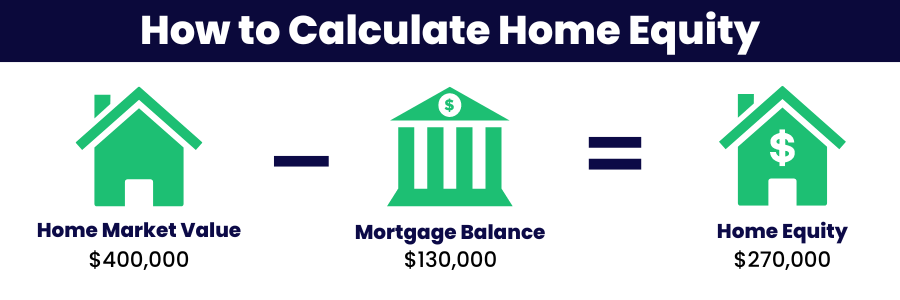

Did you know the average U.S. homeowner has $270,000 in equity?

The average homeowner has more equity in their homes to borrow against than ever before.

Just think, $100k, $200k, $300k (or more) to use for debt consolidation, real estate investing, ongoing projects, home renovations, or whatever else you need.

And it’s super flexible. You only have to borrow what you need, only pay interest on the daily balance, pay it off & keep withdrawing for 10-15 years!

That’s an incredible tool, isn’t it?

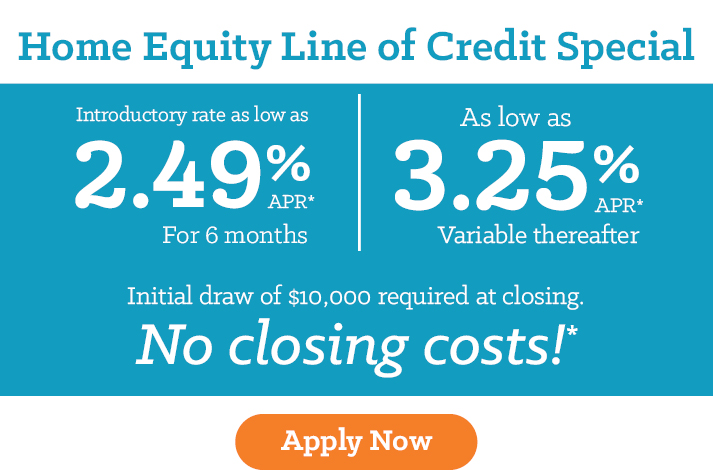

The cherry on top is that HELOCs are one of the most affordable types of financing available.

But even despite all the many benefits… HELOCs are not for everyone.

Here are some things to think about before you start looking for one:

►Home Value & Equity – For starters, the home may not be appraised for the amount you expected. The current home value is a crucial factor for the lender in considering your HELOC because the lines of credit are based on the current appraised value of your home.

►Ability to Refinance an Existing Mortgage

There are certain lenders that don’t allow refinancing on existing mortgages. While you can get a HELOC as soon as 30-45 days after purchasing a home, if a lender doesn’t allow you to refinance the existing mortgage, it won’t help you.

►Right Type of HELOC Account – To save significant amounts of money and pay off your home quickly –not just any HELOC will work…

A first-lien HELOC is ideally what we’re looking for.

►Interest Rate – The HELOC typically has a variable interest rate, meaning your payment may fluctuate during the life of your contract. Look for a low interest rate cap or ability to lock-in rates.

The good news is that many banks offer the ability to lock-in rates, and usually come with introductory interest rates of 1% to 2% for 12 months. Plus, more and more lenders are also offering fixed-rate HELOCs. So you can choose an option that best fits your needs.

Even better, you pay interest only on what you spend and there is no penalty for making payments toward principal prior to the repayment phase. This enables you to pay off the debt as quickly as you would like.

►Draw & Repayment Periods -This is when you can withdraw funds from your HELOC. This term will also vary slightly between lenders but typically lasts between 10 and 15 years. After this time funds can no longer be withdrawn and the repayment phase begins, lasting anywhere between 10-20 years. However…

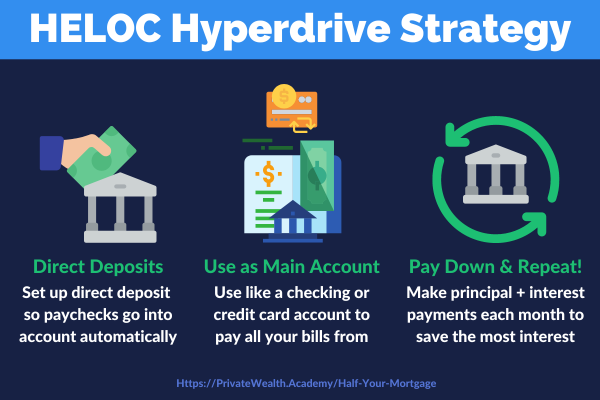

If you follow the HELOC Hyperdrive Strategy like we teach inside the Half Your Mortgage program, you’ll be able to have your loan paid off BEFORE the repayment period begins – allowing you to save TONS OF MONEY in interest (like 5 to 6 figures saved in interest ALONE!)

►How Much Money You Need – Before you take out the loan, you should also consider how you will use the money from your HELOC. Considering that this money is your equity, it is important that you carefully consider how the funds will be spent. Generally speaking, the higher the loan amount the lower the interest rates because most lenders figure it will take borrowers longer to pay back.

►Lenders – HELOCs are more adaptable than mortgages, including the fact that you can take advantage of a lower interest rate if it drops. The downside is, HELOC lenders (and their rates & terms) vary dramatically!

And that’s also why you’re here! We’ve done the hard work and found the best HELOCs out there that will allow you to shred your amortization schedule as quickly as possible with the most affordable terms available.

Let us help you reduce your mortgage by 50% (or more)!

This is why we’ve created the Half Your Mortgage program – we’ll show you the criteria your HELOC must have, how to calculate your home’s equity, find your DTI ratio, how to prepare your finances, how to calculate your DTI & interest (so you know how much you’ll be able to save), how to shop to find the right HELOC lenders, how to lock-in the best rates and MORE!

Just click the link below for more details to learn how you can cut YEARS off your mortgage and START SAVING THOUSANDS of dollars:

Learn More About the Half Your Mortgage Program

As with any debt, a HELOC needs to make sense for you. Meet with our team and we’ll run over the numbers with you to see if it’s a good fit for you.

Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll seehow much you’ll save in interest anddetermine YOUR PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.