Have you ever wondered what types of credit and business financing are available for a company like yours?

We’ve shared a lot of the benefits of having strong corporate credit and today we’re going to discuss the types of business financing that are available to you.

There’s no definitive answer to state the “perfect” type of funding because that will depend on multiple factors such as:

Your credit history, how you plan on using the funds, the strength of your business and finances. In actuality there are hundreds of different types of credit (if you include the various types of credit lines and loans available) much more than we could ever hope to cover here.

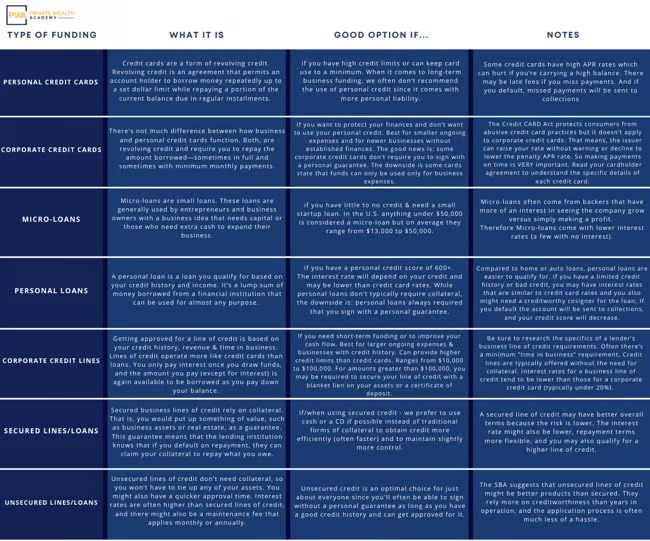

Here’s a chart with the most common types of business financing (right-click + save the image below to enlarge it), what they are, what makes them a good option and some important notes about each type to help you better understand which ones may be right for you.

In the meantime, we want to share a few general tips to help you better understand your options and how to get the best rates.

Business Financing Options Chart:

Secured vs. Unsecured Business Credit

Secured Business Credit means you are putting up assets such as inventory or property as collateral. If you fail to pay back the credit line, a lender can seize your assets to make their money back. Using cash or a CD (Certificate of Deposit) is less risky if you have the funds and can sometimes be used in place of collateral.

Unsecured Business Credit doesn’t require collateral, but typically lenders will still require a personal guarantee (always required for personal credit.)

A personal guarantee (is something we ALWAYS try to avoid when possible), it gives a lender the right to go after your personal assets, such as a house or car, if you default. A lien is similar; a lender can seize your business assets if you haven’t repaid the borrowed amount.

Tips When Getting Business Financing & Credit for Your Company:

- Do your due-diligence. An hour or two of research could save you LOTS of wasted time & money down the road… The internet is an amazing thing – use it to your advantage.

- Make sure you fully understand any requirements & terms of a lender’s agreement. Every lender and type of financing has its own requirements as well as terms and conditions. As a borrower, it’s your responsibility to know what you’re signing and that you can meet said terms.

- When in doubt – ask questions. What is the interest rate? How often will you need to make payments? How long is the term of the line? Are there prepayment penalties? Is there flexibility to choose monthly or weekly payments?

- *In the event of a loan, ask if there are any fees or potential penalties (for example: if you want to pay off the loan early.)

- Alternative & online lenders tend to have slightly looser qualification requirements.

- If you miss payments your interest rates may increase.

Need Help Getting Business Financing & Credit?

Inside the Corporate Credit Secrets program we’ll show you how to build corporate credit using all types of financing including: micro-loans, credit cards, credit lines, varieties of secured, unsecured loans and more (even if you’re a startup.)

As you’ll see, there are different requirements and purposes for each type of credit. By strategically utilizing different forms of credit you’ll not only be building a stronger, well-rounded credit profile, you’ll also be able to take advantage of the unique benefits that come with each one.

Corporate Credit Secrets helps you establish excellent corporate credit in a strategic way. Reducing the time it takes to get approved for high limit credit.

Learn More About Corporate Credit Secrets

Loans on your mind? Loans can be great but they can also be a burden if you’re not ready for them – tomorrow we reveal what you need to know before applying for loan no matter what stage your biz is in.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.