Have you been considering using a HELOC for Debt Consolidation?

How much debt is your household carrying right now?

If it’s A LOT (like $50,000 or more) – you’re not alone…

Many households are carrying significant debt nowadays (between mortgages, personal loans, credit card balances, student loans, etc.)

In fact, the average American has $90,460 worth of debt. If that weren’t bad enough, interest rates are sky high right now.

If you’re looking for a way to reduce your debt burden, you have more options than you may realize…

Debt consolidation is one of the most popular uses of a home equity line of credit. Here are a few reasons why so many choose to go this route…

►HELOCs Offer A Lower Interest Rate

Since you’re using your home as collateral, HELOC rates are significantly lower than credit card rates, auto loan rates, and personal loan rates. The lower your interest rate, the more money you’ll free up each month to pay down the balance or put toward other financial goals.

►A Home Equity Line of Credit Streamlines Payments

Recent data shows that the average American adult owns about four credit card accounts.

If you have multiple credit cards or several other loans, you can consolidate all of them into one HELOC. That means you only have one payment to keep track of each month. Make it even easier on yourself by signing up for automatic payments for at least the minimum amount, so that you’ll never miss a payment.

By using a home equity loan or HELOC, you can pay off multiple balances and clear a number of debts. You’ll also then only need to worry about repaying your one home equity loan on its due date.

►HELOCs Offer Incredible Flexibility

We always recommend you make principal payments during the draw period, so you’re able to pay the least amount of interest (and pay off the balance as fast as possible.) However, you do have the option to make interest-only payments during the draw period if you get into a tight financial situation. Also, no other financing option offers this level of flexibility.

►Consolidating Debt to a HELOC Can Boost Your Credit Score

Having high credit card balances relative to your limits can hurt your credit score. Reducing those balances by paying down that debt with a HELOC will also improve your credit score.

►A HELOC Provides Future Borrowing Power

As long as you pay down the balance, you’ll continue to have access to funds if you need them for the duration of the draw period. That means you have options to avoid more expensive means of accessing funds, such as new credit cards, personal loans, or borrowing against your retirement accounts.

Will the amount of debt that I have impact my ability to get a HELOC?

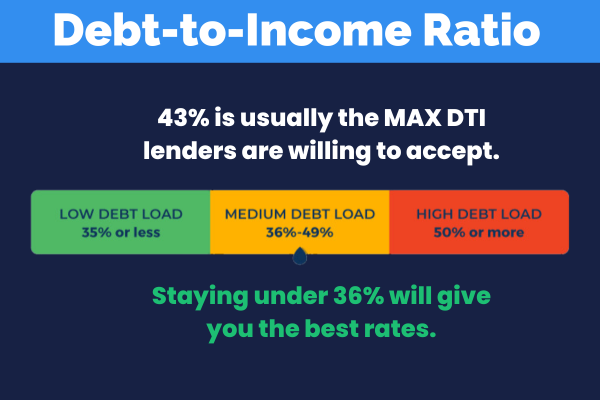

It might. Remember lenders will also always check your debt-to-income ratio. Some may accept a ratio as high as 50% but this is rare. Ideally lenders like to see DTIs less than 43%. Typically having high debt will simply reduce the amount you get approved for and also increase your rates.

Everyone’s situation is different. If your main reason for wanting a HELOC is for debt consolidation purposes, compare interest rates and also see how much you’ll be saving (and how much faster you may be able to pay it off.)

Run the numbers – they’ll tell you what to do.

You should also figure out if a home equity line of credit will cover your total debts. If it doesn’t, perhaps you decide to pay off your highest-interest debt first.

Being able to pay off your debt twice as fast at HALF the interest rate can end up saving you a lot of money.

Here’s how homeowners can use a HELOC to consolidate their debt:

1. Calculate All Your Debts. Get a rundown of ALL your debts – from credit cards, to loans, to medical bills, to student loans to alimony and/or also child support payments. Write it all down.

2. Calculate Your Home’s Equity. Before you can borrow against your equity with a line of credit, you need to know how much equity you have. This number represents your home’s value minus any debts against the property, such as your mortgage loan balance.

3. Consider Your Credit Score. In many cases, you can also get pre-approved from various lenders without impacting your credit or submitting a formal application. A higher score often generates better interest rates.

4. Compare Lenders. Compare the HELOC offers you receive, including the amount you can borrow, the draw terms, closing costs, fees, and also the interest rates. HELOC interest rates are variable, which means that they can also change over time.

5. Choose Your Lender And Apply. Once you know which lender will give you the line of credit you need at the right price, it’s time to apply. Gather the necessary documentation (W-2, pay stubs, bank statements, and more) to show that you meet the lender’s income, debt, and other requirements.

6. Close & Begin Drawing Against The Line Of Credit. A HELOC is an open-ended, revolving credit account, similar to a credit card. You can draw from those funds as needed to pay off different debts. Once you borrow against the HELOC, you’ll need to make payments until the amount is satisfied.

Whether you’re using a HELOC to consolidate your debt, free up your cash flow or simply want a proven way to pay off your property in as little as

3 years – the Half Your Mortgage program is the path to get you there.

We’ll show you how to secure the right type of HELOC (ideal for debt consolidation purposes.) This type of financing is easier to get approved for than debt consolidation loans, offers lower interest rates, only charges you interest based on the amount you use, comes with super-flexible repayment options and the ability to withdraw funds for 10-15 years, making it a great solution if you have a large amount of debt to pay off.

We’ll teach you the exact criteria to look for, how to prepare your finances, how to calculate the interest & payments, put you in touch with the right HELOC lenders, how to lock-in the best rates and MUCH MORE!

Unless you’re scared of saving money – there really is no better time to start – click the link below to get started on your HELOC journey TODAY.

Learn More About the Half Your Mortgage Program

If you’re not ready just yet…

Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE! Click the link to schedule a call now.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.