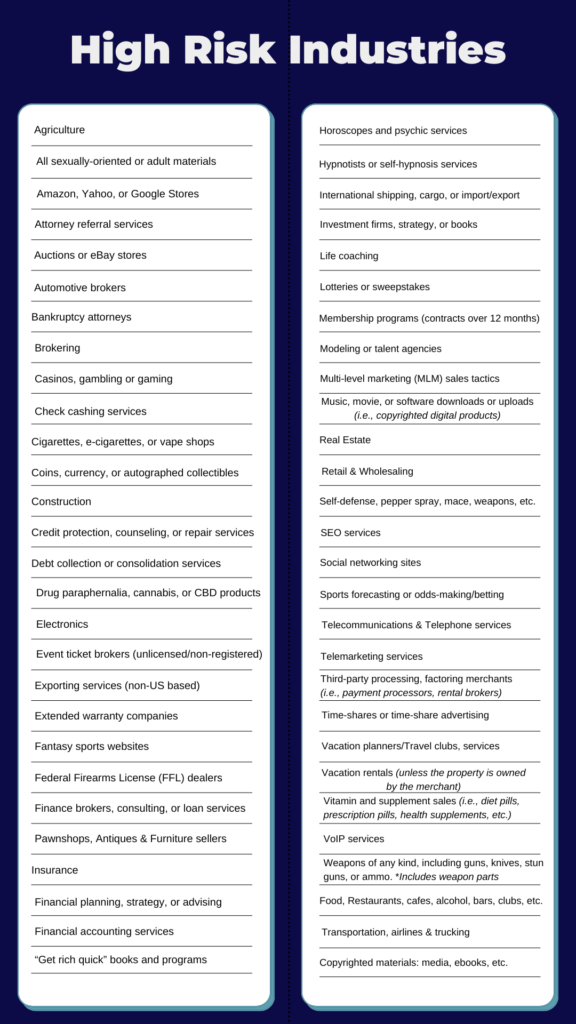

Did you know, that simply being in the ‘wrong’ industry can lead to automatic denials?

Even if you have an excellent credit score – if your business appears to be in a high risk industry, it’ll be tougher to get lenders to approve you (with reasonable rates at least anyway.)

Follow these tips if you’re looking to get business credit in high risk industry.

Here are the major reasons why certain industries are considered higher risk to lenders…

1.Changes in legislation: Industries related to alcohol and firearms are considered extremely high-risk due to its precarious relationship with the law. Regulations for these industries can change often and as a result, can lead to higher business costs and lower profits.

2.Inconsistent revenue: The seasonal aspects of certain industries leads to varying revenues which can make business revenue consistent. Profits for these industries are unpredictable and banks are often wary to give loans for these types of enterprises.

3. High Amount of Refunds/Charge-backs: Certain industries such as clothing and retail stores can come with a higher percentage of refunds or charge-backs which can also be seen as a higher risk.

4. Too many competitors: Places like nail salons, pizza places, and gyms seem to be on every corner – meaning more competition. In order for these businesses to succeed, they have to provide a better alternative than the others like lower prices or more amenities. Banks are hesitant to give loans to business if there’s several competitors in close proximity due to lower profits and potential failures.

5. Potential Fraud: certain businesses(like crypto mining, online stores & telecommunications) can be more prone to fraud than others.

6. Dying industries: Technology is constantly changing and many industries have turned digital while making others obsolete. No lender wants to make an investment in a venture that may disappear in a couple of years.

If you happen to be in a high-risk industry, don’t worry – that doesn’t necessarily mean you’re not able to get business credit or financing.

What to do if you’re seeking business credit in high risk industry..

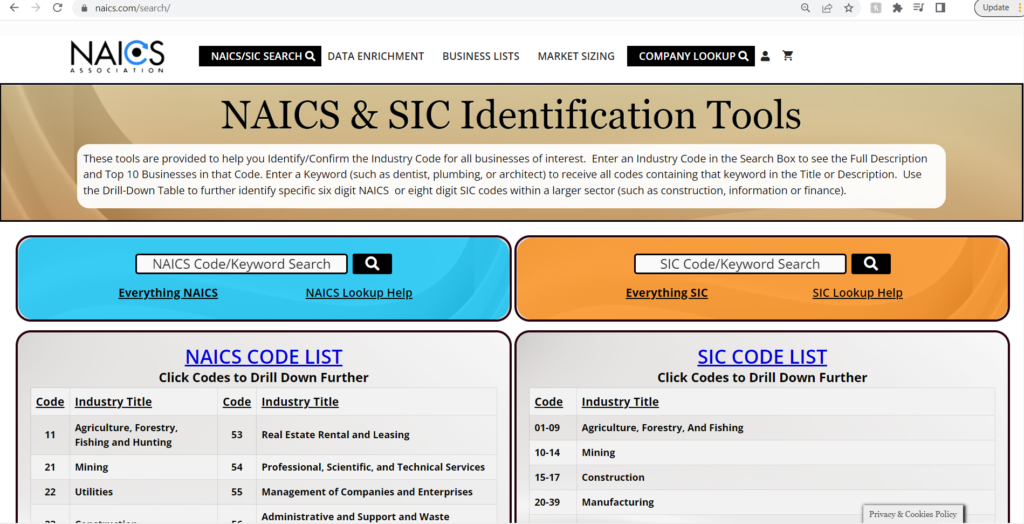

On a credit application, lenders will first see your business name then they’ll look at your NAICS/SIC code to see what kind of industry you’re in.

1) Choose a Less Risky Sounding Business Name

Your company name could be causing you denials… If you’re in real estate, and your business name is Miller Realty – you’ve made it pretty clear to lenders you’re in a high-risk industry just by seeing your company name. However, by choosing a less obvious name, like Miller & Sons Inc. you can actually appear less risky to lenders and increase your credit approvals.

But this alone won’t be enough. You’ll also need to…

2) Choose less risky NAICS & SIC codes

In case you don’t know, NAICS & SIC codes are numbers that the government assigns to businesses.

The SIC code

The Securities and Exchange Commission (SEC) developed the SIC Code system. The first four digits signify the general industry of a business. For example, 8711 refers to Engineering Services. Then, numbers add to the end of this 4 digit chain to add specificity. *SIC codes are also used by the IRS. They will use it to determine if your business tax returns are comparable to other businesses in your industry.

The NAICS code

Was developed in conjunction with the U.S., Canadian, and Mexican governments and work the same as SIC codes.

You get to choose your code. While you want to be honest, you can still be vague. You do not have to be more specific than necessary.

For example, software is risky, but if you also sell consulting, you can use a SIC code for that. If more than one SIC code can represent your company, choose the one that is the least risky to lenders. There is nothing unethical in doing so.

One final thing you can do to set yourself up for approvals when getting business credit in high-risk industry is to get your finances in order…

3) Lower Your Debt

Lenders want to lend to borrowers who will pay them back. If you can prove you’re a responsible borrower with currently low credit utilization, they’ll be more likely to approve you than if your credit utilization is high or maxed out.

Names, codes and credit utilization aren’t the only important factors to lenders. For more details on choosing the right code for your industry & quickly becoming a high-fundable company that will help you get business credit faster – get the Corporate Credit Secrets program.

Whether you’re in a low-risk, mid-risk or high-risk industry…

We’ve designed this program to help you quickly become a fundable company and get access to $50,000-100,000 in business credit in 6 months or less…

Learn More About Corporate Credit Secrets

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.