Ever wonder what’s considered good business credit?

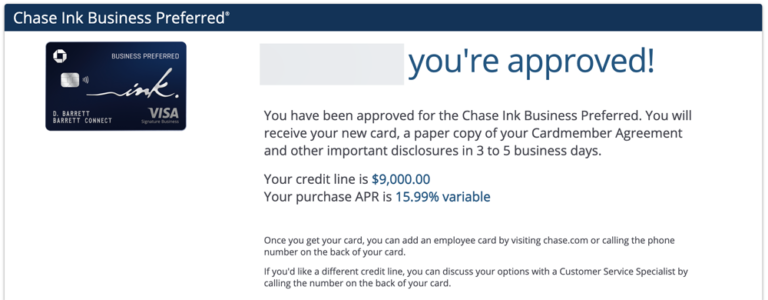

Yesterday we shared what Samantha was able to do with Corporate Credit Secrets – securing well over $100,000 in as little as 9 months!

So what was the secret behind her rapid success?

She followed our instructions on the 3 C’s & how to establish strong business credit the right way that shows she’s a favorable borrower to lenders.

What are the 3 C’s of Good Business Credit?

Character. Capacity. Collateral. Those are the big 3’s lenders are looking for.

One could define ‘Character‘ as your financial reputation (or the info that shows on your credit profiles). For example: how well you pay your bills, current credit utilization, how long you’ve been in business, how long you’ve lived at your current address, banking & credit history (even public records like your legal history.)

Capacity (or cash flow) represents the borrowers ability to repay the lender. By analyzing bank statements, company revenue, P&L statements, etc. lenders are able to calculate how much the borrower can comfortably handle.

Collateral are assets that help to secure a loan. This may be necessary if the lender deems you a higher risk or your cash-flow is low. Savings, real estate, inventory, accounts receivable, and equipment are acceptable collateral assets. *The lender is concerned only with these types of assets, because in the event of insolvency, they can be sold or collected to generate funds to pay the loan.

Inside Corporate Credit Secrets we show you how to properly fill out your credit bureau profiles & credit applications so that even the newest of startups will get higher approval rates.

What about business credit scores? What’s considered a good score?

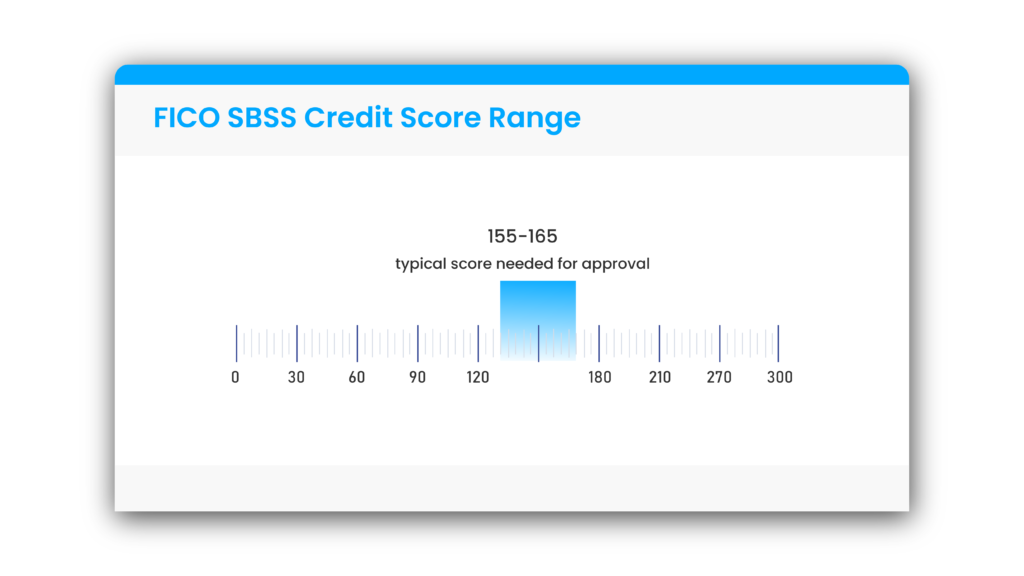

Like we mentioned a few days ago, unlike consumer credit, which largely revolves around a standardized credit scoring system, business credit scores vary based on the bureau.

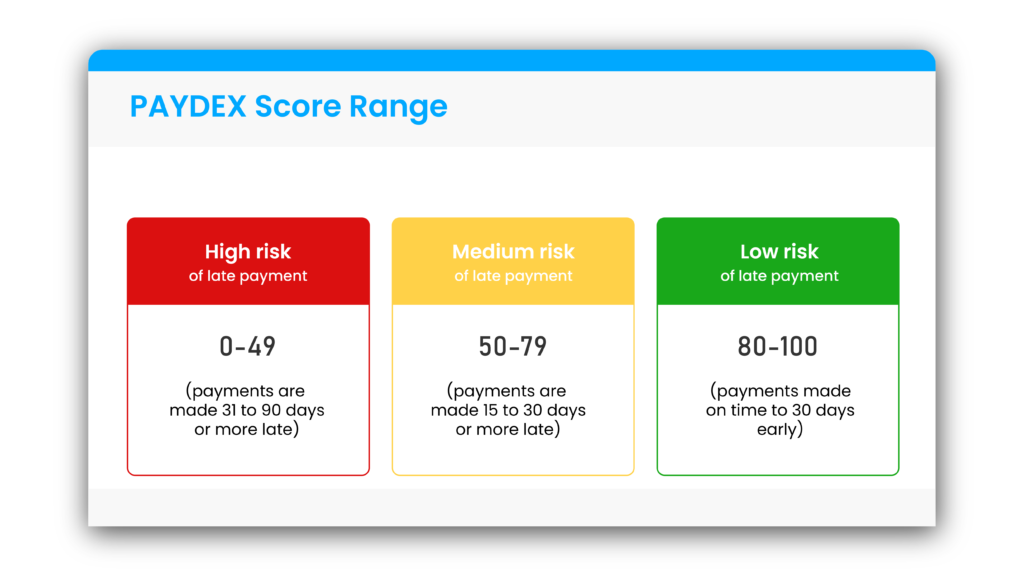

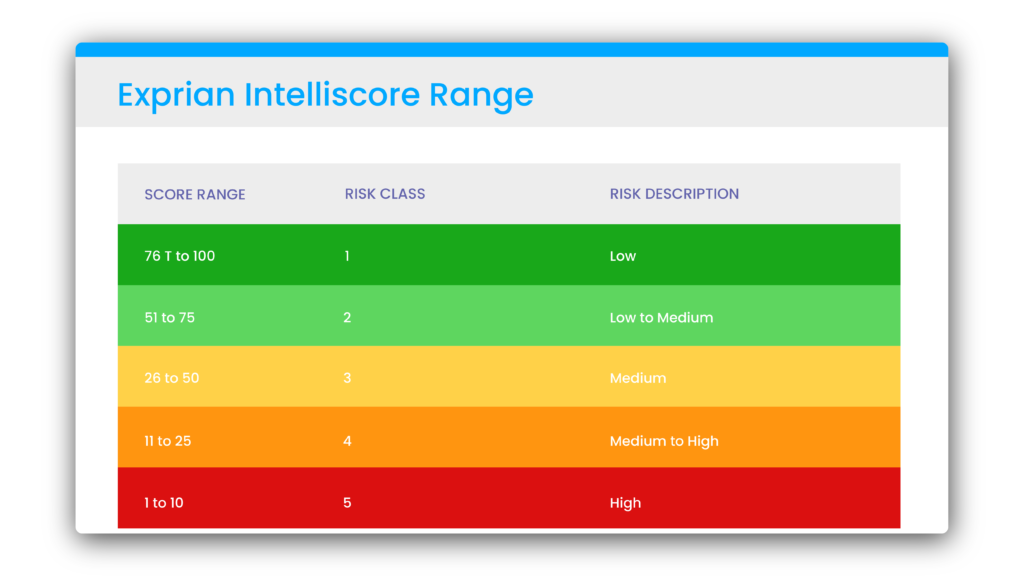

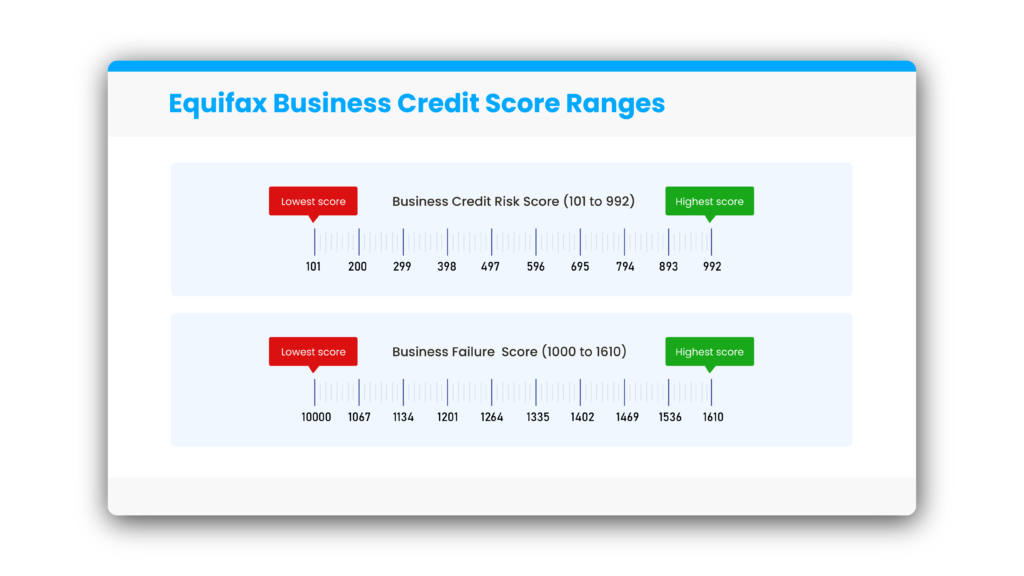

While each scoring system varies slightly, here are the three main scoring models of the BIG 3 business credit bureaus…

D&B’s PAYDEX Score. A D&B PAYDEX Score of 80 or higher means you regularly make on time or early payments.

Experian Business also uses a rating system out of 100. Other bureaus like Equifax’s Small Business Credit risk Score, uses a rating system that ranks scores from 101 to 992.

Bureaus like D&B & Equifax have multiple scores but we go into detail about that inside the program. For now, all you need to know is that generally speaking, higher scores are associated with better business credit.

The more payment experiences and credit history you establish, the stronger your overall credit profile will be to lenders.

While business credit scores aren’t everything when it comes to getting approvals (which we’ll talk about more in the coming days.) Samantha had a new business with limited revenue, and used our tips to help her get approved for MUCH MORE than the average startup.

If you want a program that’ll take you step-by-step through the process of establishing excellent corporate credit for your company quickly…

with dozens of proven, time-saving tricks you won’t find anywhere else…

Learn More About Corporate Credit Secrets

In tomorrow’s email we’ll dive into the reality of no PG corporate credit and what that may mean for your business.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.