Have you ever been so engrossed in a project that’s all you could think about until it was finished?

That’s how Carlton felt when he initially found out that a conventional 30-year mortgage isn’t the best option when financing a home. And neither is a 10 or even 15-year mortgage!

There’s also an even better solution…

A HELOC (Home Equity Line of Credit)

What is a HELOC?

A Home Equity Line of Credit (HELOC) works like a credit card linked to your home’s equity. You can borrow money up to a certain limit using your home as collateral. You also only need to repay what you borrow, with the flexibility to choose how quickly you pay it back. Interest rates are often lower than other loans or credit cards, but just like a mortgage – if you can’t repay, you could risk losing your home. As long as you make more than you spend each month, it’s a great way to tap into your home’s equity so you can use the money for whatever you need.

If you’ve been keeping up with our emails, you know that all mortgages are basically scams. After dinner with the banker, a glass of wine with a friend and many months of research, Weiss finally had a HUGE epiphany…

He realized that all that truly matters is…

…how the interest is calculated!

That’s what makes ALL the difference.

Lenders use different ways to calculate interest across loan and credit products. Turns out, the way the bank calculates your mortgage interest compared to Home Equity Lines of Credit interest is VERY DIFFERENT…

leaving you with an opportunity to SAVE BIG!

After MUCH math & also research, Weiss came to understand that how much one pays in mortgage payments and how long it takes to pay off – all boils down to how one is making their mortgage payments.

A HELOC is like a credit card, with the interest calculated on the Average Daily Balance. If you do some math, you realize that if you pay down your principal faster than a typical amortization schedule, you end up saving an ENORMOUS amount of interest.

While that itself isn’t revolutionary, the flexibility of a HELOC is just that!

Every dollar paid towards the principal in a HELOC is 100% liquid and able to be withdrawn like cash in your bank account. No mortgage can ever do that!

That’s how we began to see how incredible HELOCs are!

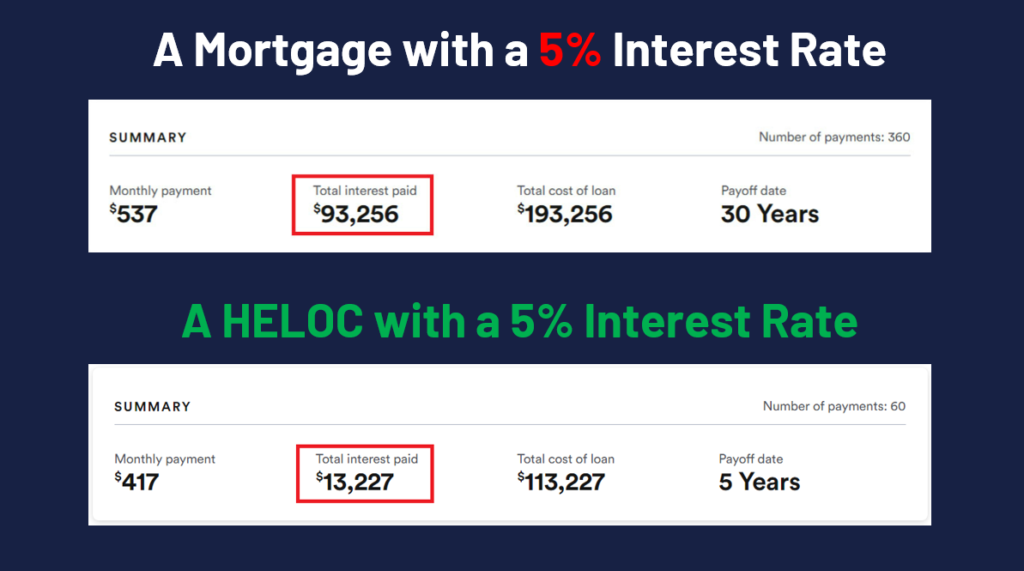

With a traditional mortgage at a 5% interest rate…

For every $100,000 the bank loans you – you’re paying them $193,000!

That’s $93,000 you’re paying IN INTEREST ALONE!

That means you’re paying almost 200% for a home! Isn’t that insane!

With a HELOC for every $100k – you’re only paying ~$13,000 in interest.

How’s that for savings? (We’ll be breaking down the math in coming days.)

You wouldn’t pay 200% for almost anything else – so why for a house?

How the interest is calculated is the difference between you paying off your home in 15-30 years or 5 years.

Pretty incredible isn’t it? How they get us all to pay 200% more for the most expensive asset we’ll ever own…

By simply changing the bank account you keep your money in, a HELOC will help pay down your principal balance much faster than you ever thought possible! As anti-climatic as it may seem, this is the truth.

While paying off your home in 5-7 years may seem like a dream come true – it gets even better…

Weiss also discovered MANY hidden benefits of HELOCs that make this alternative form of financing even more attractive.

In tomorrow’s email we’ll share the BEST benefits we found…

Until then, if you haven’t had the opportunity to watch the entire Half Your Mortgage workshop yet, take a moment for that now. It’s an eye-opener!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.