Not a homeowner yet?

Or looking to put a down payment on another property?

Wondering if you can use a HELOC for down payment?

Finding the funds to put a down payment on a home in today’s economy can be challenging to say the very least. For many, the size of the down payment required to purchase a property can be enough to prevent the sale. This doesn’t have to be the case for you though…

A first lien HELOC is a line of credit and mortgage in one.

It works by replacing your existing mortgage, taking over as first lien or first mortgage. But unlike a traditional mortgage, it also works like a checking account, similar to a home equity loan.

That means you’re able to apply direct deposits to the loan principal — reducing the interest & loan term. You can also withdraw cash for the duration of the draw period (10-15 years).

“Can I use a HELOC for down payment?“

Yes, you can use a home equity line of credit to either subsidize or completely pay the down payment on a home. Working as home financing and personal banking combined into one financial tool.

First, you’ll need to get approved…

Lenders may have a few specific requirements for borrowers who use a first lien HELOC for a primary residence purchase or down payment.

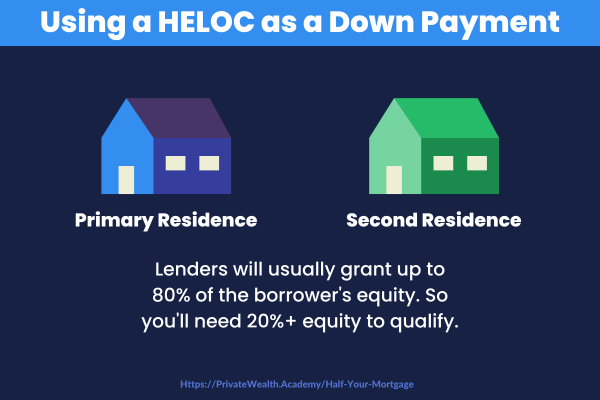

For a primary residence, lenders typically grant up to 80% of a borrower’s home equity. Meaning you’ll typically need at least 20% equity to be eligible.

To determine your home’s current value, your local realtor can evaluate your property in an appraisal. A real estate agent can calculate your home equity by finding its current market value. Then, they’ll subtract any outstanding loan amounts from it. These outstanding loan amounts include your current mortgage and any other loans supporting it.

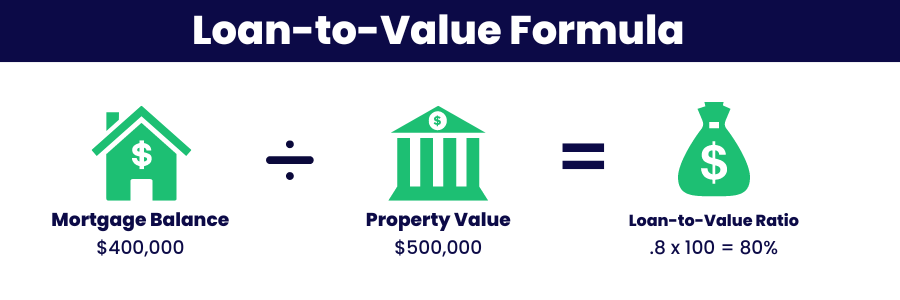

Loan-to-Value Ratio

Although your realtor calculates the appraised value, it may differ from the real estate purchase price. That’s why lenders compare these two values, which produces the loan-to-value ratio. Dividing the loan balance by the appraised value shows you an exact comparison. Loan-to-value ratios are helpful for both you and lenders and because it calculates the loan risk.

The more equity you have, the less risk you’ll carry.

Debt-to-income Ratio

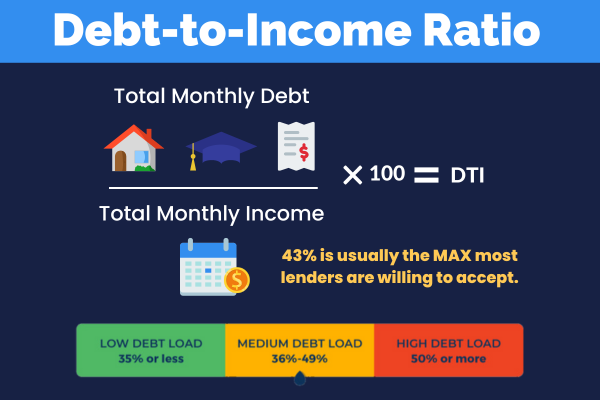

Lenders also calculate your debt-to-income (DTI) ratio, which estimates your borrowing risk. It also shows how much borrowers can manage along with their other outstanding debts.

Although lenders may accept a DTI ratio up to 43% – as a rule of thumb, it’s good to keep your DTI ratio under 36%. Mortgages that occupy a majority of your debt can also skew this ratio.

Besides your home loans, your debt-to-income ratio is a total of all your debts. This includes: credit cards, auto loans, insurance, student loans, plus – alimony or child support payments.

Credit Score

Your credit score is also a significant factor for approval. Each lender has their own credit score requirements. However, scores in the high 680s-700s are a standard benchmark for borrowers looking to buy a house. Boosting your credit score before applying for a HELOC can increase your chances of approval and lower your interest rate.

Aren’t you ready to stretch your purchasing power?

A HELOC can help you do just that – especially when buying real estate. If you’re wondering whether or not using a HELOC for a down payment is the right move for you depends on your current financial situation.

Here are some tips to help you decide…

It may not make sense to use a HELOC for a down payment if:

- You have an ultra tight budget and will struggle to make payments.

- Your home lost SIGNIFICANT value from when you first bought it.

- You haven’t paid off your primary home, want to invest in another home, but don’t plan to sell or rent it out.

Using a HELOC for a down payment can make sense if:

- You have at least 20% equity in the property.

- Your credit score is 620+ and your DTI ratio is below 43%.

- You can comfortably make payments.

- You’ll generate income from the home by selling or renting it out.

- You’re purchasing a second home.

If you’re wondering about using a HELOC as a down payment for an investment property, we’ll be going into detail about that another day.

Whether you’ve just bought a home, are looking to buy another, want to pay it off in record time or you just want an affordable form of funding…

A HELOC is just the tool to get the job done!

The Half Your Mortgage program can help you get started TODAY!

We’ll show you how to find out how much equity you can borrow, how much you’ll be paying in interest & payments, how to find the right HELOC with little to no closing costs & low fees, the right questions to ask lenders, how to get approved for the best rates and so MUCH MORE!

Learn More About the Half Your Mortgage Program

Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE! Click the link to schedule a call now.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.