Curious as to what you can expect when talking to a HELOC lender or loan officer?

You’ll typically meet with a loan officer after prequalifying for a HELOC.

(Although it may be earlier in the event that you choose to work with a credit union or bank in your local area.)

When meeting with a loan officer, you can expect to discuss your financial situation, including your income, expenses, and credit history.

The loan officer may ask you questions about your reasons for seeking a HELOC, such as whether you plan to use the funds for home improvements, debt consolidation, or other purposes. So it’s a good idea to review your equity and finances prior to meeting with your prospective lender.

They’ll also explain the terms of the loan, including the interest rate, loan terms, and any fees or penalties that may apply. They may discuss the process for applying for the loan, including the documentation you will need to provide and the timeline for approval and funding.

During your conversation, it’s important to ask any questions you may have and to make sure you fully understand the terms of the loan before signing any agreements.

What You’ll Review with the HELOC Lender

You may want to ask about the specifics of the loan, your options for repayment, and any potential risks or drawbacks associated with this type of loan.

Keep in mind that a HELOC is a secured loan that uses your home as collateral. So before signing any contracts, carefully consider your ability to repay the loan and to have a plan in place for making payments on time.

It’s also important to note that the loan officer will likely be focused on selling you on the loan or try to get you to sign that day. While they may be able to provide you with valuable information, don’t feel pressured.

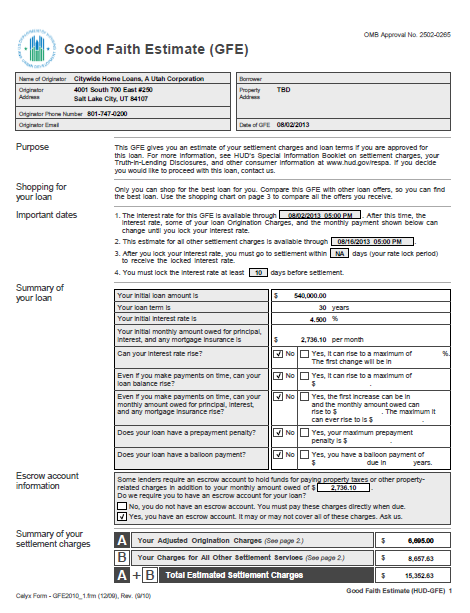

It’s important to do your own research, ask for a Good Faith Estimate and compare offers from multiple lenders before making your decision to ensure you’re getting the best deal.

The right time to ask for a Good Faith Estimate (GFE) is after you’re

pre-qualified. You can request a GFE at any time during the loan application process, even before submitting your formal application.

You may be charged a credit report fee before receiving a GFE. But, you can’t be charged any other fees until you get the GFE and indicate that you want to proceed with the loan.

Requesting a GFE early on can help you compare the costs of different lenders and make an informed decision about which loan offer is the best fit for your financial situation.

Keep in mind that the GFE is an estimate, and some costs may change over the course of the loan application process.

However, the GFE can provide a helpful starting point for evaluating loan offers and understanding the costs associated with a HELOC.

Not sure what you should ask lenders?

Or how to ensure you get the right HELOC criteria?

We’ve got you!

We’ve created the Half Your Mortgage program to help you go through the entire process of securing a HELOC (and lock-in the most affordable rates.)

We’ll show you the right type of HELOC to go after, the exact criteria to look for, how to prepare your finances, how to calculate the interest (so you know how much you’ll be able to save) get access to our proprietary calculators to make the math easy-peasy and so much more!

We’ll even put you in touch with affordable HELOC lendersin your state plus a list of the right questions to asklenders to you can be sure you’re getting the best deal.

Click the link below to learn everything you need to know about securing an affordable first lien HELOC so you can transform your equity into cash.

Learn More About the Half Your Mortgage Program

Got questions before you’re ready to dive in?

Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.