Thinking about requesting a tax extension this year?

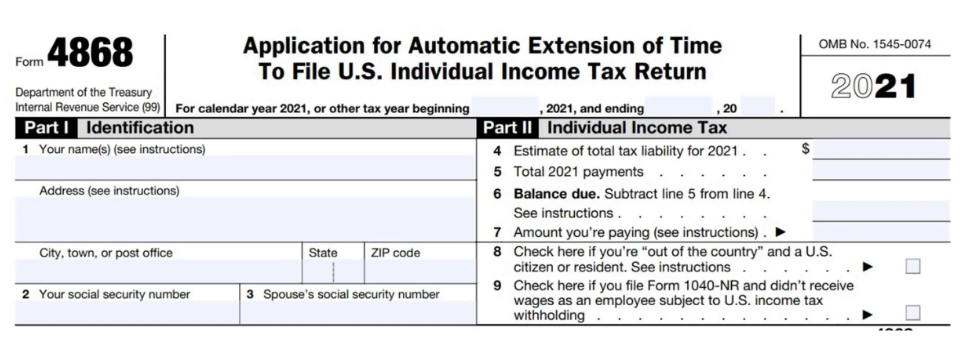

Filing a tax extension request using IRS Form 4868 asks the Internal Revenue Service (IRS) to give you additional time to file your personal tax return. An extension moves the filing deadline from April 15 to October 15.

But is requesting a tax extension really the right move?

Many people file for an extension because they owe taxes & also are unable to pay them.

Inability to pay is the worst reason to file a tax extension. Why?

First of all, an extension gives you extra time to file, but not extra time to pay. After you file an extension, if you owe taxes when you file your return, you might also have to pay penalties and interest on the tax due.

Use a tax estimator calculator to estimate how much you may or may not owe.

Tax Extension Approvals Are Usually Automatic

Most extension requests will be honored automatically. You also don’t even have to explain to the IRS why you need the extension. Simply file the form.

But take the time to file it correctly. Double-check your Social Security number and other data. Erroneous information can trigger a rare rejection.

Certain individuals receive an automatic extension without having to apply or File Form 4868.

Pros and Cons of Filing an Extension

You also might not have a choice under some circumstances. Having extra time to finish your return is often necessary. However, there are both pros and cons involved with filing for an extension.

PRO: Reduce Late Penalties

The IRS imposes two types of late penalties: 5% on any tax due for each month or fraction of a month that a tax return is filed late without an extension request, plus also a late payment penalty of 0.5% a month, up to a maximum of 25%.

You’ll only have to deal with one of these if you ask for an extension, and even then only if your return indicates that taxes are due, and you don’t pay at the time you file Form 4868.

Note: You’ll avoid the 5% per month late-filing penalty if you file for an extension, then file your return by the extended deadline of October 15. The late-filing penalty won’t begin until October 15 if you don’t file by that time.

PRO: Preserve Your Tax Refund

Some people end up filing several years late, and there’s a three-year deadline for receiving a refund check from the IRS if it turns out that you’re due one. This three-year statute of limitations begins on the original filing deadline for that year (usually April 15).

The refund statute of limitations is also extended by six months when you file for an extension, which can preserve the ability of taxpayers to receive their federal tax refunds, even if they’re behind with submitting their tax returns.

Other Pros Include:

Fund a Self-Employed Retirement Plan

Take Extra Time To Make Elections

Improve the Accuracy of Your Return

Reduce Your Tax Preparation Fees

Cons

You Won’t Gain Extra Time To Fund an IRA

Contributions to a traditional IRA and Roth IRA are still due by the original tax deadline (usually April 15) unless you are contributing to a SEP-IRA.

No Switching From Married Filing Jointly to Separately After April 15

Married taxpayers who file jointly before the April deadline still only have until April 15 (unless you are subject to a disaster relief exception) to amend their tax returns to switch to the married-filing-separately status.

Mark-to-Market Election for Professional Traders Doesn’t Advance

You must make this election by the original April 15 due date (unless you are subject to a disaster relief exception).

You were able to change the nature of your IRA by the October extended deadline before the enactment of the Tax Cuts and Jobs Act (TCJA) as long as your IRA was funded by the April deadline.

The Truth: Despite being a wide spread rumor, there is no hard proof that filing for an extension will increase your chances of being audited.

This misconception is often more of a scare tactic. This is to ensure businesses are on time with their taxes and truthful about their finances. Returns with extensions are processed in the same manner as returns filed through the usual filing deadline. So it is unlikely that your late return would trigger red flags for an audit. HOWEVER…

We believe one of the reasons this myth got started is because in the event that you request an extension but don’t end up filing a return…

- You Might Confuse the IRS…

The IRS will most likely think you have to file a tax return if you ask for an extension. In this case, the IRS may decide to further investigate your case and MAY end up resulting in an audit.

Bottom line: You Have Other Options…

Instead of requesting an extension when you can’t pay your tax due, the IRS offers some payment alternatives.

#1 – You can request a short extension to pay, of 60 to 120 days; you will still pay penalties and interest, but at a lower rate.

#2 – The IRS also offers installment agreements for taxpayers who can’t pay their taxes when they are due. An installment agreement lets you pay a set amount per month until the tax is paid.

#3 – The IRS also allows you to pay taxes with a credit card or loan. In many cases the interest on these accounts will be lower than the combined penalties and fees you’ll pay with an extension.

#4 – Discover how to legally remove your tax liability with Elite Tax Secrets so you can avoid having to pay income taxes every single year for the rest of your life.

Inside Elite Tax Secrets we’ll teach you numerous financial practices used by the elite to eliminate taxes by avoiding income taxable events altogether.

Get Instant Access to Elite Tax Secrets

Join hundreds of students and free yourself of the tax system FOR GOOD.

Learn More About Elite Tax Secrets

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.