Looking to break into the real estate investing game? (Or take your current investments to the next level?)

If you’re going to use a home equity line of credit for anything, put it into a sound investment. Unused equity is, after all, dead money that could be better utilized by working for you.

Stagnant equity isn’t giving you any interest or return on investment (ROI).

Real estate investing is one of the best ways to achieve financial freedom. This is because you’re owning a real asset, creating “passive income” and increasing your cash flow.

Using equity to buy an investment property is one of the best ways to use equity.

- You can use the equity from 1st or second home to help pay for another.

- Any money you put into the home will further increase your equity (which will put you in a good position when opening future HELOCs.)

- You can easily use the proceeds of the rent or sale to pay off the HELOC loan

Which is why a HELOC is a real estate investor’s best friend. Especially, for those looking to purchase properties for fix n flips or long-term rentals. HELOC funds can also be used to fund home improvements for investment properties. Just as you would for a primary residence.

The great thing about long-term rentals is – they’re a performing asset.

A performing asset is one that puts cash in your pocket every month.

Your primary home is NOT a performing asset unless you were to rent out a room, for example. However, most of us aren’t looking for a new roommate, so what’s the next best option?

Using a HELOC to invest in another property that you can rent or sell.

This allows you to borrow from your existing equity without having to sell your home or have your money tied up in mortgages.

Unlike home equity loans, a HELOC allows you to withdraw and pay back funds as needed and only pay interest on the amount you use. Which is perfect for investors that have on-going or variable costs.

As long as you meet other necessary requirements, 15-20% equity can get you approved for a HELOC that you can use as a down payment on an investment property. Pretty cool, right?

The question is – should you use all of the equity in your home to pay down your primary mortgage or should you use it to invest in another property?

That’s a great question to ask.

While we can’t tell you what’s best for your situation, run the numbers – see what makes the most sense.

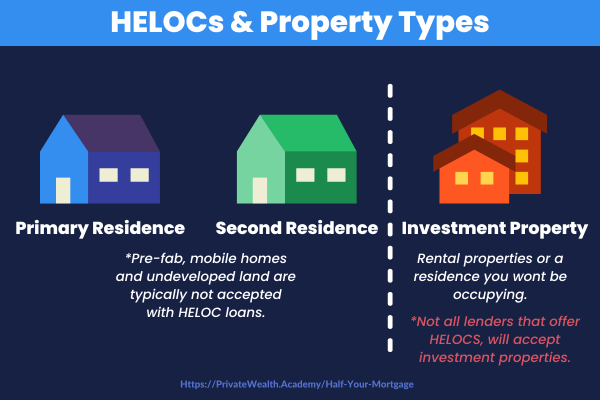

Also keep in mind that it may be slightly harder to qualify for an investment property HELOC than one for a primary or secondary residence.

So if you have low equity, a high debt-to-income ratio or your credit history isn’t the best, the more conservative choice may be to make paying off your primary home the first priority.

Some students with lots of equity choose to put half of the HELOC toward the principal of their primary home payments and use the remainder as a down payment on a new property.

If you choose to put more money towards investing, make sure you’ve done your homework, have a timeline planned out and an exit-strategy to be able to rent or sell the property quickly.

The other thing about using HELOCs for investment properties is that lenders can be harder to come by. Don’t worry, we’ll still point you in the right direction inside the Half Your Mortgage program. But for now just know that it’s best to start with your local credit union or nearby regional bank.

They will offer the best rates and be familiar with the real estate market in your area. Often you will receive a very low introductory interest rate that big banks simply can’t offer. A local bank will also have a better assessment of the neighborhood than a national bank would.

“Can I take out a HELOC on one of my fix n flip or rental properties?”

Possibly. There’s a lot you should know before doing so. Not every bank will allow owners to take out lines of credit on investment properties. There are VERY FEW lenders that allow rental properties due to the high risk.

Using a HELOC to purchase real estate is a smart way to make your equity work for you. Leveraging the equity in your home to finance real estate investment properties makes your home a partially performing asset that will bring passive income over the long term.

This is what successful real estate investors do…

Increasing their net worth with every new property they purchase.

If you’ve ever wondered how investors are able to acquire multiple properties so quickly without going underwater…

THIS IS HOW THEY DO IT!

Not only are you able to use the equity you’ve built up in your primary home to your advantage, you can put the funds where it counts most to exponentially increase your wealth, credit score, and investment portfolio.

The equity in your home is there whether you decide to use it or not.

Now that you know an affordable financing tool that will help you pay off the property in HALF THE TIME (at nearly HALF the cost), why not jump on the opportunity?

If you’d like help finding the right HELOC lender for your investment property we can help you do that…

The Half Your Mortgage program will teach you how to find the best HELOC lenders for your investment properties, the exact criteria to look for, how to prepare your finances, how to calculate the interest (so you know how much you’ll be able to save), how to lock-in the best rates and pay it off in the FASTEST time possible and so much more!

We’ll even teach you a few of our favorite real estate investment tips and a HUGE banking secret so you can secure a 12% ROI year after year! Click the link below to learn more about using HELOCs for real estate investments.

Learn More About the Half Your Mortgage Program

You can Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE! Book a call TODAY!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.