How soon do you think we’ll officially enter a recession?

Wondering what will happen to business credit during a recession?

Business owners across all industries are concerned. 8 in 10 owners surveyed in CNBC Small Business Index Q2 2022 said they expect a recession to happen soon.

You can’t predict with certainty when a recession will occur. You also can’t predict exactly how long it will last or how it will affect your business. But you can prepare. The first step: is educating yourself on the signs to lookout for.

What happens to business credit during a recession?

A recession is defined as a significant and widespread decline in economic activity. Based on what happened to business credit during a recession in ’08 recession, here’s how that might affect commercial lending:

♦ Credit requirements may increase: When economic uncertainty is high, lenders may become more cautious, raising their credit qualifications. If you don’t have good business credit history, it might be harder to get approved for a loan during a recession.

♦ Interest rates usually decrease: Interest rates tend to reduce for business credit during a recession. The Federal Reserve lowers rates in an effort to stimulate or stabilize the economy by making it more affordable to get a loan. One or two corrections are often enough to accomplish the job. But when prime interest rates are dropped several times in a relatively short period of time, then that is a bad sign.

♦ Banks may restrict lending: When an economy starts to slow down, banks will often react by reducing the amount of regular lending they will do for small businesses. When the bottom fell out in 2008, it was after at least 12 months of news stories about how reluctant banks were to lend operational funds to small businesses. In most cases, a recession will hit small to medium sized businesses first, and then moves up to large corporations.

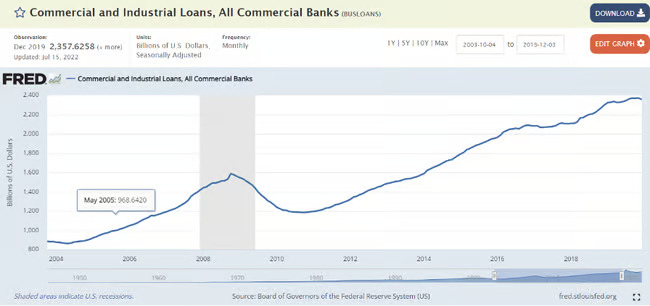

The chart below shows what can happen to business credit during a recession.

You can see the gray area was the official recession.

♦ Lenders may process fewer loans: For a variety of reasons, lenders might end up processing a lower volume of loans during a recession. Traditional financial institutions like banks may not want to approve long-term loans at hyper-low interest rates.

BUT THE GOOD NEWS IS – YOU WON’T BE OUT OF OPTIONS…

There is still business credit during a recession!

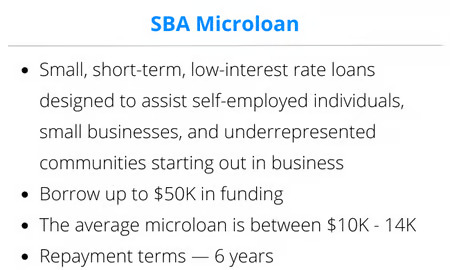

♦ Look to Alternative Lending Sources: Traditional banks and small business lenders will likely restrict their lending during a recession. But, the Small Business Administration (SBA) has a program called the SBA Microloan Program.

There are hundreds of SBA Microlenders across the country that are non profit organizations. They receive government grant funding to support small businesses that are not able to get a loan at a traditional bank. So if you get turned down by a bank, you can search for an SBA Microlender in your area.

The Corporate Credit Secrets program will help you get business credit during a recession and during good economic times. The methods we show our ever-green regardless of the current economic climate.

Interested in SBA loans?

They can be tough to qualify for. Luckily the Corporate Credit Secrets program will take you step-by-step through a proven process to help you establish excellent business credit so you can get approvals & higher limits much quicker.

So when is the best time to get credit for your business?

NOW! But the real answer is – before you think you need it.

“Business owners who want financing like a line of credit should consider getting it before they actually need it. If they wait until they get that large order and they need the line of credit to produce it, it’s going to be harder to go to the bank and ask for that money at that time and get it turned around quickly.” Says Shauna Huntington, from the NAWBO Institute of Entrepreneurial Development.

5 Good Reasons to Get Business Credit Now

1) You don’t know how long the recession will last. The average recession lasts 6 to 12 months according to CNBC but you never know whether this time is different. It would be dangerous to assume a 6 month downturn and then end up with a 24 month downturn. Extra cash gives you a longer runway to survive.

2) You’ll Need Extra Capital. It’s always smart to invest in your business’s growth, but it’s especially crucial ahead of a potential recession. If you don’t have enough capital going into a recession and you see a slow down in your business you might have to start cutting staff or budget items that you really don’t want to cut and that will set you back strategically in your business.

3) More Credit = More Options. When the economy slows down, you need to be able to adapt. For example, with a business line of credit, you can access funds whenever you need to without scrambling or tying up all your available cash (and only pay interest on the fund you use.)

4) Lower Interest Rates. If you apply for business credit sooner rather than later, you could end up saving a lot of money in interest payments, especially if you get a fixed-rate offer.

5) Good Business Credit = More Approvals. Give your business the best chance of surviving the upcoming recession by becoming a highly-fundable company and establish excellent business credit. A higher business credit score means a greater chance of getting approved for credit offers—and getting more favorable terms. Having a stronger credit score can open the door to more financing options, even if credit requirements tighten during a recession.

Why wait?

We’ll teach you a proven system to establish business credit the right way so you can secure high amounts of funding for your company quickly.

Learn More About Corporate Credit Secrets

Want a list of recession-proof lenders? Lookout for our post tomorrow – we’ll show you how to get your own personal list!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.